Recently, the cabinet decided to levy toll tax on Narayangadh–Mugling road for maintenance as the road is damaged heavily by landslides. Every light and heavy vehicle is now required to pay Rs 25 and Rs 55 respectively while passing through this road section. This road is the lifeline that connects Kathmandu with the Terai plains and the only route for heavy vehicles transportation of industrial raw materials and trading goods. Indirect taxes such as this increases the cost of the goods, industrial raw materials, public transportation fares, and is ultimately passed on to the consumer.

Importers of vehicles already have to pay high taxes on import of vehicles which hovers at 225.44% for cars and jeeps. Besides this, the owner of the vehicle pays ‘vehicle tax’ every year for using the roads. Public vehicles have to pay route permit and renewal fees to provincial governments. There are altogether 3.5 million vehicles registered in the country and 80% of them are two-wheelers, 8% are cars and jeeps and 3% are public vehicles.

Unreliability of public vehicles is what primarily attracts people to purchase private vehicles. The government is generating huge revenue from the import of private vehicles and thus does not show any zeal to improve the status of public transportation.

Transport logistic cost is one of the major factors eroding business competitiveness. It is reported that the share of transport logistics in finished products stands at around 9% in China, 18% in India and around 32% in Nepal.

Despite being a least developed country (LDC), Nepal’s tax to GDP ratio is the highest in South Asia. Being competitive in manufacturing and production under current circumstances of high tax, high cost of labour, inefficient infrastructures is almost impossible, say the bearers of this brunt. “While comparing taxes, labour cost, efficiency of infrastructures and government’s service delivery of neighbouring countries - India and China - everyone can easily understand the cost of production in Nepal,” opines Hari Bhakta Sharma, Executive Director of Deurali-Janta Pharmaceutical.

Another major increment behind transportation cost is fuel price. The fiscal budget has slapped further tax on petroleum products. Finance Minister Yubaraj Khatiwada has increased the customs duty on petroleum products by Rs 10 per liter through the fiscal budget 2020-21. Per liter customs duty of petrol is now Rs 25.20 and Rs 12 on diesel and kerosene. Similarly, infrastructure tax being levied on each liter of diesel, petrol, aviation fuel has doubled to Rs 10 from Rs 5 per liter.

The government is highly focused on revenue generation and sets aside the critical concerns of people and domestic manufacturers about competitiveness, production, investment and employment generation.

Other disappointing factor for taxpayers are the lack of facilities, inefficient infrastructure, poor service delivery of the government despite high taxes, indirect taxes are increased rampantly bleeding people financially.

The fiscal budget 2020-21 has made very few changes in taxation as the government is forced to narrow down revenue collection targets due to the progression and prolonged impact of the pandemic. The government has targeted collecting Rs 1,011 billion in this fiscal. It has already collected Rs 60 billion in the first month (mid-July to mid-August) despite the economy being shattered by the pandemic.

The government has ambitious revenue collection targets even with economic activities slowing down. Manufacturers, traders and service providers are severely affected due to demand-shock as people’s income are depleting.

The government has taken some regressive moves like raising excise and customs duty on electric vehicles by five folds. A vast contradiction and inconsistency has been witnessed in the government policies as Prime Minister KP Sharma Oli had announced promoting electric vehicles in the country soon after the unofficial embargo by India. It is also a contradiction on part of the Finance Minister Khatiwada who is known as a champion of development policies

Many countries around the world have been increasing subsidies to increase use the electric vehicles, however Nepal moved in the opposite direction ignoring the fact that lesser carbon emission is the commitment of each country as part of the recent global development model which focuses on conservation of the environment. The government has taken this regressive move at a time when the country has sufficient electricity generation.

The Finance Minister has raised excise and customs duty of electric vehicles and electric equipment in contrast to the policy of the government to increase electricity consumption. The government has slapped 40% customs duty from the earlier 10% and also levied up to 40% excise (after 50% waiver given from increased excise duty) based on the engine capacity.

EVs traders have said that this will discourage the EV market majorly. “EVs could be the best option to consume surplus energy,” said Rameshwore Prasad Khanal, former Finance Secretary, “There is sorely lack of coherence in government’s policy regarding promotion of the EVs.” The government has also raised the duty on induction heaters against the decision of the cabinet meeting after lockdown. The cabinet had decided to fully waive the duty on induction heaters, however the fiscal budget 2020-21 has slapped 5% duty on induction, same as on sanitizer which is being used largely for the prevention from coronavirus disease.

Paradoxically, the government has reduced the customs duty on chocolates to 30% from 40% earlier, without any rationale. Similarly, excise of some construction materials is also raised mainly on iron products, GI wire, I-beam among others.

Major changes in tax provision through fiscal budget 2020-21

Health risk tax

Every year the government raises the excise duty of tobacco and alcohol products as health risk tax through the fiscal budget. The government has rationalised the excise of hand rolled cigarettes (beedi) 0.25 paisa per piece, cigar and cigarettes to 0.50 paisa from earlier 0.85 paisa per unit and the excise of pan masala and tobacco related products has increased to Rs 40 per kg from Rs 25 per kg.Casino royalty

The fiscal budget has extended the time to pay royalties by the casinos till first half of the fiscal from the first two months of the fiscal. Pending additional fee of 2018-19 is waived under condition of submitting full payable royalty till 2018-19 and 50% of the additional fee of 2018-19 along with third quarter of 2019-20.Changes in customs duty

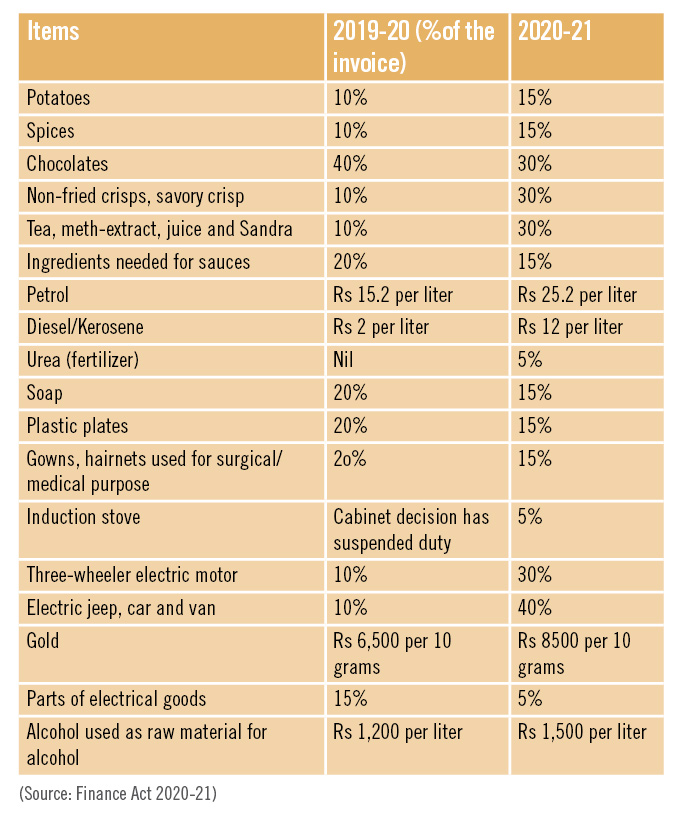

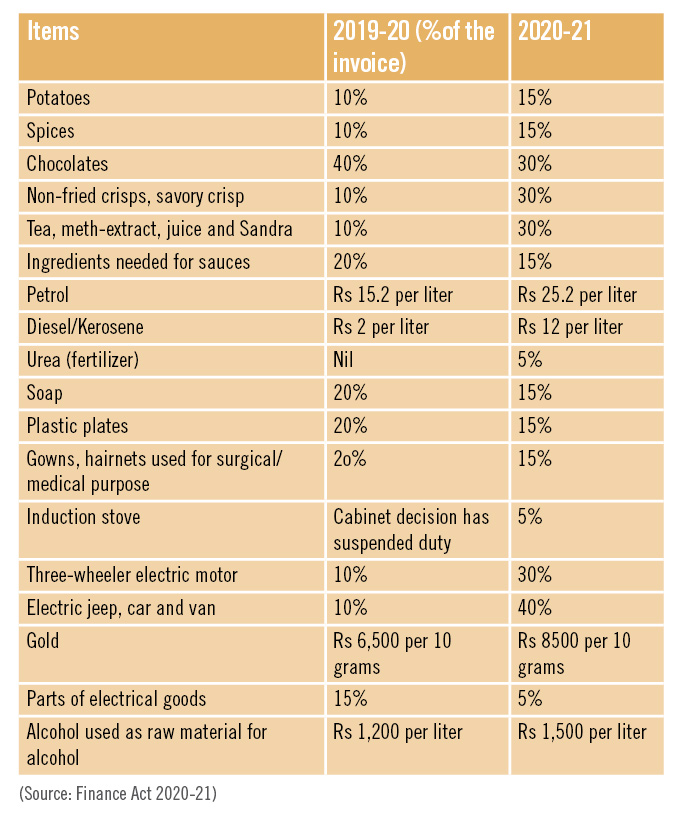

The fiscal budget 2020-21 has provisioned rebate of customs duty on the import of machinery of raw materials imported by cottage and micro enterprises, agriculture businesses, mask producing industry and agriculture machinery. Apart from that it has slashed customs duty on medical equipment. Major changes are as follows:

Income tax

The fiscal budget has kept the provision of income tax slab and rate at standstill. However 1% tax (social security) from income tax free first slab of income worth Rs 450,000 (in case of couple) shall not be levied in case of taxpayers registered as sole proprietorship firm, income from pension and natural person contributing to social security fund (SSF). The fiscal budget has provided tax exemption on drinking water and sanitation registered consumer group pursuant to Water Resource Act 2049 for amount derived as per their objective. Similarly, rural community-based cooperatives are benefited with tax exemption from the fiscal budget 2020-21. Industries operated in very undeveloped (remote), undeveloped areas, industries of less developed areas (such areas are classified in Industrial Enterprises Act 2076) will also get waiver of 10%, 20% and 30% respectively on applicable tax rates for the 10 income years from the date of commercial operation. Special industries and tourism industry (except casino) that has capital investment exceeding Rs one billion that provides direct employment to 500 individuals throughout the year benefited with cent percent income tax exemption for the first five years followed by 50% exemption for next three years. In respect to special industry currently in commercial operation where investment is Rs 2 billion and provides direct employment to at least 300 individuals throughout the year along with enhancement capacity of at least 25% will receive cent percent income tax exemption for first five years and 50% waiver for the next three years. Likewise, cent percent income tax exemption for first seven years and 50% for next three years is provided for person engaging in transaction of fuel research and exploration, minerals, petroleum and natural gas that start commercial operation by the third quarter of fiscal 2022-23. In addition, software development, statistical processing, cyber-café, digital mapping related industries established in geological and zoological biotech related park, information technology park prescribed by Nepal government through publication of notice in Nepal gazette are provided 50% income tax exemption. Electricity generation (includes solar, bio and wind energy) projects that start commercial operation by fiscal 2022-23 receive cent percent income tax exemption for first 10 years and 50% for the next five years thereafter. Income tax rebate is increased by two-fold to 40% from 20% rebate on operation of trolley and tram buses as well as building and operation of ropeway, cable car and overhead bridge. The fiscal budget 2020-21 has extended cent percent tax exemption for micro industries to seven years from commercial operation and another three years for micro industries run by women entrepreneurs. Following the controversial requirement of PAN (permanent account number) invoice while computing business and investment, the fiscal budget of 2020-21 has allowed to pay wage and renumeration up to Rs 3,000 on account of wages of one-off nature made to natural person without having PAN which can be claimed as deductible expenses while computing income. Similarly, amending the earlier provision of requirement of invoice containing PAN for more than Rs 1,000 at the time of calculating taxable income the fiscal budget 2020-21 has provisioned that no invoice containing PAN is needed for expenses up to Rs 2000 and this provision is applicable on purchase of agro, forest items, animal products, domestic goods from natural person. The transport service provider or transport rental provider registered in Value Added Tax (VAT) net have to pay 1.5% withholding tax, however for those not registered under VAT have to pay 2.5%. Withholding tax on repair of aircraft is suspended, earlier there was 5% withholding tax on repair of aircraft. Banks borrowing from foreign financial institutions to invest in prescribed sectors of the Nepal Rastra Bank have to pay 10% withholding tax. However, applicable withholding tax on retirement payment (pensions, gratuities) has been waived upon transfer of funds from approved retirement funds to social security fund by third quarter of ongoing fiscal 2020-21. As another new tax provision, banks are allowed to collect 15% as advance tax from students preparing to go to foreign countries to study while availing foreign exchange facility for language and examination fees.VAT related provisions

The fiscal budget has extended VAT waiver on imports of medical equipment as per the recommendation of the Ministry of Health and Population for the prevention, control and treatment of Covid 19 including face mask machine, PCR kits, incineration machine, face shield, protective goggles, thermal gun, ventilators, mask, surgical gloves, viral transport media, personal protective equipment among others, Likewise, VAT is exempted on micro insurance services. Similarly, the fiscal budget (finance act) has provisioned zero VAT for projects operating in Nepali in accordance with the multilateral and bilateral agreement with tax exempt status (as approved by the Ministry of finance) on purchase of any essential machineries instruments or construction materials which are approved in the master list, provided such materials are purchased from domestic industries or through contractors of the same projects. The fiscal budget has extended VAT exemption facilities on import of one bus with capacity of 30 or more seats by community-based education institutions for the purpose of transportation of students on recommendation of the Ministry of Education, Science and Technology. However, if sale, transfer and change in ownership occurs within 10 years, VAT shall be levied as per prevailing VAT Act. The VAT related penalty amount is doubled in every offence period, as per the new Finance Act. As per the new provision, the government provides VAT refund of raw, auxiliary raw materials and packing materials in trimester basis for pharmaceutical industries. The tax officer will determine the refundable amount within 60 days and beneficiary will be able to get VAT refund within 90 days. In addition there are some amnesties related to VAT in the fiscal budget. If a VAT registered person who has not filed VAT return and paid VAT of fiscal 2017-18 files the returns and pays applicable taxes and 50% of the interest by the end of second quadrimester of this fiscal 2020-21, the additional charges/fees/penalty and balance of interest will be waived. Those who have not filed VAT returns till 2015-16 will be automatically deregistered after recovering the remaining tax dues, interest and fees. However, charges applicable for late filing of returns shall be waived, as per the Finance Act 2020-21.

Special provisions for businesses affected by Covid 19

The fiscal budget has some provisions for rescue and relief of businesses severely hit by the Covid 19. The fiscal budget has eliminated the demand charges and offers 50% discount on electricity bills on energy consumed during off-peak hours for industries. The budget has provided waiver on parking fees and operational license renewal fees for airlines. Rebate of 75% on applicable tax liability for those doing business in metropolis/sub-metropolis, municipality and rural municipality and having annual transaction no more than Rs two million and annual profit of no more than Rs 200,000. Similarly, 50% tax liability is waived for trading, production or service business with annual turnover of over Rs 2 million and less than Rs 5 million. The fiscal budget has provided 25% rebate on tax liability for 2020-21 to persons having annual turnover of Rs 10 million and 20% for business of aviation, transportation, hotel and trekking having equal annual turnover. There is also provision of deducting expenses which is contributed towards national, provincial and local levels for the prevention, control and treatment of Covid 19 while computing taxable income.Excise duty

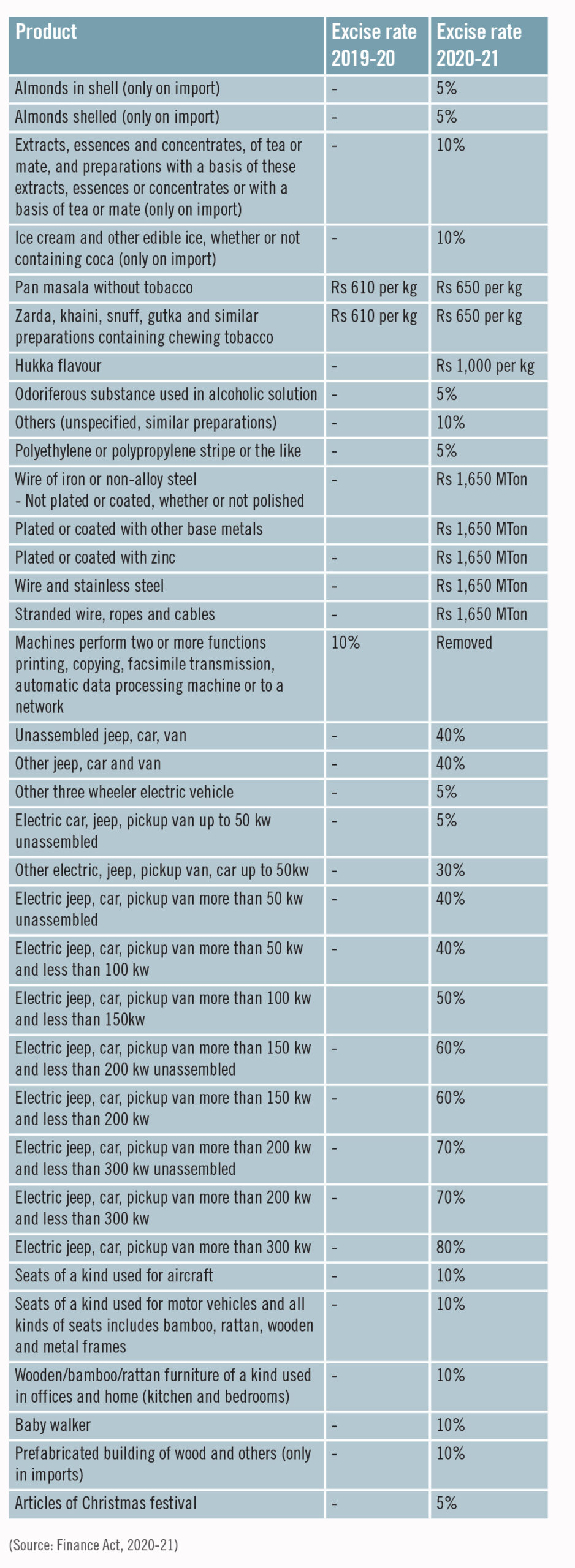

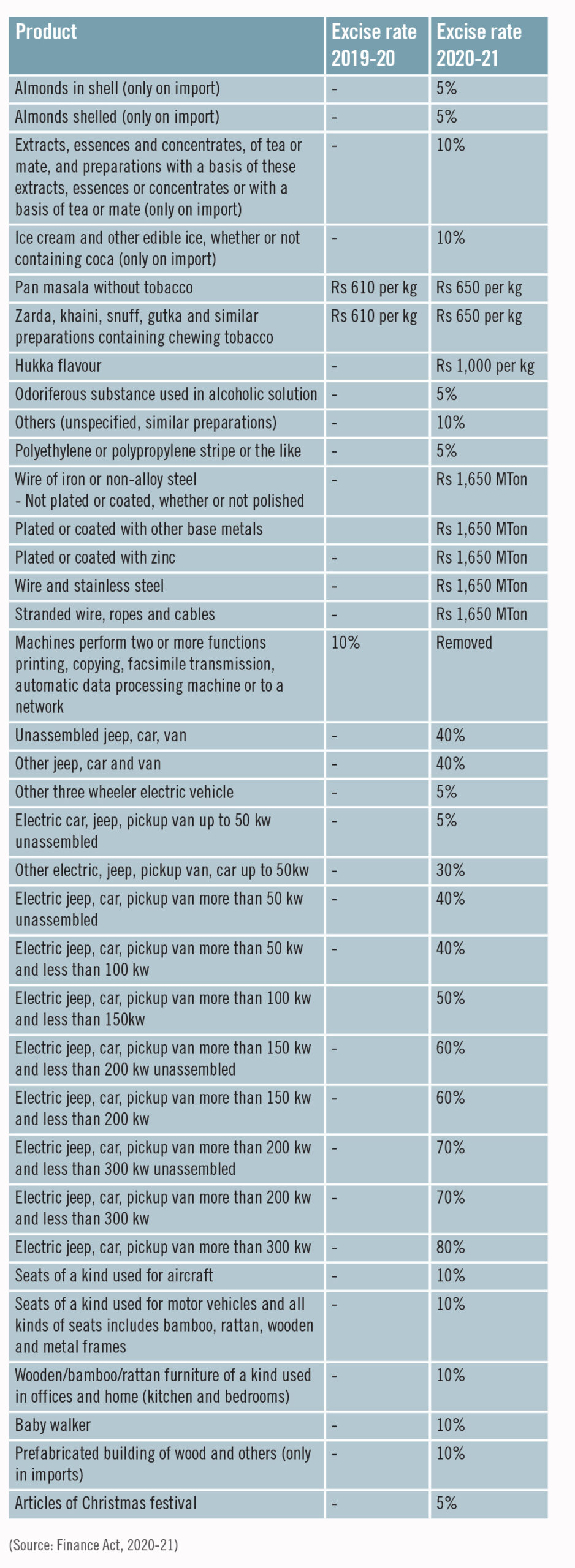

The fiscal budget, 2020-21 has revised the excise duty as follows:

Published Date: September 14, 2020, 12:00 am

Post Comment

E-Magazine

RELATED Feature

-1758006240.jpg)

-1752225714.jpg)