The policies and programmes of the government unveiled by President Bidhya Devi Bhandari on 21 May has envisioned developing one industrial estate in each of the seven provinces and industrial villages in all local bodies. This comes as an initiative of the government to promote industrialisation in the country which is considered fundamental for the sustainable and inclusive growth of the economy. Without a strong production base the country’s import dependence will continue to rise. Additionally, industries are labour intensive and vital for job creation, and they have backward and forward linkages.

World-renowned economist Dani Rodrik has said that manufacturing became a powerful escalator of economic development for low-income countries for three reasons. First, it was relatively easy to absorb technology from abroad and generate high-productivity jobs. Second, manufacturing jobs did not require much skill: farmers could be turned into production workers in factories with little investment in additional training. And, third, manufacturing demand was not constrained by low domestic incomes: production could expand virtually without limit, through exports.

The government’s policies and programmes have identified some industries with competitive advantage: sugar, pharmaceuticals, cement, and leather footwear. Likewise, jute, carpet, yarn, and handicraft industries have competitive edge in export.

GDP is expected to plunge to 5.4% in this fiscal from 9.2% in 2000/01. Shekhar Golchha, Senior Vice President of the Federation of Nepalese Chambers of Commerce and Industry, has said that the country must have a strong production base to cope with the ‘unsustainably’ growing trade deficit, address supply side constraints, and create employment opportunities in the country. “Since Nepal’s accession to the World Trade Organisation, the country has put its whole effort to comply with the agreements signed under the multilateral trade arrangements. Nepal stands among champion nations in terms of WTO compliance; however, the government and policymakers have overlooked the challenges faced by domestic industries, and that is a pity,” Golchha stated. “Other issues like, lack of regular electricity supply, labour unrest, frequent strikes compounded the distortion of the industrial production base,” he elaborated.

Golchha underscored that government should address the inefficiencies in the system whether they are legal, administrative issues or high cost of trade logistics to raise the competitiveness of Nepali industries.

Industrialisation Initiative

Following the second people’s movement of 2006, the government had tabled the Special Economic Zone (SEZ) Bill to the parliament. However, it took more than 10 years for it to be approved. The SEZ bill envisioned to provide basic infrastructure such as road, electricity, drinking water and tax incentives for several years to industries being established within the SEZ. However, these industries would have to export 75% of their production. The SEZ bill also envisioned that the private sector develop the zone. The government tabled the SEZ bill after construction of Bhairahawa SEZ had started but the bill was not endorsed until it was ready for operations.

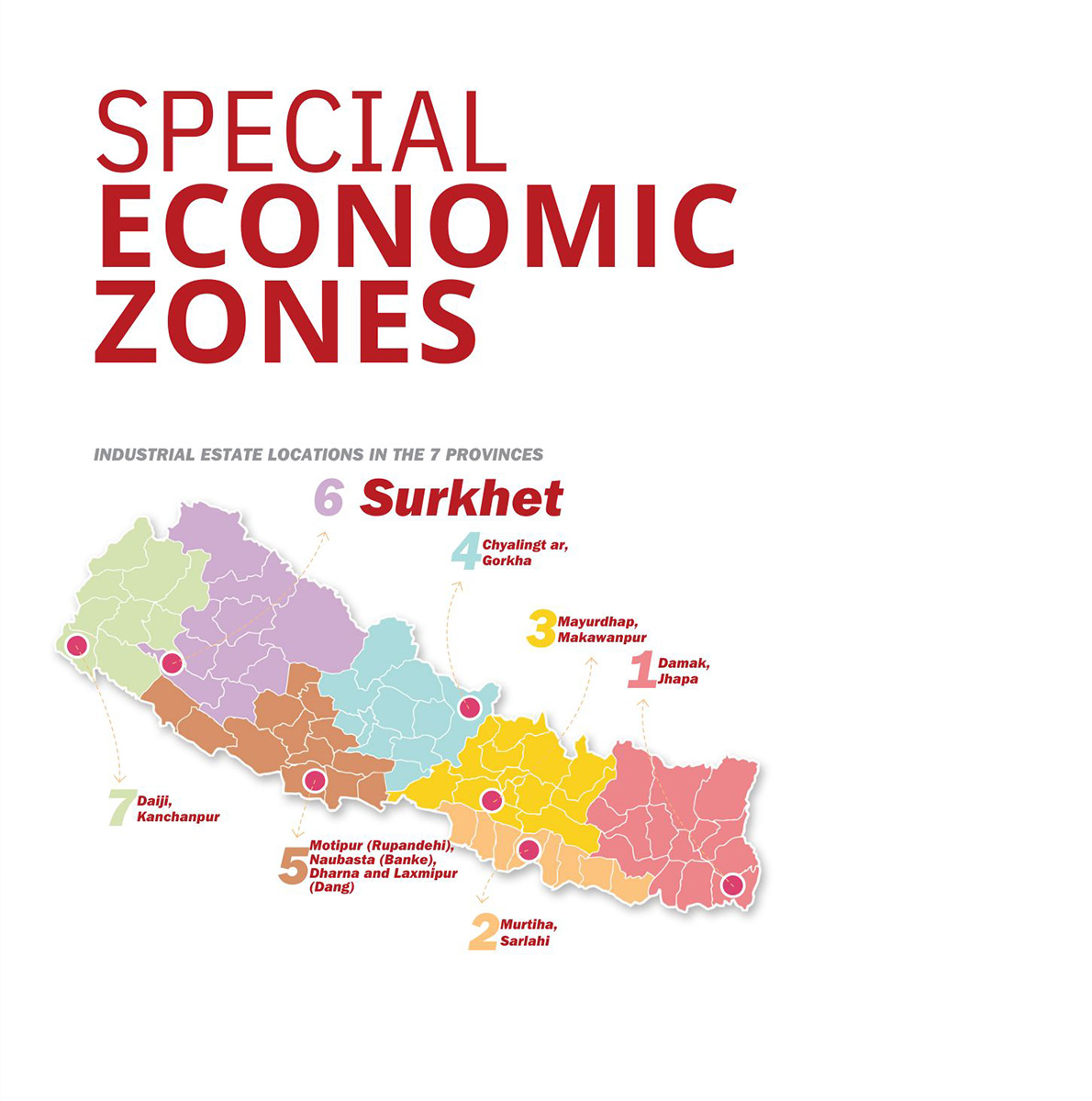

Seven industrial estates in seven provinces

Under the federal set up of Nepal, the erstwhile government led by Prime Minister KP Sharma Oli during his first premiership initiated the process to establish seven industrial estates in the seven provinces. Then Industry Minister Som Prasad Pandey took the initiative to acquire land for the seven industrial estates to be registered in the name of Industrial District Management Ltd (IDML), a public enterprise under the Ministry.

Currently, there are 11 industrial estates and one SEZ operational in the country. All the 11 industrial estates were established 54 years ago. The pace of industrialisation in the past five decades has been stalled unlike emerging economies like South Korea, China, India among others.

Hari Bhakta Sharma, President of the Confederation of Nepalese Industries (CNI) shared that the Chinese President Xi Jinping visits the industries in China frequently to ask industry operators about their problems and consults with them about what the government can do to resolve them. “In Nepal, leaders and policymakers have not seriously considered the importance of industrialisation. How can we make the economy competitive in this high tax regime and landlocked status where the logistic cost of trade is high,” he questions.

The share of logistic cost in production of goods is 9% in China and 18% in India, but nobody cares about such fundamental aspects in Nepal where minimising cost of production and enhancing export competitiveness is imperative.

Endorsement of SEZ bill and reform in legal regime

The SEZ bill tabled in the parliament was endorsed in August 2016 for the first time. The Act has offered numerous facilities for industries that set up within the SEZ. Industries established in SEZ get income tax exemption for five years. Customs duty is waived on raw material imports. Likewise, the government provides a one stop service for registration of industries and entire works in the SEZ. Strikes are prevented here. The government provides all basic infrastructure to industries under condition that they have to export 75% of their production. The only SEZ established by the government has come into operation. Chandika Prasad Bhatta, Executive Director of SEZ Authority Nepal, said the SEZ has called for request for proposal from other firms interested to set up industries in Bhairahawa SEZ. Altogether 19 industries have booked 55 plots, out of the total 69 plots in Bhairahawa SEZ. The remaining plots will be sold to interested and eligible firms to set up industries.

The government also has plans to establish SEZ in all provinces and the Ministry of Industry has completed the feasibility study for it. The locales are in Biratnagar for Province 1; Simara for Province 2; Panchkhal for Province 3; Gorkha for Province 4; Jumla for Province 6 and Dhangadhi for Province 7. Bhairahawa SEZ in province 5 has already come into operation.

The parliament has also endorsed the Industrial Enterprises Act, and amended and endorsed the Company Act. It has additionally framed the umbrella Intellectual Property Rights Policy, Foreign Investment and Technology Transfer Policy among others. However, the facilities offered by the Industrial Enterprise Act contradict the revenue laws which has a domination, according to Sharma of CNI.

[su_note note_color="#fbf0c8"]

Policy Stability And Consistency A Must

Prof. Dr. Pushkar Bajracharya

Policy consistency will be ensured by committing to declared policies, facilities and laws in a consistent and transparent manner at least for five years if not ten. Proper coordination will be ensured with periodic plans and budgets to maintain consistency.

Consistency will be maintained in making and reforming macro-economic policies, revenue policy, local tax and other sectoral policies, while providing protection, facilities and concessions. The policies will be continuously reviewed and improved to capture changing needs.

In the current environment of Nepal, transiting into a federal system, the prospect is always there of all levels levying taxes on industries. There must be a mechanism to ensure that no multiplicity of taxes is levied. Even if levied, they must be in affordable proportion and the concurrent procedures should be clear, transparent and simple.

Foreign investment both from foreigners and Non Resident Nepalis will be attracted by providing definite commitment, eliminating bureaucratic procedural hassles, treating them equally with Nepali investors and providing ready and quick information. Nepali resident missions and other agencies must be fully mobilised for the purpose.

The provision of deducting from the taxable amount, the expenses made by industrial enterprises in research and development, will be made to encourage investment in new technologies. In new areas, accelerated depreciation for priority industries will be ensured.

Traditional skills and technology will be promoted establishing the handicraft house in every province.

Despite continuous improvement in customs rules, procedures and documentation requirements, there are still reportedly areas where customs duty on finished products or packages of products are lesser than for import duties. Such anomalies will be duly addressed and corrected. Nepali currency is reportedly overvalued by 13-14% and so far it exists, ability to encourage exports and discourage imports will be arduous. Hence, foreign exchange regime will be reviewed periodically and present strategies of pegging the Nepali rupee with Indian currency will be reviewed or necessary adjustments initiated while taking into account feasible and viable implications.

Facilities and incentives proposed in the policy will be concentrated at industrial corridors or zones only to ensure its efficient administration. The provisions of multilateral, regional and bilateral agreements will be effectively implemented in consistency with the condition, context and needs of the country.

Forward and backward linkages among industries in the country will be promoted and provision of entitling facilities based on value addition within the country for sustainable industrial development will be made defining incentives based on the level of value addition.

Well-facilitated Industrial Clusters, Special Economic Zones and Export Processing Zones shall be established for encouraging export oriented industries based on public-private partnership.

Dr. Bajracharya is a Professor of Management at Central Department of Management, Tribhuvan University. He is currently honorable member of the National Planning Commission of Nepal.

-1758006240.jpg)

-1752225714.jpg)