The aforementioned references speak loud about the problems and burdens the common citizens are forced to face. No matter who you are, what profession you are in and what you earn, rising inflation challenges you at all levels. The common man is crying for immediate and effective action at the government level.

Rojina Sharma (36), a permanent resident of Tokha-8 lives through an ordeal every day making ends meet. A home-maker and mother of three school going kids, she does her best to maintain a regular and ‘average’ menu in her kitchen. Her husband, a security guard by profession, earns Rs 18,000 a month. After paying the monthly school fees for the children, room rent and other expenses and also after deducting transportation and lunch expenses of her husband, she is left with Rs 4,500 to meet the arduous task of fulfilling the needs of a family of six including her elderly mother in law. “I literally cry finding myself helpless,” she laments, “At a time when the price of every consumable commodity has shot up, fulfilling the needs of my family is very challenging.” What troubles her more is the fear of any one falling sick with the need of medical treatment. She shares, “I am always cautious about expenses, no matter what.”

Terrifying data

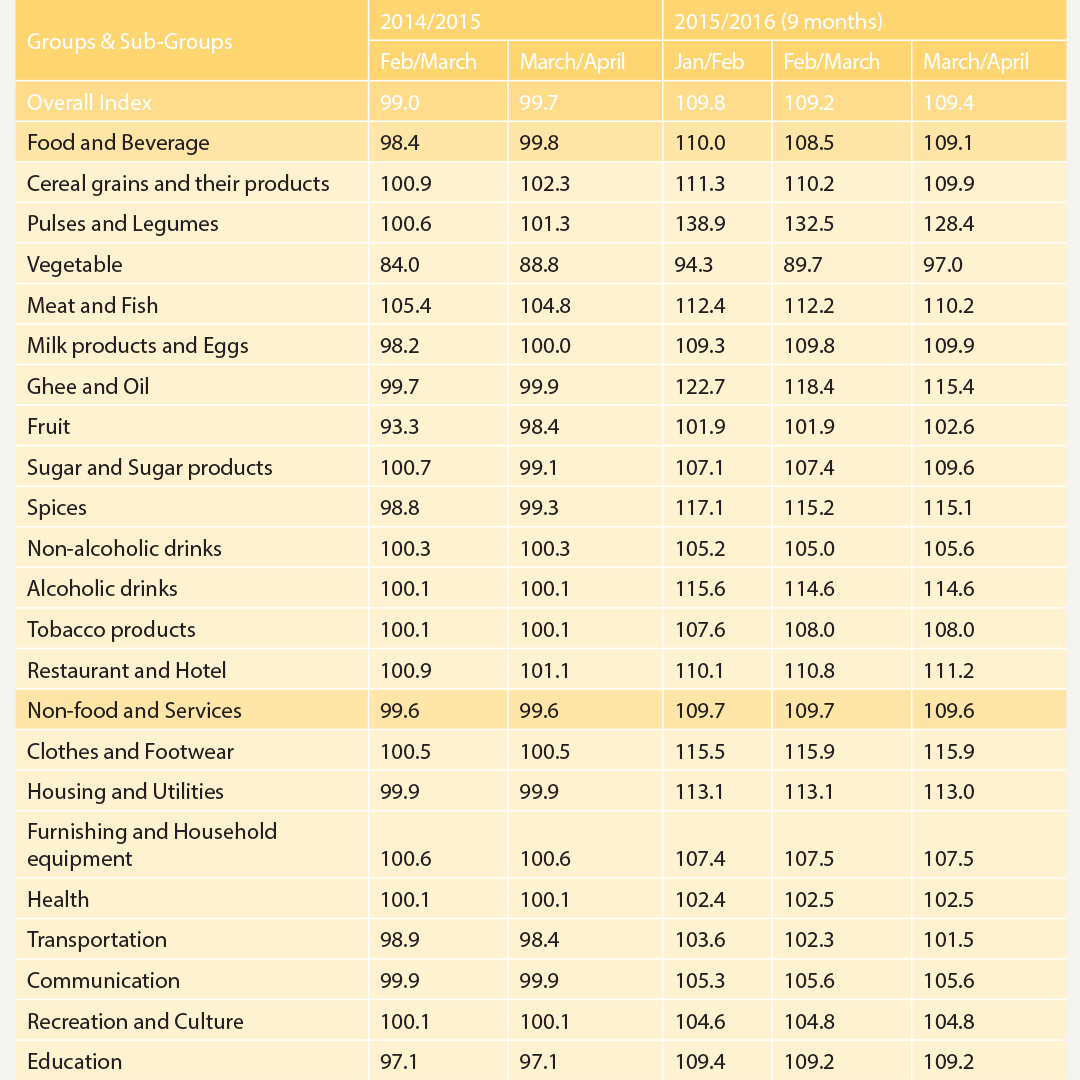

The recent report, Current Macroeconomic and Financial Situation of Nepal-2016 paints a gloomy picture pertaining to how common citizens are living under severe inflation. According to the report that Nepal Rastra Bank (NRB) released in May, the consumer price inflation moderated further to 9.7 percent in mid-April, 2016 from the peak of 12.1 percent in mid-January 2016. “Consumer price inflation continued to show a falling trend since mid-January 2016 on account of improved supply of fuel and other consumable items following the return of normalcy in the southern customs points,” the report states. While food and beverage group price index saw a pickup of 9.3 percent, nonfood and services group price index showed a growth of 10 percent in mid-April, 2016. Food and beverage items such as pulses and legumes sub-group and spices sub-group saw a price rise of 26.8 percent and 15.9 percent respectively in the review period. Moreover, prices of ghee and oil sub-group and clothes and footwear sub-group shot up by 15.5 percent and 15.3 percent respectively. Geographically, the Kathmandu Valley witnessed a relatively higher rate of inflation at 11.7 percent followed by Hilly region at 10 percent, Terai region at 8.3 percent and Mountain region at 8 percent in the review period. Last year, the Kathmandu Valley, Hilly region and Terai region had seen an inflation rate of 6.5 percent, 7.4 percent and 6.8 percent respectively. Economists believe that the current inflation in the country is the outcome of two major factors: the first is supply-side constraints such as obstruction in transportation mainly due to the unofficial trade embargo clamped by Indian government, low productivity leading to higher imports and lack of key ingredients to boost local industrial, service and agricultural outputs, and the second is hike in prices of imported goods in the source country including, India, China and others. As Nepal relies for more than 60 percent of its consumption on India, any direct or indirect instance of price hike in the country impacts the budget of Nepali citizens. The report states further that the year on year consumer price inflation of Nepal in the ninth month of fiscal year 2015-16 continued to remain at a higher level of 9.7 percent compared to that of India at 5.4 percent showing an inflation wedge of 4.3 percent. A year ago, such inflation in Nepal was 6.9 percent compared to 4.9 percent in India reflecting a narrower inflation wedge of 2.0 percent. The report also states that the rise in inflation wedge between Nepal and India was on account of lingering impact of April/May 2015 earthquakes and the obstruction on southern trade routes.“At a time when the government wants to embark on a journey of long-term financial prosperity, such inflation will do anything but good than that of creating adversaries in the path,” says Chittaranjan Pandey, Assistant Professor at King’s College, “The increment in consumer price, instead of expanding, will rather shrink economic activities and hints at the prospects of change in the consumption habit of the people as they try to curb expenses.” According to him, the inflation persisting at present is not the outcome of any of the external or special factors like the 2015 earthquake or the recent blockage in the Nepal-India border but because of the regular normal factors including sluggish industrial activity, growth in imports, low business confidence and weak investment. Stating that the increment in inflation above seven percent against the projected growth rate is a grave situation, he adds, “However, we have been in this condition for last many years. Thanks to the remittances sent back home from the Nepali migrants that has been the lifeline of consumption and overall national economy.” He also argues had remittance been spent in capital formation, the story would have been just the other way around. According to NRB report, the workers’ remittances grew by 13 percent to Rs. 481.69 billion in the review period compared to a growth of 7.1 percent in the previous year.

Prakash Subedi, Lecturer at the Tribhuvan University makes what is considered an ‘average income’ in Kathmandu. Yet he also does not remain unaffected from the daily problems prompted by the skyrocketing prices of essentials. Two days after the government launched its ‘expansionary and distributive’ budget, Subedi vented his frustration on his Facebook wall. “It’s good that there has been an increment in the salary of public servants by 15 percent. But this is not a solution. It’s not how much has been increased that matters, but what really matters is the purchasing capacity of that salary in the present day market place. Unless the government shows initiatives towards controlling the market system and inflation, it does not help our lives. By the time there is one third increment in the salary, inflation reaches two thirds,” he writes.

Budget - Will it help?

Commoners had high hopes from the budget. For them the annual fiscal policy was the only and effective measure to crack the whip on inflation. However, Finance Minister Bishnu Poudel was not yet finished reading the budget for the fiscal year 2016-17 when hullaballoo began among the circles of those familiar with Nepal’s current macro-economic situation. Of other several objections regarding the budget, one of the major was its inclination towards not solving but rather aggravating the problem of inflation. According to economists, the budget, despite promising to reduce the percentage of Nepalis under the poverty line by containing inflation rate within 7.5 percent is rather expected to push more people towards poverty, thanks to the increasing inflationary pressure that the budget is expected to create. During the post-budget discussions in the Parliament, opposition parties have also voiced dissatisfaction over the budget stating that its expansionary and distributive nature poses higher risk of increased inflation. Senior Economist Dr Bishwambher Pyakurel in one of his recent interviews claimed that the hike in the salary of government employees by 25 percent and various other distributive programmes in the budget is likely to push up the prices of commodities. According to him, people who earn their living from day to day earning are at higher risk of falling back below the poverty line. “The resultant inflation of expansionary budget will again thwart government’s target to reduce poverty,” adds Pyakurel. Similarly, Assistant Professor Pandey says that the government’s decision to levy Infrastructure Tax at the rate of Rs 5 per liter in the import of petrol, diesel and aviation fuel will directly foster inflation as manufacturers, suppliers and dealers will have to invest more in production and transportation of raw materials and finished goods. Bishwo Poudel, Economist at Office of Millennium Challenge Nepal claims neither the budget nor the government has attempted to find reasons behind the abnormal soaring of prices. He expresses fear over the prospect of many people falling in the cycle of poverty as their purchasing power and consumption capacity diminishes as a result of which they have to compromise on their daily basic needs. He also suggests measures including enhancing local production, especially of consumable commodities, reduction of transportation cost and boosting of industrial and investment climate. “However, since there is no plan to increase domestic production even though subsidies have been proposed rampantly, imports are likely to jump eventually to widen trade deficit,” he states.

Published Date: June 22, 2016, 12:00 am

Post Comment

E-Magazine

RELATED Feature