With factors like fixed exchange rate, porous border and stringent capital controls, the Nepal Central Bank usually has limited room to make its policies truly efficient and independent. Despite the limitation, the Central Bank since its inception has done a condemnable job to maintain financial stability of a country that has gone through few major socio-political upheavals. In less than a month, the Central Bank will be announcing the Monetary Policy for 2021 – 2022, jotting down my 10 observations and recommendations the Central Bank should consider in the upcoming monetary policy to achieve sustainable economic growth and avoid any systemic vulnerabilities.

Credit Rating: NRB regulation mandates that the loans above Rs 50 cr get a credit rating. Companies are not getting better rates, even when they have superior ratings, questioning the rationale for getting the credit rating. Giving better rates for companies with better ratings will encourage financial discipline and better corporate governance.

Environmental and Social (E&S) Risk Management Practices: Nepal is the fourth most climate-vulnerable country globally. Frequent natural disasters and unmonitored development efforts have created a large environmental and socio-economic toll. For sustainable development, the private sector will play a critical role. In 2018, NRB had launched the first policy document, “Guideline on Environmental and Social risk management (ESRM) for banks and financial institutions. NRB should continually push this initiative forward and support the banks to increase their capacity on this front. NRB should also announce incentives for banks and borrowing companies to implement E&S risk management practices.

Outbound Investment: For any Nepali company to sell its goods and services to a foreign market, it is essential to set up a sales and marketing office abroad to increase its market share, customer reach, and support services; also to receive foreign capital and investment. NRB should allow Nepali companies to set up a subsidiary abroad, especially when Nepal is sitting on a forex reserve of USD 12 bn plus. One of the highest and comfortable forex reserves to GDP in South Asia. Allowing outbound investment may be counter-intuitive, but in the long run it will help ease current account deficit.

The government has missed out on its foreign borrowing target for the last few years but has achieved its domestic borrowing target. There is fear that too much focus on raising domestic funds might “crowd out” private sector borrowing and increase the cost of debt for the private sector.Healthcare Bond: NRB last year introduced the concept of Agriculture and Energy bond. Similar bonds are required for the healthcare sector. Ideally healthcare service should be provided by the State. However, due to resource and institutional limitations, the private sector plays a significant role in fulfilling some of the gaps. Private healthcare providers have large capital expenditure, particularly due to high land prices and equipment costs. Introducing long-term healthcare bonds will reduce the cost of debt for private healthcare providers and increase investment in healthcare infrastructure. Currently, credit to hospitals and healthcare service is around 1% of the total lending. While sector-specific bonds issued by banks are a good start, policies need to be introduced to have private companies issuing bonds in the long term. FDI reforms: Central Bank is also a gatekeeper for any foreign currency exchange coming in or coming out of the country. Given this role NRB has and will play a critical role to attract much needed FDI in the country. While the recent bylaws introduced by NRB are welcoming, there is significant room for improvements and clarification. The most touted automatic route is still a disappointment for existing companies or brownfield processes, as pre-approval is still required. NRB’s own study done in 2019 shows that in the last 24 years, only 34% of the FDI initially committed is realised (money actually comes to the country). Delays in FDI approval might be one of the reasons for such a low realisation. Nevertheless, the FDI Facilitation Committee setup by NRB should keep the ball rolling and continue to push the reforms forward. I hope this reform drive is contagious and motivates the Department of Industry too. Another piece of reform or innovation that is required to attract FDI is related to foreign currency. While the forex hedging mechanism has been announced in the past, it has not been effectively materialised. Refinancing: Last year, the Monetary Policy announced refinancing for hydropower companies, however even after almost a year, the hydro companies are still waiting for approval from NRB. If it’s due to resource constraints at NRB, then additional resources need to be deployed for swift approvals, or approval processes need to be revamped by leveraging technology. Reducing debt cost will support hydro companies under construction to absorb some or all cost overrun due to Covid related lockdown, making the sector attractive for future investment. These reductions are significant for small-scale hydros where economies of scale are low. Evergreening: Nepal’s credit to GDP is around 103% highest in South Asia and highest among its peer group worldwide. Credit growth rate to the private sector has averaged 20% (year on year) whereas the Non Performing Asset (NPA) is mere 1.5%, despite having two big disruptions - blockage and Covid 19 - in the last few years. This combination of high credit expansion and low NPA does raise concern about some banks possibly underreporting NPA by rolling over loans. While the under reporting of the NPA situation might be overhyped or might even be fully under over because of high capitalisation of the banks, NRB should be proactive to conduct Asset Quality Review by independent experts and put in all the mitigated measures to avoid any future vulnerabilities.

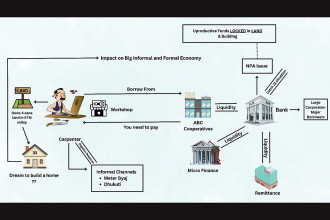

Between mid-July 2020 to mid–May 2021, the number of electronic payment transactions has grown at 43% with the number of transactions reaching 42mn. The future is digital and Covid 19 has accelerated the timeline. The current regulation imposes restrictions on Foreign Private Equity investment in non-deposit-taking finance companies that could extend credit using alternative credit scoring mechanisms.NBFC: Between mid-July 2020 to mid–May 2021, the number of electronic payment transactions has grown at 43% with the number of transactions reaching 42mn. The future is digital and Covid 19 has accelerated the timeline. The current regulation imposes restrictions on Foreign Private Equity investment in non-deposit-taking finance companies that could extend credit using alternative credit scoring mechanisms. Opening up licensees and FDI in non-deposit-taking non-banking financial institutions, including fintech frontend NBFCs, to invest through debt structure will support SMEs with access to more affordable, patient, and flexible forms of capital. Despite the strong credit demand and growing appetite from SMEs, local financial institutions have limitations on lending to this segment due to CCD ratio ceiling controls, profitability requisites for companies, and the risk-averse nature of the banks in Nepal. Allowing FDI through the venture debt structure will also increase liquidity in the market and bolster Nepal’s foreign exchange reserves. Fiscal Dominance: The Government just announced its budget amounting to Rs 1,647 billion. The projected budget deficit is Rs 559 bn, of which Rs 250 bn is expected to be fulfilled through domestic borrowing and Rs 309 bn through foreign borrowing. The government has missed out on its foreign borrowing target for the last few years but has achieved its domestic borrowing target. There is fear that too much focus on raising domestic funds might “crowd out” private sector borrowing and increase the cost of debt for the private sector. For instance, a recent coupon on the same tenure bond issued by NRB was 50 bps higher than that of a debenture issued by Class A commercial bank. To avoid crowding out private sector borrowing, NRB should encourage and support the government to achieve their foreign borrowing target. Multilateral institutions like IMF and World Bank are already contemplating initiatives like Debt Service Suspension initiative and increasing Special Drawing Rights allocation for developing countries and other built back better post disaster recovery initiatives. Inflation: In May 2021, according to NRB, the CPI index in Nepal increased by 3.65% compared to 6.3% in India. The historical trend suggests that most of the time - not always - inflation in Nepal tends to be higher than that in India. The inflation is highly correlated due to open borders, pegged currency, and a strong reliance on imports. The wedge between the two and anecdotal evidence of increasing prices from the consumers suggests some inconsistency between reality and the picture painted by data. While the demand has remained weak, lockdown for the last two months has definitely created supply side pressure.

Published Date: July 27, 2021, 12:00 am

Post Comment

E-Magazine

RELATED Guest Column