- Slow execution of capital budget hits economic recovery

The World Bank has made a projection of sluggish growth in view of the slow vaccination drive, spread of Omicron variant, and increasing public debt as well as potential obstruction in smooth supply of goods and services.

“Nepal missed the chance to trigger its growth potential like India and Bangladesh due to slowdown in government expenditure and liquidity crunch in the banking sector,” said senior economist Dr Dilli Raj Khanal. “Growth potential from both the public sector and private sector shrunk as the government was unable to accelerate development expenditure and the government is the largest procurer of goods (construction materials) and services (engineering/consultancy/expertise) and such expenses have a multiplier effect on the economy,” he shared.

Khanal further elaborated that if the government had been able to increase expenses the banking sector would not have faced a liquidity crunch and the private sector would have been able to get credit more easily.

When life started getting back to normal following the vaccination drive, credit demand from the private sector went up substantially. Gunakar Bhatta, Spokesperson of Nepal Rastra Bank, states that half-yearly credit growth hovers at 31% as compared to the corresponding period of the previous fiscal against an effort of the Monetary Policy to keep the private sector credit growth at 19% for this fiscal. In the first six months of this fiscal, banks and financial institutions disbursed Rs 450 billion in spite of the slow deposit growth.

Meanwhile, Sishir Kumar Dhungana, former Finance Secretary, says that the federal government’s treasury surplus hovered at only Rs 9 billion at the end of January this year. “The government sorely lacks resources to expedite expenses and the Ministry of Finance has shelved the budget request filed due to lack of funds,” he shared. “We have to mobilise domestic debt and foreign aid for development activities; this year, foreign assistance has plummeted and the government has to raise domestic debt considering the current situation of liquidity crunch.”

On one hand, the federal government has a weak treasury position and on the other, the price of construction materials is skyrocketing. “Increased cost of construction materials means development projects require more funds than the amount that was initially allocated to execute particular projects,” says Dhungana.

Dhungana further adds that the rising inflationary pressure has posed manifold challenges to those who have lost their source of income due to the pandemic. Inflation in mid-December stood at 7.11% despite the central bank’s target to tame inflation within 6.5% in this fiscal. “It seems real growth in the economy will be insignificant this year as inflation is high,” he says.

The government has envisioned to mobilise domestic debt worth Rs 239 billion in this fiscal, however it has raised Rs 36 billion — Rs 20 billion through Development Bonds and Rs 16 billion from Citizen Saving Bond. Similarly, foreign assistance plummeted heavily in the first half of this fiscal as compared to the corresponding period of the previous fiscal.

The World Bank has made a projection of sluggish growth in view of the slow vaccination drive, spread of Omicron variant, and increasing public debt as well as potential obstruction in smooth supply of goods and services.

“Nepal missed the chance to trigger its growth potential like India and Bangladesh due to slowdown in government expenditure and liquidity crunch in the banking sector,” said senior economist Dr Dilli Raj Khanal. “Growth potential from both the public sector and private sector shrunk as the government was unable to accelerate development expenditure and the government is the largest procurer of goods (construction materials) and services (engineering/consultancy/expertise) and such expenses have a multiplier effect on the economy,” he shared.

Khanal further elaborated that if the government had been able to increase expenses the banking sector would not have faced a liquidity crunch and the private sector would have been able to get credit more easily.

When life started getting back to normal following the vaccination drive, credit demand from the private sector went up substantially. Gunakar Bhatta, Spokesperson of Nepal Rastra Bank, states that half-yearly credit growth hovers at 31% as compared to the corresponding period of the previous fiscal against an effort of the Monetary Policy to keep the private sector credit growth at 19% for this fiscal. In the first six months of this fiscal, banks and financial institutions disbursed Rs 450 billion in spite of the slow deposit growth.

Meanwhile, Sishir Kumar Dhungana, former Finance Secretary, says that the federal government’s treasury surplus hovered at only Rs 9 billion at the end of January this year. “The government sorely lacks resources to expedite expenses and the Ministry of Finance has shelved the budget request filed due to lack of funds,” he shared. “We have to mobilise domestic debt and foreign aid for development activities; this year, foreign assistance has plummeted and the government has to raise domestic debt considering the current situation of liquidity crunch.”

On one hand, the federal government has a weak treasury position and on the other, the price of construction materials is skyrocketing. “Increased cost of construction materials means development projects require more funds than the amount that was initially allocated to execute particular projects,” says Dhungana.

Dhungana further adds that the rising inflationary pressure has posed manifold challenges to those who have lost their source of income due to the pandemic. Inflation in mid-December stood at 7.11% despite the central bank’s target to tame inflation within 6.5% in this fiscal. “It seems real growth in the economy will be insignificant this year as inflation is high,” he says.

The government has envisioned to mobilise domestic debt worth Rs 239 billion in this fiscal, however it has raised Rs 36 billion — Rs 20 billion through Development Bonds and Rs 16 billion from Citizen Saving Bond. Similarly, foreign assistance plummeted heavily in the first half of this fiscal as compared to the corresponding period of the previous fiscal.

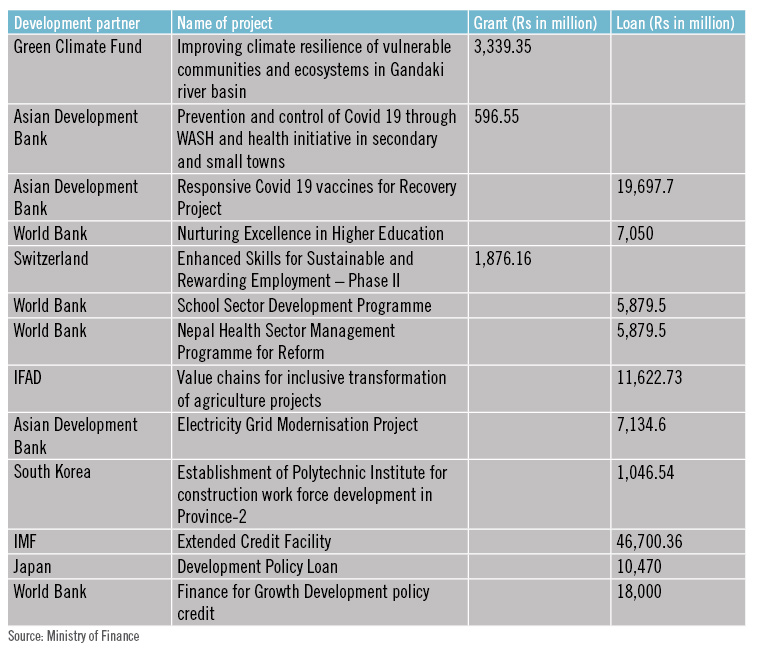

The fiscal budget 2021-22 has envisaged to mobilise Rs 343 billion through foreign assistance — Rs 59.92 billion through foreign grant and Rs 283 billion in the form of loan assistance, however, only Rs 121 billion has been received as foreign aid commitment. Recently, after the first half of the fiscal, the government decided to avail $150 million (approximately Rs 18 billion) from the World Bank Group under ‘Finance for Growth Development Policy Credit’. The government had received commitment of Rs 187.44 billion in the first half of the corresponding period of the previous fiscal year.

Recently, Finance Minister Janardan Sharma had summoned the secretaries of various ministries and instructed them to expedite capital expenses and also said he would take all necessary initiatives to facilitate them. The finance minister had also urged the secretaries to surrender the budget allocated for projects which the ministry and concerned executing agencies are not hopeful of execution and to focus only on those projects that will perform better. He laid emphasis on execution of big-ticket projects and productive capacity enhancement related projects.

“I have noticed that the budget executing agencies are facing structural constraints to deliver results despite their efforts to perform better than in the past,” said Minister Sharma, “We have to diagnose the deep-rooted problems of our expenditure system.”

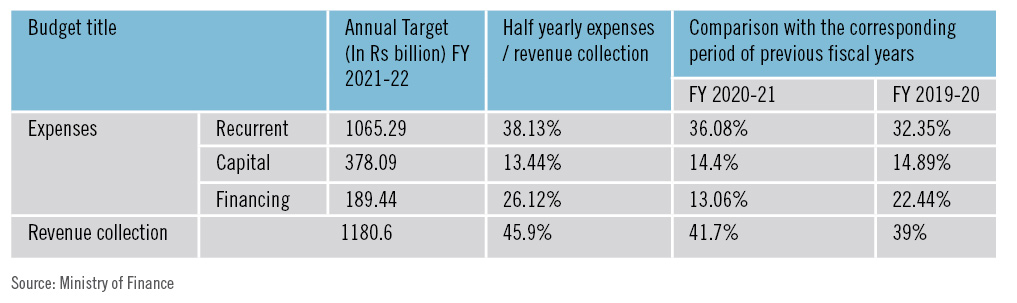

The Ministry of Finance (MoF) has reviewed the expenditure target from Rs 1,623.82 billion to Rs 1,546.28 billion, which is 94.7% of the allocation. The government expects to spend Rs 1,006.46 billion as recurrent expenditure and Rs 306.32 billion as capital expenditure from the allocated Rs 1,035.46 billion and Rs 340.32 billion, respectively. Likewise, under the financing heading 90% of the allocated Rs 170.49 billion is expected to be spent in this fiscal.

Similarly, the government also reviewed the resource of budget financing. As per the reviewed estimation, the government expects to mobilise Rs 1,289.82 billion from revenue and domestic debt (internal resources), Rs 50 billion form foreign grants and Rs 206.46 billion through foreign loans.

Initially, the government had estimated to collect Rs 1,050.82 billion from revenue, Rs 59.92 billion from foreign grants, Rs 283.09 billion through foreign loans, and Rs 239 billion from domestic debt.

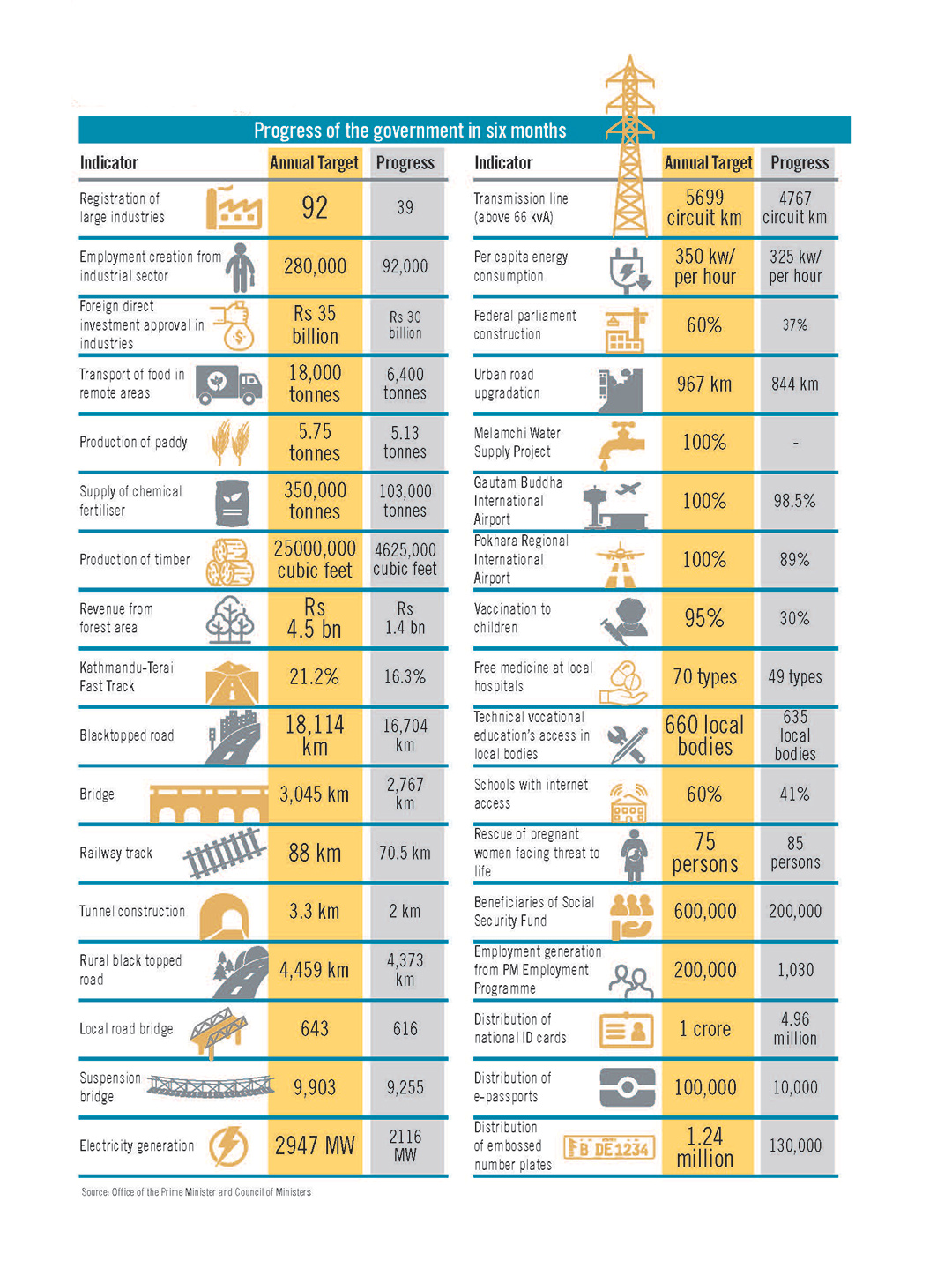

Similarly, Prime Minister Sher Bahadur Deuba had also reviewed the progress of the government in six months. The progress of six months is as follows:

The fiscal budget 2021-22 has envisaged to mobilise Rs 343 billion through foreign assistance — Rs 59.92 billion through foreign grant and Rs 283 billion in the form of loan assistance, however, only Rs 121 billion has been received as foreign aid commitment. Recently, after the first half of the fiscal, the government decided to avail $150 million (approximately Rs 18 billion) from the World Bank Group under ‘Finance for Growth Development Policy Credit’. The government had received commitment of Rs 187.44 billion in the first half of the corresponding period of the previous fiscal year.

Recently, Finance Minister Janardan Sharma had summoned the secretaries of various ministries and instructed them to expedite capital expenses and also said he would take all necessary initiatives to facilitate them. The finance minister had also urged the secretaries to surrender the budget allocated for projects which the ministry and concerned executing agencies are not hopeful of execution and to focus only on those projects that will perform better. He laid emphasis on execution of big-ticket projects and productive capacity enhancement related projects.

“I have noticed that the budget executing agencies are facing structural constraints to deliver results despite their efforts to perform better than in the past,” said Minister Sharma, “We have to diagnose the deep-rooted problems of our expenditure system.”

The Ministry of Finance (MoF) has reviewed the expenditure target from Rs 1,623.82 billion to Rs 1,546.28 billion, which is 94.7% of the allocation. The government expects to spend Rs 1,006.46 billion as recurrent expenditure and Rs 306.32 billion as capital expenditure from the allocated Rs 1,035.46 billion and Rs 340.32 billion, respectively. Likewise, under the financing heading 90% of the allocated Rs 170.49 billion is expected to be spent in this fiscal.

Similarly, the government also reviewed the resource of budget financing. As per the reviewed estimation, the government expects to mobilise Rs 1,289.82 billion from revenue and domestic debt (internal resources), Rs 50 billion form foreign grants and Rs 206.46 billion through foreign loans.

Initially, the government had estimated to collect Rs 1,050.82 billion from revenue, Rs 59.92 billion from foreign grants, Rs 283.09 billion through foreign loans, and Rs 239 billion from domestic debt.

Similarly, Prime Minister Sher Bahadur Deuba had also reviewed the progress of the government in six months. The progress of six months is as follows:

READ ALSO:

READ ALSO:

Published Date: February 16, 2022, 12:00 am

Post Comment

E-Magazine

Click Here To Read Full Issue

RELATED Feature