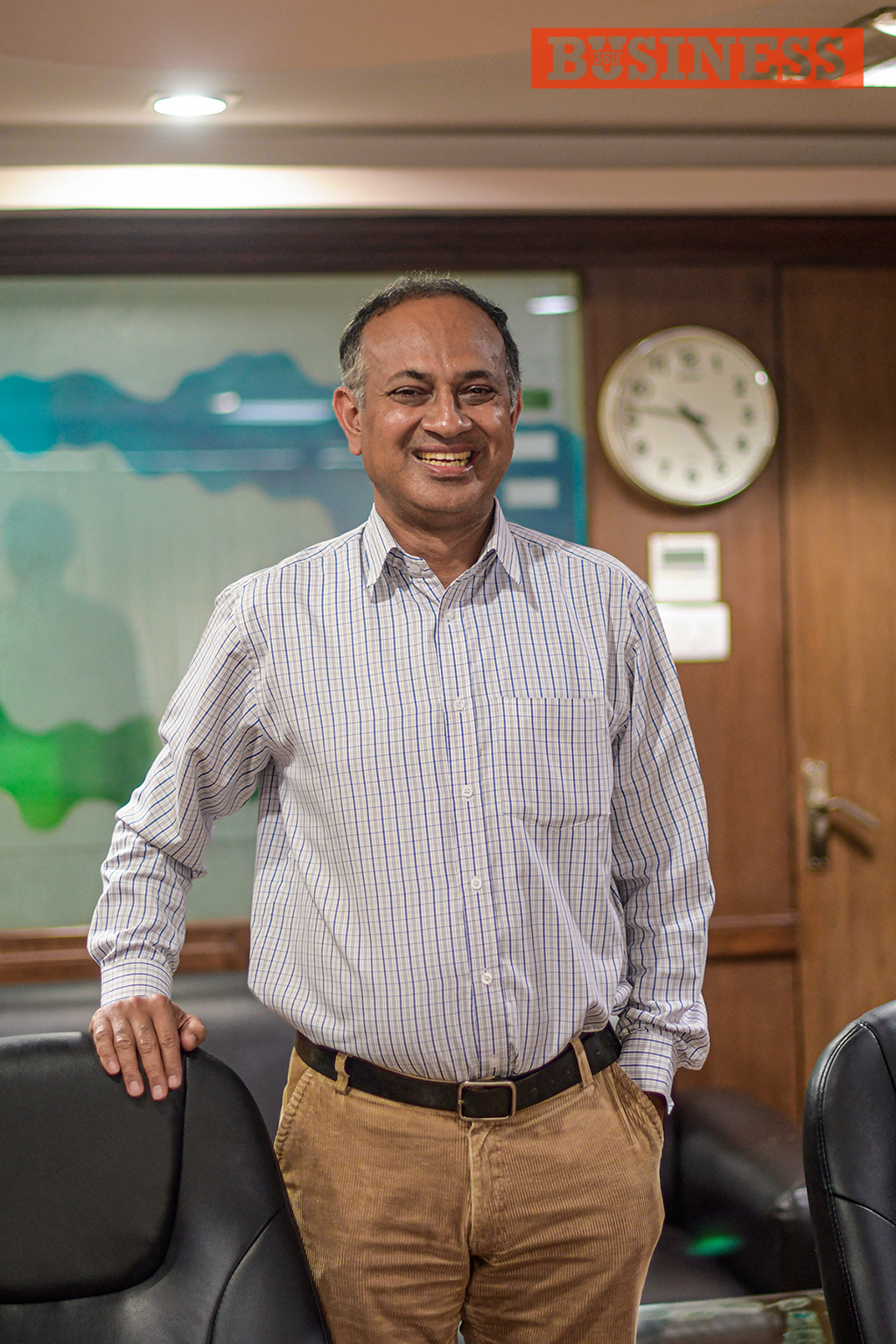

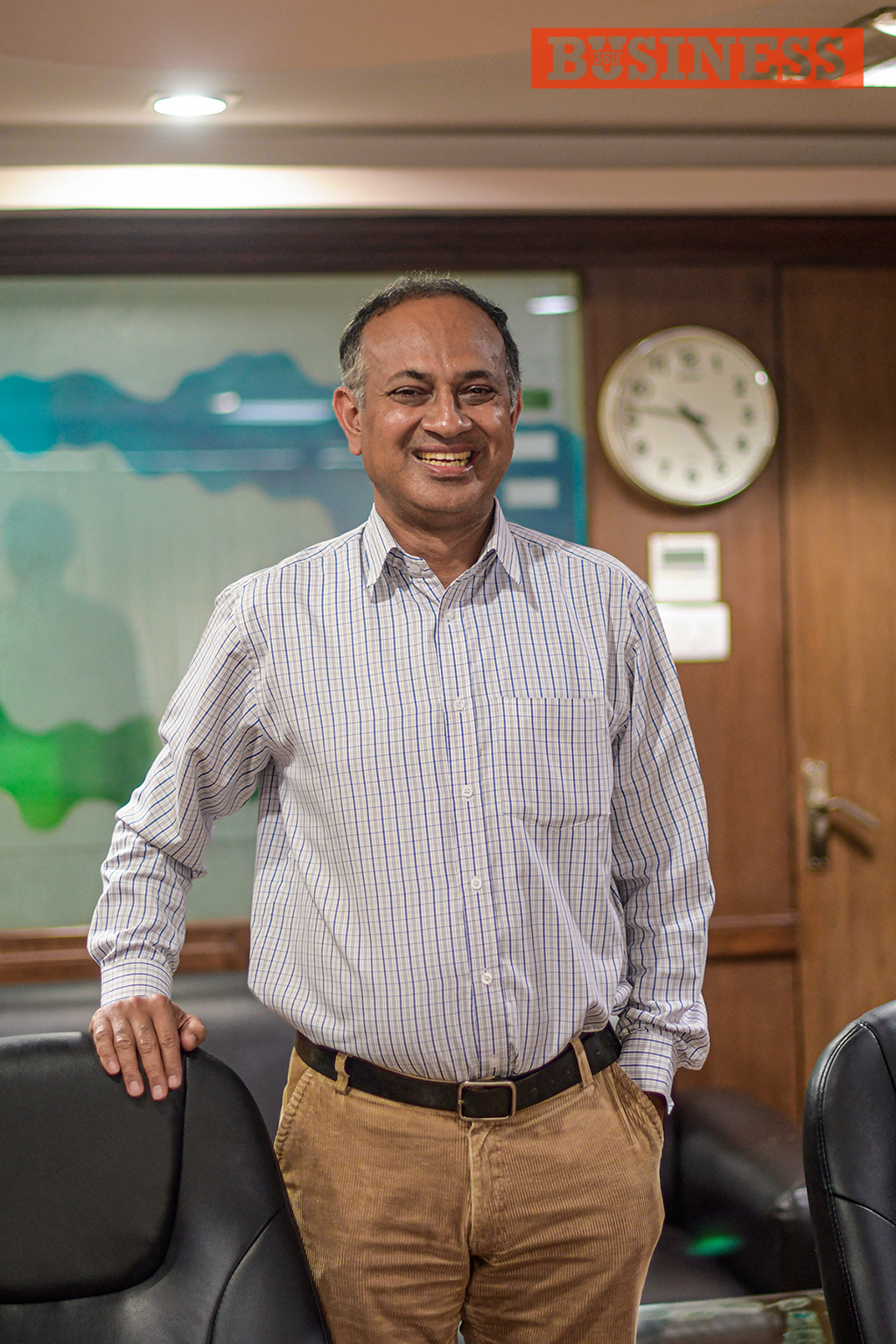

Bhuvan Kumar Dahal is the Chief Executive Officer of Sanima Bank and also the current President of Nepal Bankers’ Association. He was appointed CEO of Sanima Bank in January 2014 after holding the position of Deputy CEO for seven months. Dahal was elected President of Nepal Bankers’ Association unanimously in December 2019 and took the responsibility from January 4. A graduate in English and Economics, he has also worked as a teacher and civil servant for several years before joining Nabil Bank in 1991. Dahal was at Nabil Bank for more than two decades in various capacities and also held the post of Chief Operating Officer, Chief Investment Officer and Chief Financial Officer of the bank.

In an interview with Dibesh Dangol from B360, Bhuvan Kumar Dahal talks about the current situation at Sanima Bank and the banking industry at large with a focus on impact and challenges of Covid 19 on the banking industry and the economy. Excerpts:

How is Sanima Bank handling its activities during the current lockdown?

We are providing limited banking services due to the lockdown. But since some activities in the factories have increased, the activities in the bank have also increased. We are currently working with 130 dedicated staff and open branches every alternate day for a few hours inside and outside the Kathmandu Valley; information on the same can be found on the bank’s website. We are taking precautionary measures by using gloves, sanitisers, masks and using safe distancing norms. We have planned to increase the staff flow as per the increase in activities of the bank for now.As the president of Nepal Bankers’ Association, what are your agendas to take the banking industry forward? What are the current challenges and the solutions?

The banking industry of Nepal is not only one of the healthiest industries of the country but also of South Asia. Before the pandemic, Nepal’s banking industry was the healthiest amongst the South Asian countries according to CAMEL’s rating and it still is one of the best. The banking industry is the leader of the economy and if there is any type of impact in the economy, there is a parallel impact on the banking industry as well, and vice versa. Currently, the challenges faced by the banking industry include no proper flow of income, business transactions, remittance, etc. It should be taken into consideration that the banking sector is also one of the hardest hit sectors and till the next fiscal year it will be a huge challenge for banks. Our current agenda is to find ways to save the economy and the banking industry. For this, we are categorising our customers and industries and have written to NRB about the actions that need to be taken on default interest rates. Not all customers are highly affected because of the pandemic and some businesses can be seen booming. So, we want the Central Bank to give freedom to the banks to default interest rates depending on the nature of the customer and how hard they have been impacted by the pandemic because while a few expenses of the banks have been reduced during the lockdown, there are other fixed expenses like staff salaries, rent and so on that the bank needs to earn revenue for.

Banks have been promoting the use of mobile and internet banking excessively during the lockdown. Do you have any information on the growth rate of the use of these internet-driven services?

Yes, the use and transactions of mobile and internet banking services have increased tremendously during the lockdown which I am very happy to see. All banks are massively encouraging its customers to use digital services. Before the lockdown, on March 20, the banking sector decided to make digital channels free for transfer of funds whether it is from one bank to another bank, and also the ATM services. If you look at the current budget announcement also, the government has decided to make its digital payment system. I don’t have the exact numbers of by how much the use of these services has increased in the overall banking industry of Nepal, but in Sanima Bank it has increased encouragingly.The banking industry of Nepal has been hacked many times and questions have been raised on the credibility of Information Security. Your comments.

If you look at the news about these things of other banks in foreign countries, it’s of much bigger amount there. In Nepal, a few hacks have occurred but they are of a minimal amount. I am not saying that these hacks should be ignored, but these situations prove that the cyber-security of Nepali banks is strong. However there is always rooms for improvements.Is the banking industry happy with the relief package announced by the Government of Nepal and Nepal Rastra Bank? Did the government or NRB consult with the banks for the same?

We aren’t completely unhappy with the relief packages announced by the government and NRB. Most of the borrowers could have repaid their loans for the month of Chaitra which they should have been allowed to. Our request to the government and NRB is that they should allow and give freedom to the banks regarding defaulting interest, loan amount and relief packages because the banks know their clients and industries that have been impacted positively or negatively by the pandemic. Most of the borrowers who could have repaid their loans for the month of Chaitra haven’t repaid because of the decision taken by the regulator. Only 40% of borrowers repaid their loan of that month so that adversely affected our income and the activities in the banking industry has drastically gone down. We were consulted on some issues before the announcement was made.There are deliberations that a major slump in the economy will mean many big and small businesses going bankrupt resulting in unemployment and even possible liquidation of B and C class banks. What are your thoughts?

Some of the industries and borrowers will probably go bankrupt. I don’t disagree on that. But I can’t say anything about B and C class banks. The economic situation of Nepal will bounce back but it will take some time. The activities like buying expensive things, vehicles, eating out and travelling will slow down and will not be at the best as it was before the lockdown. Some industries including the activities mentioned will certainly take a long time to regain its original state until the vaccination or medication of the virus is made. People will now be more aware of their necessities and luxury, and will make financial decisions carefully.

Published Date: June 22, 2020, 12:00 am

Post Comment

E-Magazine

Click Here To Read Full Issue

RELATED Face 2 Face

.jpg)

.jpg)

.jpg)