The Nepal government’s new budget for the fiscal year 2078/79 seems promising for the market of Electric Vehicles (EVs) as it abolishes excise duty.

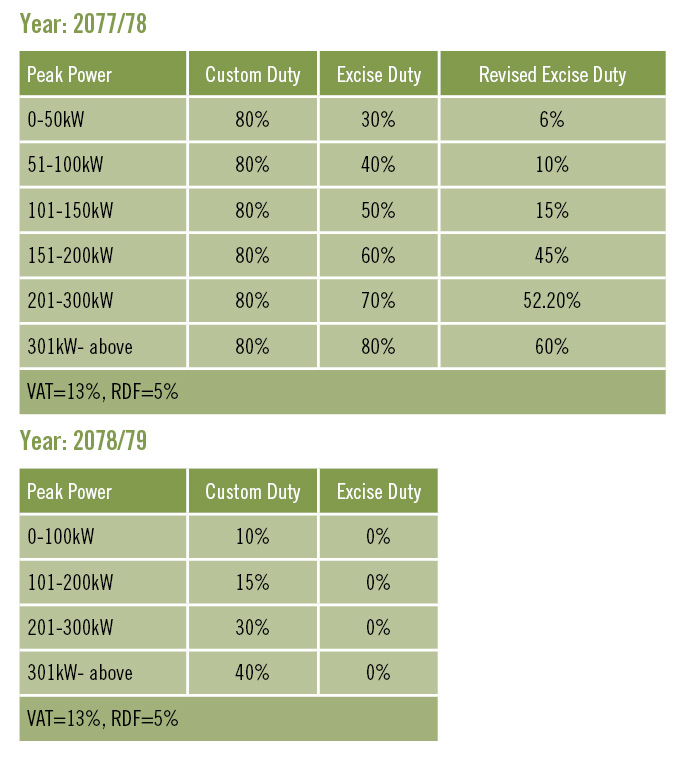

During the budget announcement of the 2077/78 fiscal year, former Finance Minister Dr. Yubaraj Khatiwada stated that 40-80% excise duty was applicable on EVs depending on the vehicle’s peak power. In addition, last year’s tax policy added 80% custom duty on top of 13% Value Added Tax (VAT) and 5% Refuse Derived Fuel (RDF) tax. Customers had to pay a total of up to 178% tax excluding 15-20% distributor profit to get their hands on an EV.

From the perspective of the government’s promise to promote green energy, the 2077/78 tax policies were not in favour of promoting green energy vehicles. However, later that year, the government revised the hefty tax system which only saw changes on excise duty ranging from 6% to 60%. “With this tax system in place, there was no import of EVs in the country,” said Krishna Prasad Dulal, President of Nepal Automobile Dealers Association (NADA).

Due to heavy taxation on EVs, their price increased significantly from around one million to three million rupees. One of the most affordable EVs, Thee Go E8 cost over three million rupees which was previously priced at Rs. 1.89 million before the 2077/78 tax policy. “Many EVs were stranded at the Nepal border as distributors were not willing to import the vehicles after the surge in price,” stated Dulal. He also said that automobile distributors had protested against the increased tax policy for electric vehicles. Raising a voice against the increased taxation, Nepal New Energy Vehicle Association had organised a awareness and protest rally last year in June asking to abolish the tax system on electric vehicles. However, the rally was stopped by local authorities due to Covid situation.

Due to heavy taxation on EVs, their price increased significantly from around one million to three million rupees. One of the most affordable EVs, Thee Go E8 cost over three million rupees which was previously priced at Rs. 1.89 million before the 2077/78 tax policy. “Many EVs were stranded at the Nepal border as distributors were not willing to import the vehicles after the surge in price,” stated Dulal. He also said that automobile distributors had protested against the increased tax policy for electric vehicles. Raising a voice against the increased taxation, Nepal New Energy Vehicle Association had organised a awareness and protest rally last year in June asking to abolish the tax system on electric vehicles. However, the rally was stopped by local authorities due to Covid situation.

Due to heavy taxation on EVs, their price increased significantly from around one million to three million rupees. One of the most affordable EVs, Thee Go E8 cost over three million rupees which was previously priced at Rs. 1.89 million before the 2077/78 tax policy. “Many EVs were stranded at the Nepal border as distributors were not willing to import the vehicles after the surge in price,” stated Dulal. He also said that automobile distributors had protested against the increased tax policy for electric vehicles. Raising a voice against the increased taxation, Nepal New Energy Vehicle Association had organised a awareness and protest rally last year in June asking to abolish the tax system on electric vehicles. However, the rally was stopped by local authorities due to Covid situation.

Due to heavy taxation on EVs, their price increased significantly from around one million to three million rupees. One of the most affordable EVs, Thee Go E8 cost over three million rupees which was previously priced at Rs. 1.89 million before the 2077/78 tax policy. “Many EVs were stranded at the Nepal border as distributors were not willing to import the vehicles after the surge in price,” stated Dulal. He also said that automobile distributors had protested against the increased tax policy for electric vehicles. Raising a voice against the increased taxation, Nepal New Energy Vehicle Association had organised a awareness and protest rally last year in June asking to abolish the tax system on electric vehicles. However, the rally was stopped by local authorities due to Covid situation.

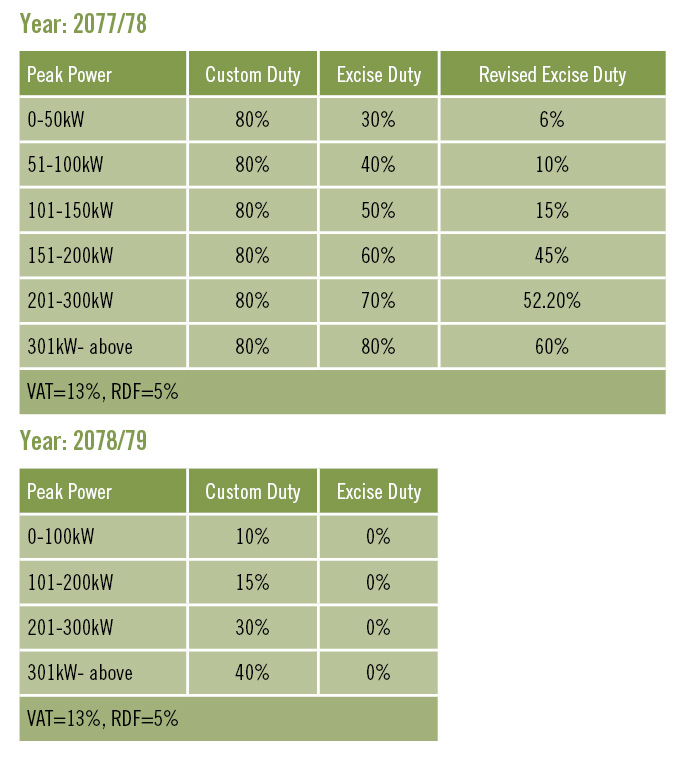

Nepal has been importing fuel and this has been a strong disadvantage for the economy, however electricity is produced in the country itself, and the government is now trying to promote EVs and use of other electrical appliances by the public.Lokesh Oli, a participant at the rally and someone who also runs a YouTube channel promoting and reviewing EVs, said there were over 30 participants including representatives from EV distributors. The rally basically promoted the use of EVs and was an appeal to the government that EVs are not luxury products but an efficient means of transport. After a disappointing year for the EV industry, the 2078/79 budget announced by Finance Minister, Bishnu Prashad Paudel has completely waived excise duty on EVs and also significantly lowered custom duty. It has been reduced to 10% to 40% depending on the power produced by the vehicle. However, VAT, RDF tax and yearly road tax remain unchanged. There are many benefits to EVs over Internal Combustion (IC) vehicles. EVs help reduce harmful air pollution, are cheaper to maintain and require less frequent servicing. At a time when fuel prices are increasing, charging an EV costs 40%-50% lower than the cost of fuel for a similar sized petrol vehicle for the same distance covered. Nepal has been importing fuel and this has been a strong disadvantage for the economy, however electricity is produced in the country itself, and the government is now trying to promote EVs and use of other electrical appliances by the public. “The EV market will definitely grow with the new tax policy as people begin to realise the price benefit on EVs compared to IC vehicles,” said Oli. According to Dulal, automobile distributors have already started importing vehicles that were stuck at the Nepal border. “10% of the total four wheelers imported into the country will be EVs,” he added.

Lack of charging stations remains a big disadvantage when buying an EV in Nepal. But this year’s budget has addressed the issue by stating that the government will be building 500 charging stations across the country.Lack of charging stations remains a big disadvantage when buying an EV in Nepal. But this year’s budget has addressed the issue by stating that the government will be building 500 charging stations across the country. Dulal also claims that the demand for EVs will increase in a massive way as private companies are also setting up charging stations for the ease of their customers. After the new tax policy, Kia Motors Nepal has already sold 45 units of Kia Niro EV, said Anish Lamichanne, AGM- Sales and Marketing of the company. He also shared that Kia Motors has already ordered Niro EVs which will be arriving in four months. Kia Motors is targeting to sell over 600 units of Niro EV yearly. Nissan is also all set to bring their globally hot selling Leaf EV in Nepal. Gyanendra Chand, AGM of Nissan Nepal said, “Bookings will be open for Leaf as soon as we launch the car in mid-July. However, sales will only start from August. Nissan expects to sell around 600 to 700 units of Leaf EV annually as it is the first Japanese EV that will be coming to Nepal.” Tata Motors Nepal is also planning to open bookings for the new Nexon EV and launch the electric SUV within August in Nepal. All in all, the new tax policy for electric vehicles will change the scenario of EVs in Nepal. The EV industry will gradually improve pace in the years to come.

Published Date: July 28, 2021, 12:00 am

Post Comment

E-Magazine

RELATED Feature