Following the November 20 elections of the federal parliament and the provincial assemblies, a new Prime Minister has been appointed under Article 76 (2) with the support of two or more political parties with representation in the parliament.

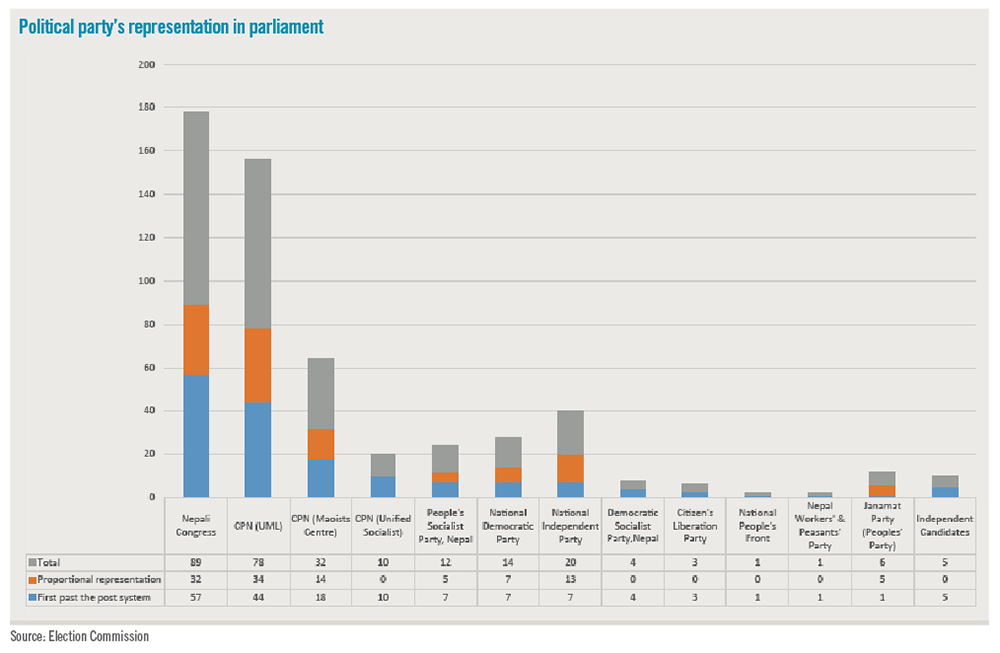

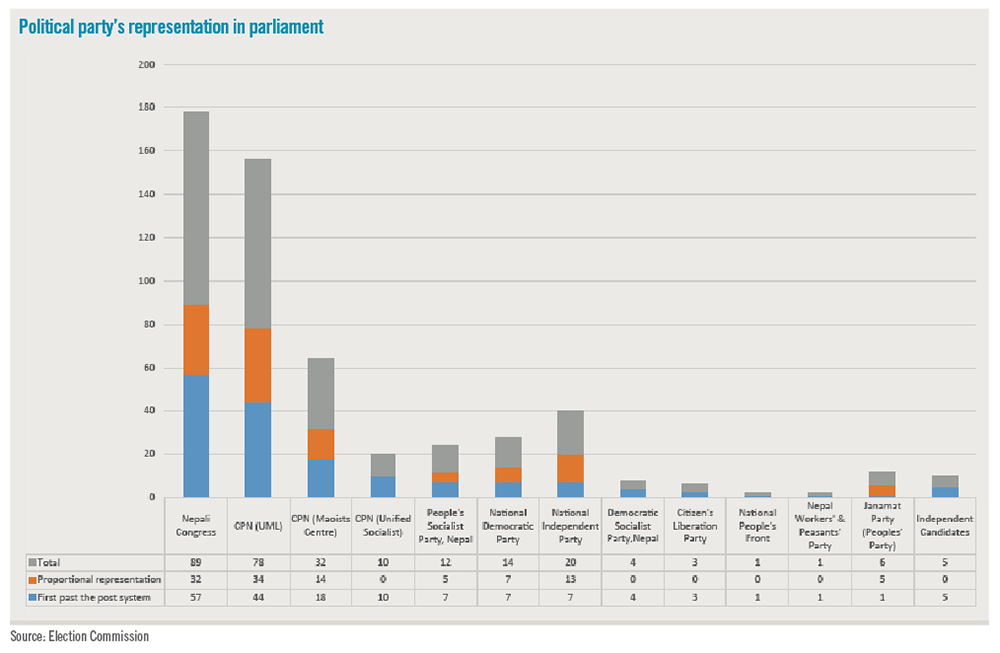

President Bidhya Devi Bhandari appointed Pushpa Kamal Dahal ‘Prachanda’, Chairman of CPN (Maoist Centre), the third largest political party with 32 seats in the 275-member parliament with the support of the second largest party CPN (UML), newly emerged National Independent Party, National Democratic Party, People’s Socialist Party, People’s Party (Janamat), Citizen’s Liberation Party and a few independent parliamentarians.

This a perfect example of a rainbow cabinet led by Dahal in his third term as the Prime Minister. Political analysts opine that the scattered priorities of the different sets of ministers representing various political parties could pose a challenge in streamlining result-based delivery.

The cabinet is yet to get complete shape as power sharing in the ruling coalition is yet to be conclusive. The ruling coalition at the federal level impacts the government formation in the provinces as well. The election of the President, Vice President and Speaker is also going to take place following the consensus in power sharing of the coalition.

Stability of the government is often questioned in Nepal due to the hung parliament which is almost unavoidable due to the mixed electoral system — first past the post (FPTP) and proportional representation.

As per Article 76 (1) of Nepal’s Constitution, the political party having majority of seats in the parliament is allowed to form a government; however, none of the political parties have absolute majority like the erstwhile Nepal Communist Party (NCP) had garnered in the 2017 election. Unfortunately, the government could not serve for the full five-year term due to intra-party conflict among different factions and finally split into three parties — CPN (UML), CPN (Maoist Centre) and CPN (Socialist).

From the recently held election, Nepali Congress emerged as the first party and the then ruling alliance garnered 136 seats.

Reported inconclusive power sharing deal between Nepali Congress and the CPN (Maoist Centre) on mainly who will lead the government for the first half of the five-year tenure caused dissolution of the previously formed ruling coalition and formed a new one backed by the second largest party, CPN (UML).

Newly appointed Prime Minister Dahal obtained vote of confidence on January 10. Interesting twists were witnessed in the parliament as Nepali Congress also gave vote of confidence to the newly formed government led by Dahal. Out of 270 parliamentarians in the parliament, 268 supported the Dahal-led government except MP Chitra Bahadur KC of National People’s Front and MP Prem Suwal of Nepal Peasants and Farmers Party. Prime Minister Dahal declared this to be a government of national consensus.

Reported inconclusive power sharing deal between Nepali Congress and the CPN (Maoist Centre) on mainly who will lead the government for the first half of the five-year tenure caused dissolution of the previously formed ruling coalition and formed a new one backed by the second largest party, CPN (UML).

Newly appointed Prime Minister Dahal obtained vote of confidence on January 10. Interesting twists were witnessed in the parliament as Nepali Congress also gave vote of confidence to the newly formed government led by Dahal. Out of 270 parliamentarians in the parliament, 268 supported the Dahal-led government except MP Chitra Bahadur KC of National People’s Front and MP Prem Suwal of Nepal Peasants and Farmers Party. Prime Minister Dahal declared this to be a government of national consensus.

Reported inconclusive power sharing deal between Nepali Congress and the CPN (Maoist Centre) on mainly who will lead the government for the first half of the five-year tenure caused dissolution of the previously formed ruling coalition and formed a new one backed by the second largest party, CPN (UML).

Newly appointed Prime Minister Dahal obtained vote of confidence on January 10. Interesting twists were witnessed in the parliament as Nepali Congress also gave vote of confidence to the newly formed government led by Dahal. Out of 270 parliamentarians in the parliament, 268 supported the Dahal-led government except MP Chitra Bahadur KC of National People’s Front and MP Prem Suwal of Nepal Peasants and Farmers Party. Prime Minister Dahal declared this to be a government of national consensus.

Reported inconclusive power sharing deal between Nepali Congress and the CPN (Maoist Centre) on mainly who will lead the government for the first half of the five-year tenure caused dissolution of the previously formed ruling coalition and formed a new one backed by the second largest party, CPN (UML).

Newly appointed Prime Minister Dahal obtained vote of confidence on January 10. Interesting twists were witnessed in the parliament as Nepali Congress also gave vote of confidence to the newly formed government led by Dahal. Out of 270 parliamentarians in the parliament, 268 supported the Dahal-led government except MP Chitra Bahadur KC of National People’s Front and MP Prem Suwal of Nepal Peasants and Farmers Party. Prime Minister Dahal declared this to be a government of national consensus.

"Governance and economic reforms will be given due priority."- Prime Minister Pushpa Kamal DahalPrime Minister Dahal earlier said he will now expand his cabinet after garnering vote of confidence. Though he has appointed seven ministers, the Prime Minister has given portfolio to three Deputy Prime Ministers. DPM Bishnu Prasad Paudel has been appointed as Finance Minister, DPM Rabi Lamichhane has been given the portfolio of the Ministry of Home Affairs and DPM Narayan Kaji Shrestha is leading the Ministry of Physical Infrastructure and Transport. However, expansion of the Cabinet is in limbo as the ruling parties have yet to forge consensus on power-sharing. Likewise, the constitutional portfolios like, speaker and deputy speaker; President and Vice President are still inconclusive as Prime Minister Dahal has signalled to bring in Nepali Congress onboard for power balance.

The New Ruling Coalition and Number of Seats in HoR

CPN (UML)- 78 CPN (Maoist Centre)- 32 National Independent Party-20 National Democratic Party- 14 People’s Socialist Party- 12 People’s Party- 6 Citizen’s Liberation Party- 3 Independent Lawmakers- 3Priority is Economy: Newly appointed PM

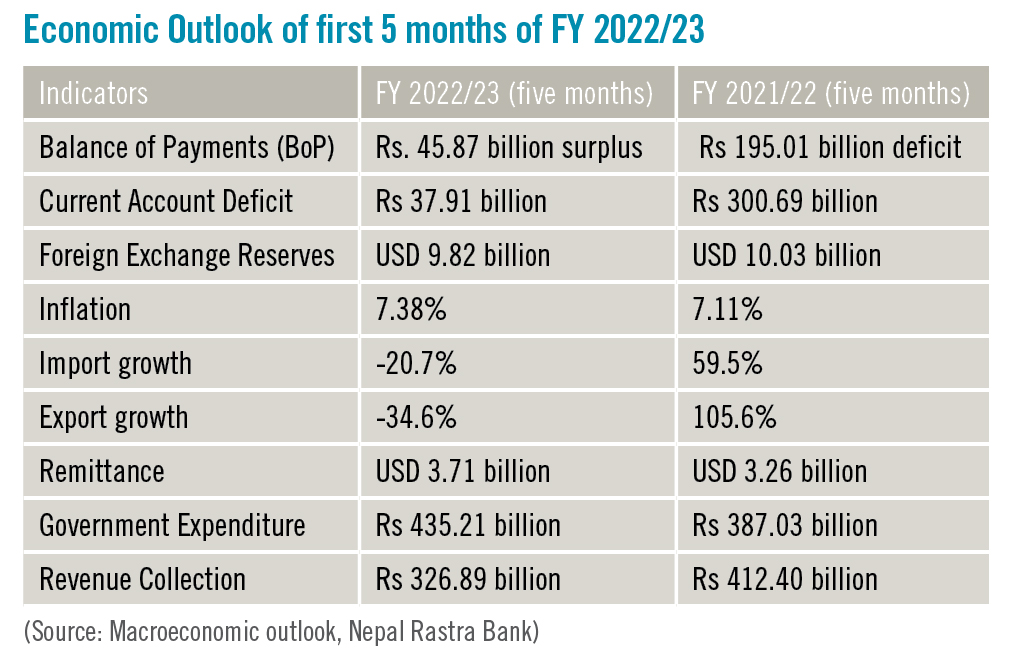

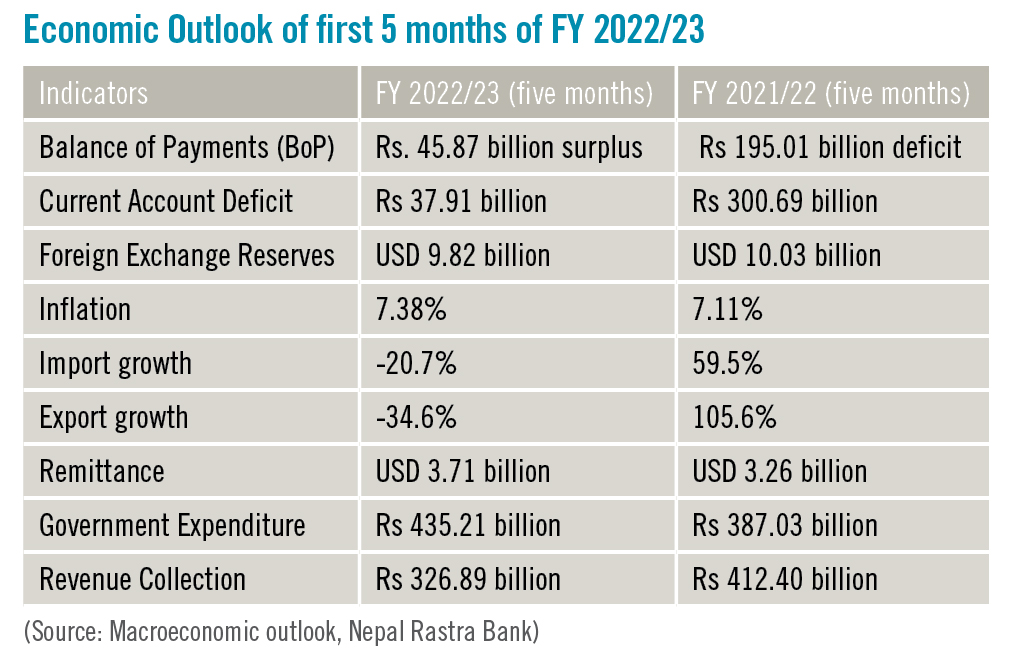

On assuming office on December 26, 2022, Prime Minister Dahal said that his government represents the true aspirations of the people reflected through the elections held a month back. “People can trust my government, and I’ll focus on delivery, access, and quality of public service delivery will be enhanced,” he said. The first meeting of the Cabinet has decided to address the difficulties of availing public services like passport, social security card, driving licences, etc. “The economy is in a bad shape and the Cabinet has discussed means and tools to navigate the economy to bring it back on the right track,” Dahal said. “Governance and economic reforms will be given due priority.” Experts deliberate whether it is coincidence that the third time Prime Minister Dahal has a third time Finance Minister Bishnu Prasad Paudel in the cabinet. The first cabinet meeting had discussed the slowdown in the economy and ways to stimulate it through effective execution of the fiscal and monetary policies, according to Finance Minister Paudel. “The government has decided to address the adverse situation of liquidity crunch, high credit rates, challenges of external sector stability caused by the strain on foreign exchange reserves and plummeting stock market to boost the confidence of investors and the public,” he said. Governance reform and effective public service delivery will be central, he explained. “We’ve decided to digitalise services and simplify processes through automation. We don’t have the luxury of time in moving this forward,” he elaborated. Parliamentarians have all focused on economic revival being the most important agenda for the new government.

Private sector seeks early remedy as situation deteriorates

Former Finance Minister Yubaraj Khatiwada has stated that the higher interest rates in deposits do not serve economic activities. “A large chunk of people who have funds have started parking their money in banks as deposits as they will be generating good returns through interest without taking any risk,” he said. Entrepreneurship then, as per Khatiwada, will suffer from lack of capital as credit rate will be exponentially high compared to the return/profit. There must be moderate interest rates at both ends for the economy to function well and the cost of fund must serve the returns to lure entrepreneurs into economic activities. However, Nepal Rastra Bank — the central regulatory and monetary authority - has said that it is still in on ‘wait and watch’ mode because as the custodian of the foreign exchange reserves it must keep an eye on balancing sound reserve position without affecting imports, the major lubricator of the Nepali economy. Meanwhile, private sector umbrella bodies have intensified their meetings with the newly appointed government with FNCCI briefing the PM about the current status of the economy and sensitivity of timing in addressing issues."Working capital is the major challenge for the smooth operation of industries and businesses. The Central Bank should postpone its working capital guidelines at least for two years considering the adverse situation.”“Working capital is the major challenge for the smooth operation of industries and businesses,” said Shekhar Golchha, President of FNCCI during the meeting with the PM. “The Central Bank should postpone its working capital guidelines at least for two years considering the adverse situation.” He advised resorting to monetary measures to address the current challenge of the liquidity crunch stating that the government should give due priority to the rehabilitation of the economy that has gone through the manifold challenges caused by the pandemic and Russia-Ukraine tensions. The private sector has also underpinned that economic activities should be encouraged, otherwise it will adversely affect revenue collection and the government will have to face a new challenge of current expenditure deficit. CNI has also advised the PM to accelerate each component of the economy including agriculture, tourism, manufacturing, SMEs, real estate and trade among other sectors to avoid a further slowdown.

NRB’s response

Nepal Rastra Bank (NRB) has addressed the demand of the private sector by amending the Working Capital Guidelines enforced from October 18, 2022, to control the rampant evergreening of loans. The private sector has demanded suspension of the guidelines till the economy remains in a bad shape citing the stringent policies introduced by the central bank will further worsen the business climate citing entrepreneurs are going through a dire need of resources. The amended Guidelines don’t allow the banks to reschedule or restructure the existing loans but can be repaid as term loan. The loan issued prior to the issuance of the Guidelines must be classified under separate categories and require provisioning, according to Gunakar Bhatta, Spokesperson for NRB. Such loans classified under new category must be repaid between mid-July 2023 to mid-July 2025 through five instalments. The central bank has enlarged the ceiling of credit from Rs 5 million to Rs 10 million. Similarly, for permanent capital needs such term loan of five-year provision has been expanded to 10 years through amendment. The provision of at least five fiscals’ statement to determine the limit of the term loan under this category has been minimised to three years. In addition, banks and financial institutions (BFIs) can consider operation cost and the tentative flow of funds while determining such limits. On top of that, the central bank has also adopted flexibility in inspection and management of working capital regarding existing assets and liability of the borrower and report to be updated along with credit file. READ ALSO:

Published Date: February 1, 2023, 12:00 am

Post Comment

E-Magazine

RELATED Feature