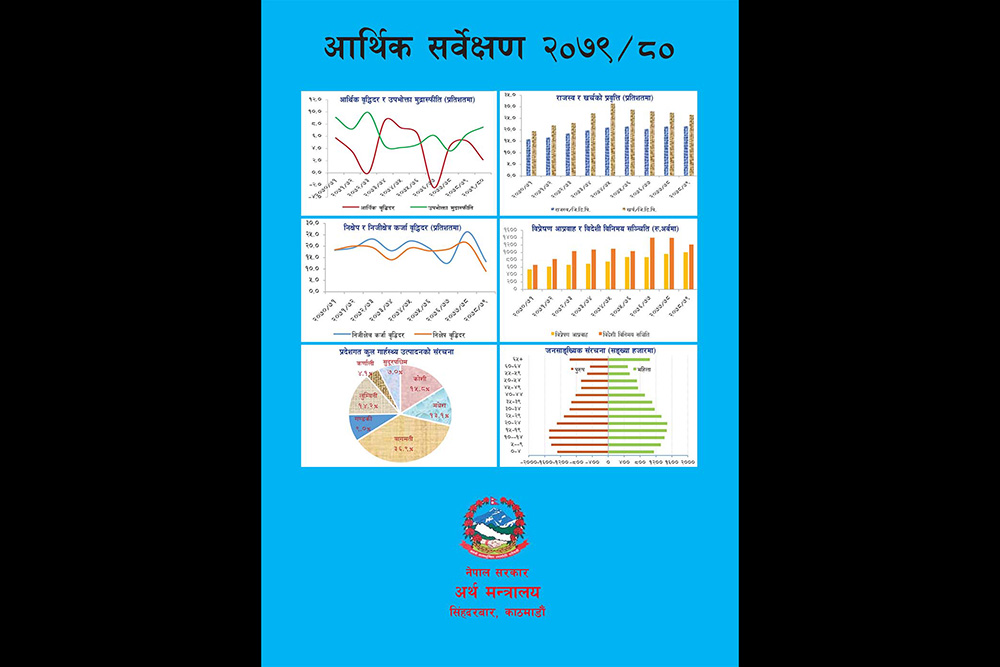

KATHMANDU: Citizens' access to finance has increased in the country of late, according to data shown by the Economic Survey, 2022/23 released by the government today.

Although the incidents of bank mergers are on the rise, the expansion of banking and financial institutions (BFIs) is wider, thereby ensuring citizens' financial access.

Till February/March 2023, the number of depositors stood at 49.205 million while the number of credit accounts stood at 1.8 million. There are 20.6 million mobile banking users. As many as 1.7 million people received internet banking services till this period, according to the Economic Survey.

The merger and acquisition of banks have not discouraged digital banking.

The number of people opting for digital payment via QR codes also rose significantly. The national economy is gradually coming back to track following the Covid 19 crisis further exacerbated by the impact of the Russia-Ukraine crisis. Import increased last year resulting in liquidity and investable means. It further triggered interest rates.

Till the survey period, there were 21 commercial banks, 17 development banks, 17 financial companies, 64 microfinances and one infrastructure development bank totalling 120 BFIs.

The number of insurance companies including reinsurance ones stands at 36 and 31, and cooperatives at 373.

In terms of the property of financial system and liability, the banking sector occupies significant size (86.6%).

By RSS

READ ALSO:

Published Date: May 28, 2023, 12:00 am

Post Comment

E-Magazine

RELATED B360 National

-1772448796.jpeg)