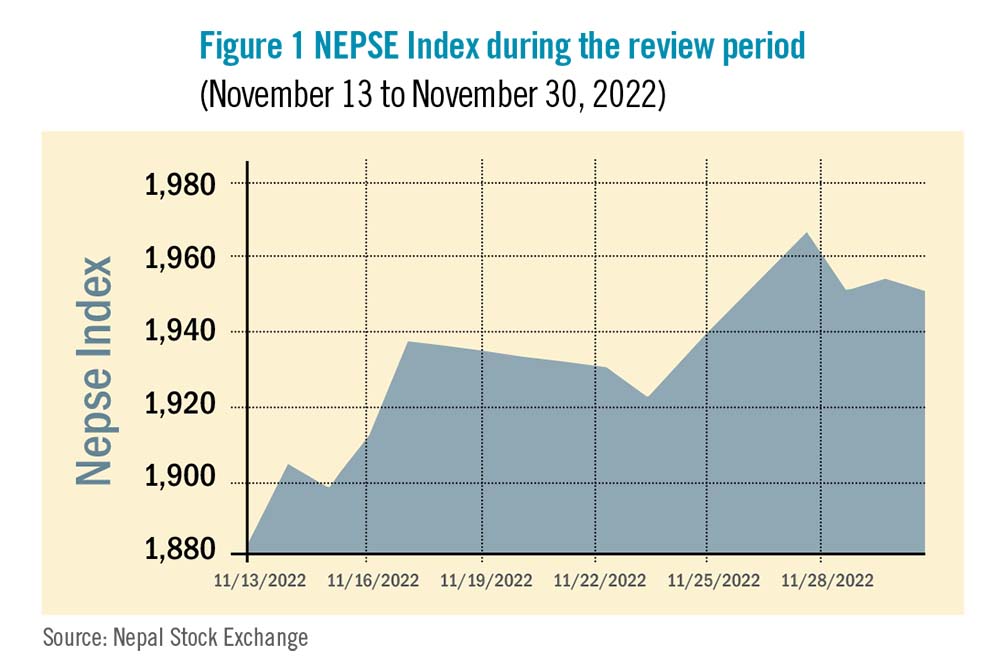

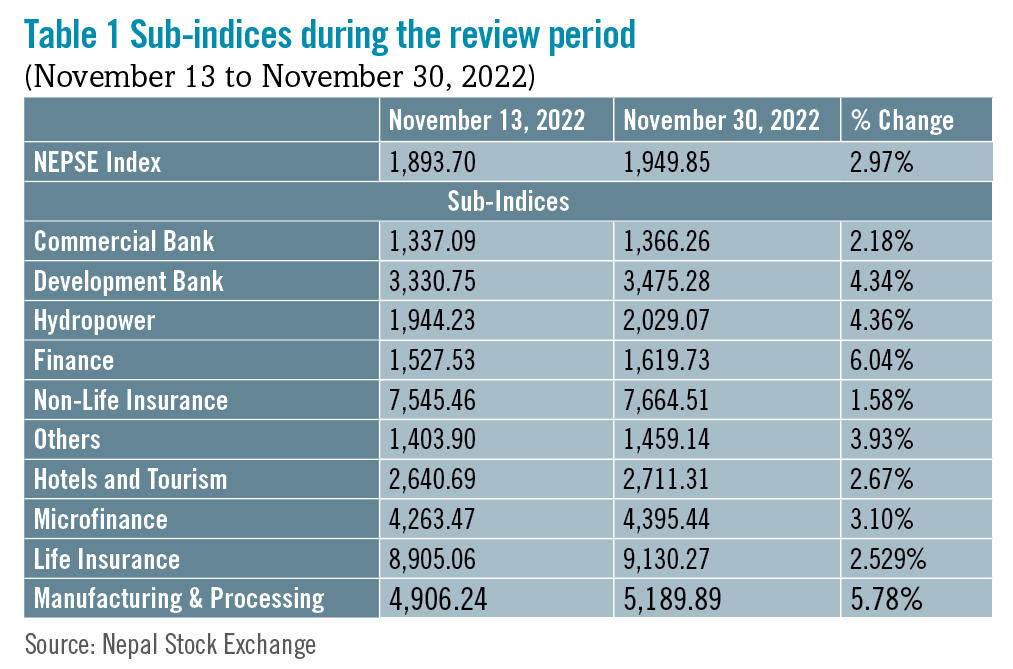

During the review period from November 11 to 30, the Nepal Stock Exchange (NEPSE) index increased by a significant 56.15 points (+2.97%) to close at 1,949.85 points. In alignment with the prior trading period, NEPSE index opened on a positive note in the initial days and provided some relief to investors. On November 27, the market reached a high of 1,965.98 points, however it fluctuated towards the latter part. As the trading period witnessed the second federal elections on November 21, investors were a bit cautious. As a result, the total market volume during the review period decreased marginally by 28.81% with total transactions of Rs 13.939 billion. During the review period, contrary to the previous period, all of the sub-indices landed in the green zone indicating a slight recovery across the sub-sectors. Finance sub-index (+6.04%) was the biggest gainer as the share value of Gurkhas Finance (+Rs 36), Goodwill Finance (+Rs 26.2) and ICFC Finance (+Rs 22.1) increased substantially. Manufacturing and Processing sub-index (+5.78%) was second in line with rise in the share prices of Bottlers Nepal (+Rs 1,470) and Himalayan Distillery (+Rs 480). Hydropower sub-index (+4.36%) followed suit with increase in the share prices of Ghalemdi Hydro (+Rs 38.6), Synergy Power (+Rs 32.1) and Panchakanya Mai Hydropower (+Rs 30.2). Likewise, Development Bank sub-index (+4.34%) also saw a rise with increase in share value of Karnali Development (+Rs 36), Shine Resunga (+Rs 34.7) and Corporate Development (+Rs 25). Others sub-index (+3.93%) went up as share prices of Nepal Telecom (+Rs 31.2) and Citizen Investment Trust (+Rs 30.9) increased. Microfinance sub-index (+3.10%) surged with a rise in the share value of Deprosc Microfinance (+Rs 92), Swarojgar Microfinance (+Rs 28.9) and Global IME Microfinance (+Rs 27.9). Hotels and Tourism sub-index (+2.67%) witnessed a rise in the share prices of Oriental Hotels (+Rs 14), Soaltee Hotel (+Rs 8.5) and Taragaon Regency (+Rs 4). Life Insurance sub-index (+2.52%) went on an upswing with rise in the share value of Asian Life Insurance (+Rs 39.9) and Nepal Life Insurance (+Rs 25.8). Commercial Bank sub-index (+2.18%) also followed suit with escalation in the share value of Nabil Bank (+Rs 67), NIC Asia (+Rs 36.9), and NMB Bank (+Rs 14.9). Non-life insurance sub-index (1.58%) gained the least value with an increase in share prices of Rastriya Beema (+Rs 205), Prabhu Insurance (+Rs 53) and IME General Insurance (+Rs 23).

News and Highlights

According to a guideline published by the Securities Board of Nepal (SEBON), Securities Issuance and Allotment (Sixth Amendment) Guideline 2079, 10% of the shares issued by companies when they call for the initial public offering (IPO) of securities should be distributed to Nepali citizens working or employed abroad and who have obtained work visas from relevant government agencies of Nepal. The guideline has been effective since November 3, 2022. All Nepali citizens intending to apply for IPO of shares issued for Nepali citizens working abroad may do so after getting work permit from the concerned government agencies of Nepal. Investors must contact member banks and financial institutions (BFIs) to apply for such IPO. Investors will be advised on how to register a Remittance Savings Account and obtain their C-ASBA Registration Number (CRN). All C-ASBA member banks and financial institutions are informed of the plans made to enter their customers remittance accounts and the CRN number required for this purpose in the C-ASBA system.  On the public issues front, SEBON has approved the IPO of Kalinchowk Darsan worth Rs 600 million. Nabil Investment Banking has been hired as the issue manager for this company. This company has published an offer letter to issue the IPO to project-affected locals and Nepali citizens working abroad. By doing so, it becomes the first company to issue IPO to investors working overseas. SEBON has also approved the IPO of five hydropower companies: Asian Hydropower, Supermai Hydropower, Super Madi Hydropower, Maya Khola Hydropower and Shuvam Power worth Rs 340 million, Rs 500 million, Rs 2.1 billion, Rs 1 billion and Rs 40 million, respectively. NMB Capital, Sanima Capital, Prabhu Capital and Muktinath Capital have been on boarded as issue managers respectively. Sanima Capital has been hired as the issue manager for both Supermai Hydropower and Super Madi Hydropower.

On the public issues front, SEBON has approved the IPO of Kalinchowk Darsan worth Rs 600 million. Nabil Investment Banking has been hired as the issue manager for this company. This company has published an offer letter to issue the IPO to project-affected locals and Nepali citizens working abroad. By doing so, it becomes the first company to issue IPO to investors working overseas. SEBON has also approved the IPO of five hydropower companies: Asian Hydropower, Supermai Hydropower, Super Madi Hydropower, Maya Khola Hydropower and Shuvam Power worth Rs 340 million, Rs 500 million, Rs 2.1 billion, Rs 1 billion and Rs 40 million, respectively. NMB Capital, Sanima Capital, Prabhu Capital and Muktinath Capital have been on boarded as issue managers respectively. Sanima Capital has been hired as the issue manager for both Supermai Hydropower and Super Madi Hydropower.

Outlook

The secondary market of Nepal has been witnessing fluctuations during the past few review periods in light of the market’s selling pressure, rising long-term interest rates and liquidity issues. Although the festive season and federal elections provided some respite, the market has been unable to hold the momentum. On a positive note, new developments such as the introduction of trading system for companies that have opted for merger and the introduction of trading mechanism for Nepalis living abroad will positively impact the market in the coming days. With the successful conclusion of federal and provincial elections, the creation of a new government is likely to increase investor confidence. increase investor confidence. This is an analysis from beed Management. No expressed or implied warrant is made for usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis. READ ALSO: