The Nepali economy which was on the road to recovery after being shattered by the Covid 19 pandemic, has started encountering enormous challenges caused by the alarming trade deficit, Balance of Payments (BoP) deficit, depletion of foreign exchange reserves and skyrocketing inflation. Cheaper credit mobilised on imports and forced economic revival are considered a major contributing factor to the depletion of reserves and huge BoP deficit. The country's foreign exchange reserves depleted by 18.5% during the first eight months of the ongoing fiscal 2021-22 (mid-July 2021 to mid-March 2022) to hover at $9.58 billion. This is sufficient to cover imports of goods and services for only 6.7 months. BoP deficit was at a high of Rs 258.64 billion in the first eight months.

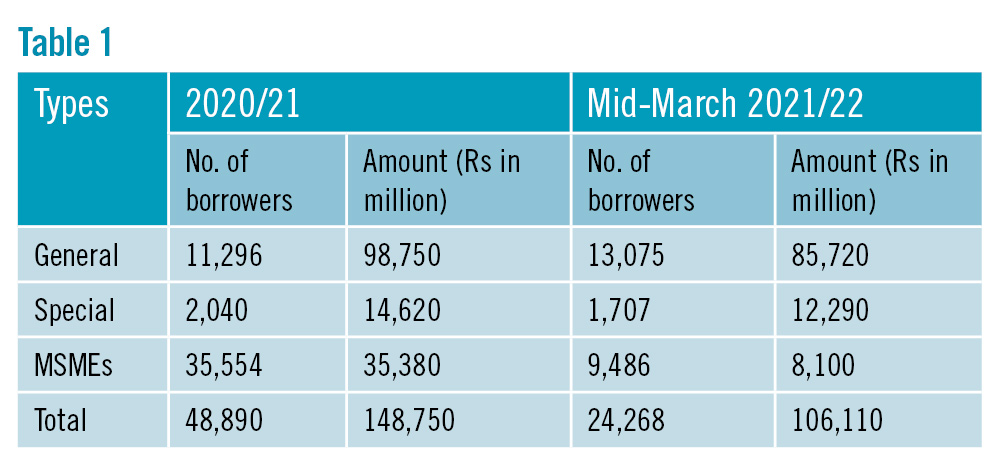

Finance Secretary Madhu Kumar Marasini has said that the financial sector is overheated as lending surged heavily in the first two quarters of this fiscal against slow recovery of credit alongside the refinancing and subsidised credit packages introduced during the Covid 19. "If we scrutinise it, a majority of the financial crisis is an outcome of the overheated financial sector," said Marasini."We can see the taper tantrum along with the withdrawal of the easing provided by the central bank." While the concessional lending facility and refinancing helped the private sector to sustain their enterprises while battling with the shocks posed by the pandemic, such facilities have adverse impacts on the economy and authorities are now struggling to keep the macro-economic fundamentals in order. During the pandemic the central bank had announced that it could provide refinancing of up to Rs 212 billion through funded and non-funded sources; a figure deemed high when compared to the central bank's capacity. The central bank has funded sources of only Rs 48 billion. The optimum refinancing rolled out during the peak time was at Rs 160 billion. However, the current outstanding refinancing hovers at Rs 134 billion till mid-March of this year, according to Nepal Rastra Bank. It means, around Rs 86 billion additional money is rolling into the economy even as the central bank's funded source of refinancing is merely Rs 48 billion. "It is considered that increased money supply tempts consumption thus triggering imports as we are an import-based economy," said Gunakar Bhatta, Spokesperson for NRB. "In view of the current external sector pressure along with depletion of forex reserves and skyrocketing imports, the central bank has given emphasis on recovery of loans as well as allowed the lending rate go up to minimise consumption," he added. Bhatta, however, stated that refinancing would continue for the hard hit sectors like tourism but that the central bank is mulling on withdrawing refinancing facility from those areas that can revive despite the withdrawal of such facility. (see table 1)  The International Monetary Fund (IMF) has asked the central bank to lower refinancing to its funded capacity, according to central bank officials. The World Bank Group has also cautioned the central bank. Hans Timmer, World Bank's Chief Economist for South Asia, has advised it to focus on quality of investment mainly in the productive sector controlling the rampant unproductive investments from the fiscal side. Since the second half of the fiscal, banks are noted to be running out of loanable funds due to slow deposit growth and the government's failure to increase capital expenditure. Inefficiency to expedite the development expenditure means banks will be running out of loanable funds for a longer term. It could hit growth and employment but simultaneously lower consumption and imports. Nepal Rastra Bank has given emphasis on tightening money supply through the Monetary Policy of this fiscal in view of the stimulus granted during the pandemic that has overheated the financial sector - mainly due to prolonged period of recovery and increasing non-performing assets (NPA) level. "The facility of loan restructuring and rescheduling does not reflect the exact situation of NPA," said Pawan Kumar Golyan, President of the Confederation of Bank and Financial Institutions Nepal (CBFIN). The outstanding amount of refinance provided by NRB remained at Rs 134.11 billion in mid-March this year. Similarly, as of mid-March 2022, the outstanding concessional loan was Rs 215.76 billion extended to 144,620 borrowers, according to Nepal Rastra Bank of which Rs 137.79 billion has been extended to 59,560 borrowers for selected commercial agriculture and livestock businesses. Likewise, Rs 74.17 billion loan has been extended to 82,197 women entrepreneurs. A total of 2,863 borrowers have availed Rs 3.80 billion concessional loan in other sectors.

The International Monetary Fund (IMF) has asked the central bank to lower refinancing to its funded capacity, according to central bank officials. The World Bank Group has also cautioned the central bank. Hans Timmer, World Bank's Chief Economist for South Asia, has advised it to focus on quality of investment mainly in the productive sector controlling the rampant unproductive investments from the fiscal side. Since the second half of the fiscal, banks are noted to be running out of loanable funds due to slow deposit growth and the government's failure to increase capital expenditure. Inefficiency to expedite the development expenditure means banks will be running out of loanable funds for a longer term. It could hit growth and employment but simultaneously lower consumption and imports. Nepal Rastra Bank has given emphasis on tightening money supply through the Monetary Policy of this fiscal in view of the stimulus granted during the pandemic that has overheated the financial sector - mainly due to prolonged period of recovery and increasing non-performing assets (NPA) level. "The facility of loan restructuring and rescheduling does not reflect the exact situation of NPA," said Pawan Kumar Golyan, President of the Confederation of Bank and Financial Institutions Nepal (CBFIN). The outstanding amount of refinance provided by NRB remained at Rs 134.11 billion in mid-March this year. Similarly, as of mid-March 2022, the outstanding concessional loan was Rs 215.76 billion extended to 144,620 borrowers, according to Nepal Rastra Bank of which Rs 137.79 billion has been extended to 59,560 borrowers for selected commercial agriculture and livestock businesses. Likewise, Rs 74.17 billion loan has been extended to 82,197 women entrepreneurs. A total of 2,863 borrowers have availed Rs 3.80 billion concessional loan in other sectors.

As per the central bank, business continuity loan has been extended to Covid 19 affected tourism, cottage, small and medium industries for payment of salaries to employees in line with 'Business Continuity Loan Procedure 2020'. Under this provision, Rs 1.10 billion loan has been approved as of mid-March 2022, states the central bank. Refinancing was needed during the pandemic to protect jobs and sustain enterprises by providing working capital. The central bank had categorised various sectors of the economy as severely affected, affected and less affected to match their refinancing and subsidised credit benefits. SMEs are the major beneficiary of the refinancing facility. The central bank had also lowered the ticket size of refinancing to Rs 50 million for a single borrower in a bid to benefit more enterprises focusing on SMEs. In Nepal, SMEs provide 1.75 million jobs and contribute 22% to the gross domestic product (GDP) and 98% of the firms employ only 10 persons each on average.

Sectors (i) Hard-hit sectors 1. Tourism (a) Trekking, travel agency, mountaineering, rafting, camping, tour operator, hilling centre, casino, massage, spa, etc. (b) Hotel, tourist accommodation/lodge, model, rural tourism, homestay, resort and restaurants, environmental tourism, wildlife reserves (c) Adventure tourism: skiing, gliding, water rafting, hot air ballooning, canyoning, parasailing, horse riding, elephant riding, bungee jumping, Himalayas expedition and observation, etc. (d) Golf course, polo, pony trekking, trekking/hiking, mountain flights, cable care 2. Civil aviation and tourist transportation 3. Entertainment, entertainment park, recreation related businesses, party palace 4. Film production, distribution and cinema hall 5. Those lost their jobs or laid off labourers, workers and staffs (In Nepal and in foreign countries) 6. Perishable goods like, vegetables, fruits, follower, meat and fish, animal feed, dairy products, egg production and distribution etc. 7. Poultry farming 8. Livestock, bee-keeping and fisheries 9. Readymade garments, handicrafts and businesses based on specified skills 10. Foreign Employment Agencies, Education Consultancy Service Providers

(ii) Moderately affected • Durables like plastic, iron/steel, tyres, leather and metal products, home appliances production and distribution related industry and businesses • Private and private boarding schools, and higher studies centres and secondary schools, colleges and universities, technical schools, pre-school child care • Public transportation (land route) • Beauty parlour, salon, cosmetic surgeries and personal services related activities • Legal, account, engineering related consultancy services and businesses • Hospital, Clinic, Nursing home, Diagnostic centre • Health centre, fitness centre • Production, processing and sales/distribution of commodities that can be stored (except food) • Forest and minerals related industry • Construction business • Pharmaceuticals production • Printing, publication and media house • Hydropower and renewable energy projects under construction • Production of stones, clay and glass related products • Less affected sectors • Hydroelectricity projects already started commissioning and connected to the national grid • Online (ecommerce) businesses • Food production, processing, storage, sales and distribution/ beverage production, processing and sales/distribution related industry and businesses • Sales and distribution of daily essentials • Import related trade • Petrol pump, gas and water related businesses • Sales of drugs/medicines • Advertising services • Internet, telecommunication service providers • Alcohol and tobacco industry and sales/distribution • Truck and transportation business • Businesses related to jewellers/gold and silver ornaments and precious stones

(Source: NRB)

READ ALSO:

- Breaking barriers to women’s leadership

- What BBIN MVA means for Nepal’s economy

- State mechanisms persecute private sector