As of fiscal year 2019-20 the Government of Nepal made Permanent Account Number (PAN) mandatory for all salaried workers. This rule was set in motion starting mid-July, the first day of the fiscal year 2019-20. As all employers are required to record tax deducted at source (TDS) in the account of their staff, therefore every employee must have PAN.

A Permanent Account Number (PAN) is an identification number that identifies an individual as a taxpayer in Nepal. PAN is also known as Tax Payer Identification Number (TPIN), and the document on which the number is printed as PAN card and PAN certificate.

A PAN card is an identification document issued to an individual by the government to identify him or her as a tax payer and keep track of the taxes paid by the citizens. There are two types of PAN cards: Business PAN and Individual PAN or Personal PAN. In this article we will be primarily focusing on the important things to know about PAN for individuals.

Why do we need a PAN?

As the Nepali Government gingerly transitions from informal to formal economy, it has been increasingly important for individuals to register and obtain a Personal PAN number. A PAN card is important as it allows the Inland Revenue Department to collect an individual’s tax related information. Normally any individual or a company involved in business or non-business activity that conducts financial transaction and files income tax to the government is required to have a PAN. As previously stated, since the start of 2019-20 fiscal year, PAN has become mandatory for employees or working men and women earning any form of salary from a business or an organisation. The government has stated that it does not validate any company’s payment of salaries and wages to its employees who do not have a PAN. The primary reason for implementing this rule is to track revenue leakages and bring more firms, companies and people into the income tax net. According to the government, by making PAN mandatory, it will be better able to track the actual amount of tax an individual pays out of his or her salary. Plus the government can also track and cross verify whether salary expenses as recorded in the accounting system of the employer or company are correct or not. In basic terms, it is the citizen’s responsibility to pay their taxes and with the help of PPAN, it makes the tax paid to the government transparent and easier to keep account of.Implementation Issues

Officials at the Inland Revenue Department (IRD) claimed that by making PAN mandatory for all salary earning citizens, the scheme would be able to strengthen tax administration and control revenue leakage. However the private sector had initially urged the government to defer the plan citing that it is difficult to make it mandatory. And rightfully so. For example, Nepali businesses employ thousands of Indian migrant workers who are involved in various projects under infrastructure and industrial sectors, therefore making PAN mandatory for such workers would be very challenging. In addition, a national daily just weeks after the new PAN rule came in to effect reported that the government’s ostentatious scheme to broaden the tax base by making PAN mandatory had badly affected micro-level businesses in the country, especially in the retail sector. Arguments from the retailers claim that not all retailers are educated and aware of the tax system and therefore they were struggling to understand the procedures of PAN registration, and its effects on their income and business. Lastly, the abrupt implementation without enough groundwork affected the retail sector negatively.Normally any individual or a company involved in business or non-business activity that conducts financial transaction and files income tax to the government is required to have a PAN. As previously stated, since the start of 2019-20 fiscal year, PAN has become mandatory for employees or working men and women earning any form of salary from a business or an organisation.The government should have conducted a proper campaign to educate or at least make aware of the new PAN provision. Even though there were efforts from the government side, it failed to reach a wider population and instead overwhelmed the private sector. The private sector additionally requested that the government allow flexibility in time for implementation. Consequently in late August 2019, less than a month after the new PAN provision was implemented, the government decided to relax the provision. The government and the private sector also came to an agreement that PAN card is not necessary for commercial enterprises when making payments to employees who work on a daily wage basis and earn up to Rs 2,000 per day. Workers whose daily wage exceeds Rs 2,000 however must mandatorily procure a PAN card to receive any sort of payment.

How to apply for a PPAN card

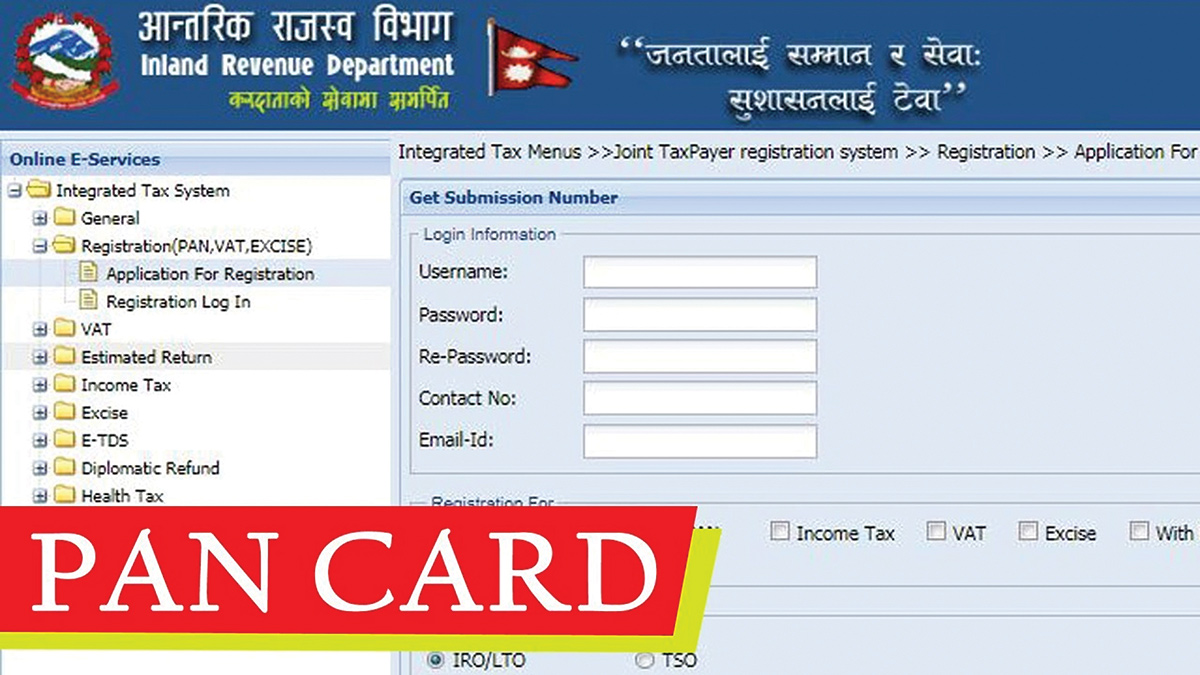

The Inland Revenue Department issues PAN through its 59 field offices including 38 Inland Revenue Offices (IROs), 19 Tax Service Offices (TSOs), one Medium Level Tax Office (MLTO) and one Large Taxpayer Office (LTO) located in different parts of the country. Applicants can easily apply for Personal PAN card online and take the document to the IRD office at their known location where the government officer there will verify the details and provide them with a PAN card free of charge. Applicants are required to take a few documents for PPAN registration such as application form, copy of the applicant’s citizenship certificate, and two passport size photos at time of registration. The following is a step by step process on how to apply for PPAN online. • Go to the website of the Inland Revenue Department (IRD): www.ird.gov.np • Scroll down if necessary, find the service tab and click on the ‘Taxpayer Portal’ link. • On the left-hand side, click on ‘Registration’ (PAN, VAT, EXCISE) tab. • Expand the vertical menu and find the application for registration. • Select ‘Application for Registration’ and you will see a registration form on the main screen. • Fill out the information and choose the IRD office located in your area in the ‘Verifying Offices’. • Once you’ve filled in the detail, Press the ‘Ok’ button once you have filled in the details and you will receive the Submission Number. • Press the ‘Continue’ button once you have your Submission Number. • Fill out all personal details as required. • Once you are done, click on the ‘Save’ button. • Click on the ‘Print’ button to get a copy of the submitted application form. • Take the printed copy to the IRD office located in your area. • The IRD office will then verify your details and provide you a PAN card free of charge.

Published Date: October 14, 2020, 12:00 am

Post Comment

E-Magazine

Click Here To Read Full Issue

RELATED Feature