Cost cutting and profit maximisation are parallel concepts intertwined in most business mottos. In normal course, most companies channel their resources and efforts to reduce and optimise cost alongside increasing profits. Business establishments usually assume revenue is correct, any leak, frauds or unintentional errors occur on the cost or recovery side. However, ensuring accuracy and completeness of revenue is a very critical aspect that needs focus, controls, monitoring and assurance in equal measures.

Losing revenue at the top line is like running a business for free. Revenue assurance or leak assessment will help companies recover revenue for services/goods provided but not billed, minimise enterprise level risks, avoid future leakage and optimise performance.

Importance [caption id="attachment_18789" align="alignleft" width="250"] Tulsi Khemka is a CA with 18+ years of experience in the space of risk, systems and security having worked with corporates in India, Nepal, US and UK.[/caption]

In the corporate world, investors, boards, management have full confidence in revenue reported in the financial statements. They rely on the top line to make future business decisions, future growth and expansion plans.

Every time I have sat through an audit committee meeting, discussions have revolved around key focal points – reduction of cost, possible frauds related to cost and profit increase. The underlying assumption remains the same – revenue reported was accurate and complete. But numbers tell you a different story. It doesn’t take an in-the-field need to understand the importance of plugging revenue leakage and its direct impact on financials.

Tulsi Khemka is a CA with 18+ years of experience in the space of risk, systems and security having worked with corporates in India, Nepal, US and UK.[/caption]

In the corporate world, investors, boards, management have full confidence in revenue reported in the financial statements. They rely on the top line to make future business decisions, future growth and expansion plans.

Every time I have sat through an audit committee meeting, discussions have revolved around key focal points – reduction of cost, possible frauds related to cost and profit increase. The underlying assumption remains the same – revenue reported was accurate and complete. But numbers tell you a different story. It doesn’t take an in-the-field need to understand the importance of plugging revenue leakage and its direct impact on financials.

Plugging the leak Cause of revenue leak varies across industries, scale and reach of operations. However, overall process of plugging the leak remains standard.

Step 1 - Understand the revenue sources: Revenue talks about story of growth, the size of growth can only be ascertained only after knowing the sources. The tool Sources-of-Revenue Statement (SRS) that was developed by Michael Treacy is commonly used for sales tracking. The model breaks revenue as follows:

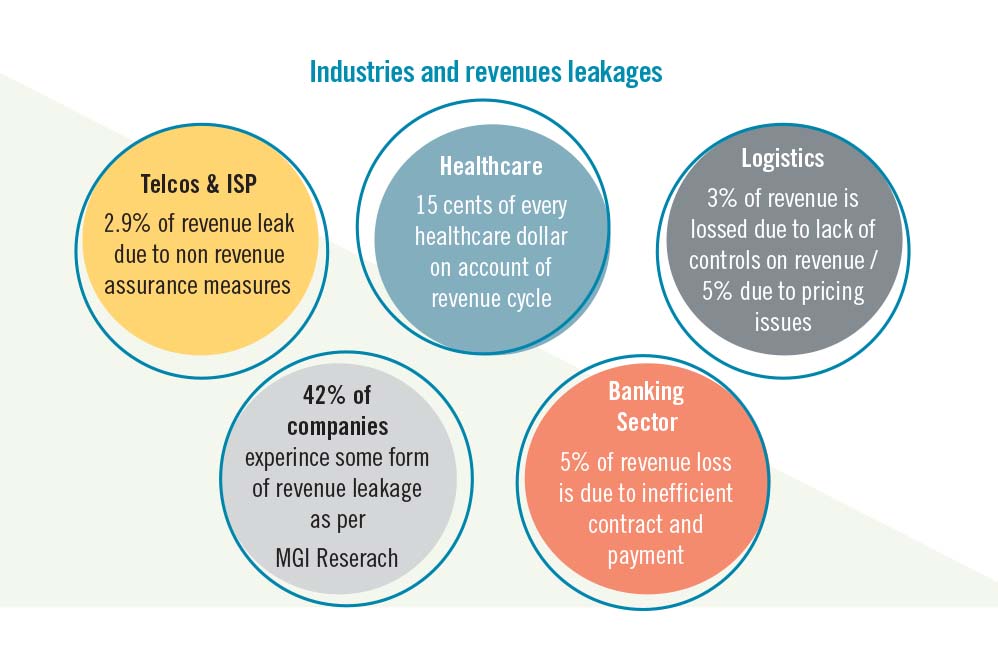

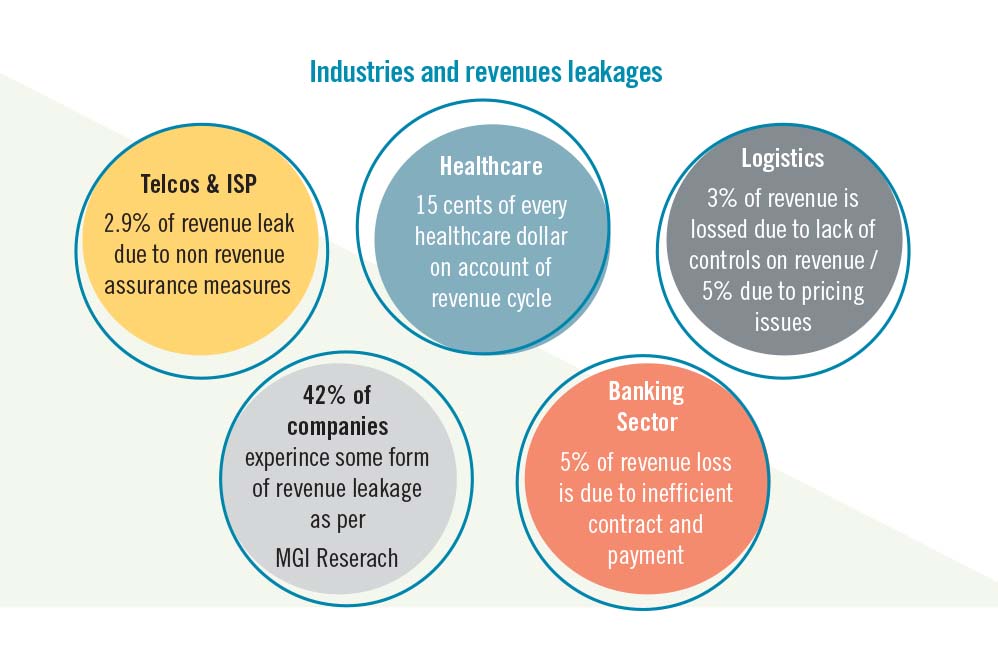

Step 2 - Possible Leaks Loss of revenue varies from industry to industry depending on your automation levels. So, what are the few areas you can see revenue leaks in? Software industry where time-based billing is prevalent: Revenue not billed because of non-filing of timesheet by team members for billable project hours. Telcos & ISPs: Technical glitch in call monitoring software not recording all calls made through the network Click based revenue: Absence of complete tracking of all clicks, resulting in non-billing of revenue and real-time billing Manual invoicing: Has an error rate of 12-15% based on a study by Aberdeen Group, this directly applies to Nepal, were manual billing is required by the law. Excessive use of spreadsheets: Errors in formula on spreadsheets resulting in incorrect price computation Product pricing formulae: Non-accounting of all costs like pre- sales, administrative to name a few not considered in product pricing Manufacturing: Incomplete estimation of manpower effort across different product segments Trading: Not raising of invoice to customers for products sold Hospitality: Not billing for special orders, laundry, room bar, for room upgrades, etc Discounts: Unchecked discount process

Step 3 – Checks, and balances along with continuous monitoring You know the source and leaks, but plugging it is the next key or rather should I say lock it. A holistic and non-traditional, end-to-end review and analysis of revenue stream and cycle, helps identify the problem areas. This helps define the checks and balances needed to prevent leaks and lay down a short and long-term vision. Process driven changes prevent any future leakages by focusing on all risks, processes, system controls, employee controls, financial practices, future automation, compliance to laws and regulations and defining a revenue assurance maturity framework. In addition to preventive controls, detective controls like periodic data analytics, surprise checks, MIS, ratio analysis, red flag placements, etc is needed to constantly ensure the leak stays plugged.

Way forward and automation Market is evolving and growing in varied complexities, reporting and regulatory environment in cross-border transactions adds pressure to the control environment. These market stressors can only be handled with constant and rapid technological changes in the operations, controls and optimisation of efficiencies. Using standard processes and advanced analytical tools for revenue assurance functions like accurate and timely billing, analysis of revenue completeness, accounting of revenue, compliance matrix, MIS and financial analysis, etc is the only way to scale, mitigate revenue leakage and quickly identify root causes and any new vulnerabilities. Have you assessed the size of your leak? It’s time to move forward and save your top line from eroding. READ ALSO:

Importance [caption id="attachment_18789" align="alignleft" width="250"]

Tulsi Khemka is a CA with 18+ years of experience in the space of risk, systems and security having worked with corporates in India, Nepal, US and UK.[/caption]

In the corporate world, investors, boards, management have full confidence in revenue reported in the financial statements. They rely on the top line to make future business decisions, future growth and expansion plans.

Every time I have sat through an audit committee meeting, discussions have revolved around key focal points – reduction of cost, possible frauds related to cost and profit increase. The underlying assumption remains the same – revenue reported was accurate and complete. But numbers tell you a different story. It doesn’t take an in-the-field need to understand the importance of plugging revenue leakage and its direct impact on financials.

Tulsi Khemka is a CA with 18+ years of experience in the space of risk, systems and security having worked with corporates in India, Nepal, US and UK.[/caption]

In the corporate world, investors, boards, management have full confidence in revenue reported in the financial statements. They rely on the top line to make future business decisions, future growth and expansion plans.

Every time I have sat through an audit committee meeting, discussions have revolved around key focal points – reduction of cost, possible frauds related to cost and profit increase. The underlying assumption remains the same – revenue reported was accurate and complete. But numbers tell you a different story. It doesn’t take an in-the-field need to understand the importance of plugging revenue leakage and its direct impact on financials.

Plugging the leak Cause of revenue leak varies across industries, scale and reach of operations. However, overall process of plugging the leak remains standard.

Step 1 - Understand the revenue sources: Revenue talks about story of growth, the size of growth can only be ascertained only after knowing the sources. The tool Sources-of-Revenue Statement (SRS) that was developed by Michael Treacy is commonly used for sales tracking. The model breaks revenue as follows:

- Retention of existing customer base to on-boarding of new (known as base retention)

- Sales won from the competition (share gain)

- Market expansions

- Lateral movements across adjacent markets to leverage core capabilities with minimum efforts

- New lines of business

Step 2 - Possible Leaks Loss of revenue varies from industry to industry depending on your automation levels. So, what are the few areas you can see revenue leaks in? Software industry where time-based billing is prevalent: Revenue not billed because of non-filing of timesheet by team members for billable project hours. Telcos & ISPs: Technical glitch in call monitoring software not recording all calls made through the network Click based revenue: Absence of complete tracking of all clicks, resulting in non-billing of revenue and real-time billing Manual invoicing: Has an error rate of 12-15% based on a study by Aberdeen Group, this directly applies to Nepal, were manual billing is required by the law. Excessive use of spreadsheets: Errors in formula on spreadsheets resulting in incorrect price computation Product pricing formulae: Non-accounting of all costs like pre- sales, administrative to name a few not considered in product pricing Manufacturing: Incomplete estimation of manpower effort across different product segments Trading: Not raising of invoice to customers for products sold Hospitality: Not billing for special orders, laundry, room bar, for room upgrades, etc Discounts: Unchecked discount process

Step 3 – Checks, and balances along with continuous monitoring You know the source and leaks, but plugging it is the next key or rather should I say lock it. A holistic and non-traditional, end-to-end review and analysis of revenue stream and cycle, helps identify the problem areas. This helps define the checks and balances needed to prevent leaks and lay down a short and long-term vision. Process driven changes prevent any future leakages by focusing on all risks, processes, system controls, employee controls, financial practices, future automation, compliance to laws and regulations and defining a revenue assurance maturity framework. In addition to preventive controls, detective controls like periodic data analytics, surprise checks, MIS, ratio analysis, red flag placements, etc is needed to constantly ensure the leak stays plugged.

Way forward and automation Market is evolving and growing in varied complexities, reporting and regulatory environment in cross-border transactions adds pressure to the control environment. These market stressors can only be handled with constant and rapid technological changes in the operations, controls and optimisation of efficiencies. Using standard processes and advanced analytical tools for revenue assurance functions like accurate and timely billing, analysis of revenue completeness, accounting of revenue, compliance matrix, MIS and financial analysis, etc is the only way to scale, mitigate revenue leakage and quickly identify root causes and any new vulnerabilities. Have you assessed the size of your leak? It’s time to move forward and save your top line from eroding. READ ALSO:

Published Date: January 21, 2022, 12:00 am

Post Comment

E-Magazine

RELATED Ringside View