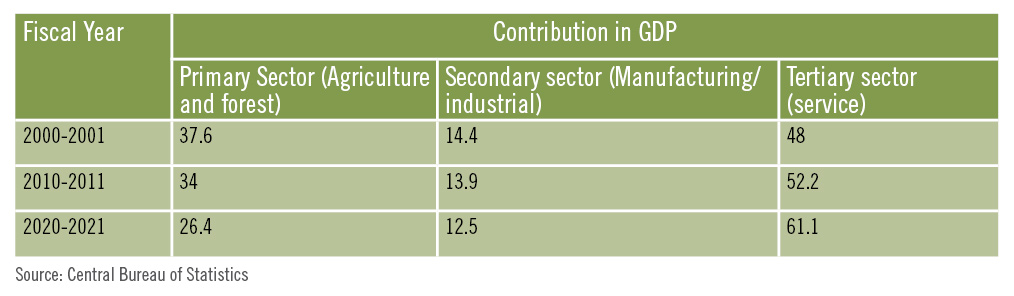

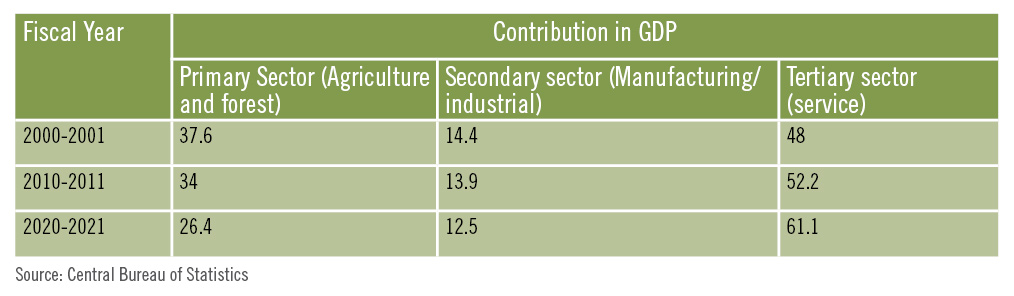

Nepal was considered to be an agrarian economy till the beginning of this century as around 38% of the country’s gross domestic product (GDP) was based on agriculture and forest. Gradually, over the years, the contribution of the agriculture sector squeezed because of the rapid expansion of services sector particularly led by the strong inflow of remittances sent by the millions of Nepalis who have gone abroad for foreign employment. The contribution of agriculture could not grow in proportion to the expansion of the services sector that has witnessed a rapid rise in the last 15 years.

Remittance has played a critical role in lubricating all sectors of the economy with increased purchasing capacity of the people. One member from among every three households in Nepal has migrated to a foreign country for employment, and consequently led the country to become an import-based economy.

When looking at the various businesses run in the country, import business tends to take precedence. It is considered low-risk business and high return as opposed to operating an industry which is a multidisciplinary task in itself and comes with a series of challenges such as the country’s deteriorating industrial climate marked by armed conflict, insecurity, loadshedding, labour unrest, high cost of transportation, frequent bandhs and strikes, etc.

The agriculture industry also has similar woes. Low returns, high labour cost due to low mechanisation of the farming system, fragmented land holdings and lack of proper land use policy, lack of finance (bank credit) and internal migration from village to semi-urban and urban areas have lowered the domestic agriculture production.

Cheaper agro imports have added to destroying the production base. This has of late become a subject of concern for policymakers, according to Ravi Shanker Sainju, an expert on international trade. “At present everything looks fine as we have been receiving food items from a number of countries but this could push the country to becoming highly food insecure if the exporting countries restrict export of food items due to a rise in their domestic demand or other circumstances,” he explains.

In the last two decades, the contribution of the agriculture sector to the country’s GDP has slumped from 37.6% in 2000-2001 to 26.4% as of 2020-2021. In the past, agriculture used to be the major sector to engage the country’s work force but it in the recent years it has remained at a subsistence level, despite two-thirds of Nepal’s population being engaged in agriculture till a decade back.

Agro imports have surged exponentially in recent years. For instance, Nepal imported agro products worth Rs 323 billion in fiscal year 2020-21, according to statistics unveiled by the Department of Customs (DoC). As per the DoC, import of agro products accounts for 21% share of total imports. In the last few years, rice has consistently been among the top ten imports of Nepal. In the last fiscal year, the country imported rice worth a whopping Rs 50 billion and in the first quarter of this fiscal 2021-22, the country has imported rice worth Rs 10.47 billion.

It is an irony that Nepal has been importing agro products from India on such a large scale because Nepal used to export rice to India till 1976-77 through the government-owned Rice Export Company. Nepal’s food export to India halted as the southern neighbour started making great strides in their agriculture sector and began producing sufficient quantities of food grains in the late 1970s.

“Policymakers often talk about self-reliance in agriculture products citing the prospect of farming high value crops, fruits and vegetables. However, the government has been working on a piecemeal basis,” states Pawan Golyan, Chairman of Golyan Group, who has been involved in the agriculture sector. “Farming in our country is still based on the traditional style and sorely lacks inputs and extension services to compete with the cheaper imports,” he mentions.

“It is time we start adopting sanitary and phytosanitary measures, and making use of anti-dumping laws in a bid to discourage the rampant import of agro products that has been destroying the production base in the country,” he adds.

Golyan opines that the local governments should have a strong data base of land and promote farmers to farm viable crops, fruits and vegetables. “The local levels should also establish centres through which farmers can rent agricultural tools and other equipment to help mechanise farming practices. Proper storage facilities must also be set up along with market centres,” he says.

“All three tiers of the government should work together to bring about transformation in the agriculture industry of the country,” shares Golyan. He lays emphasis on promoting the production of high-value crops that suit our climate and ecological diversity as well as organic production to reap benefits through the export of niche agro products.

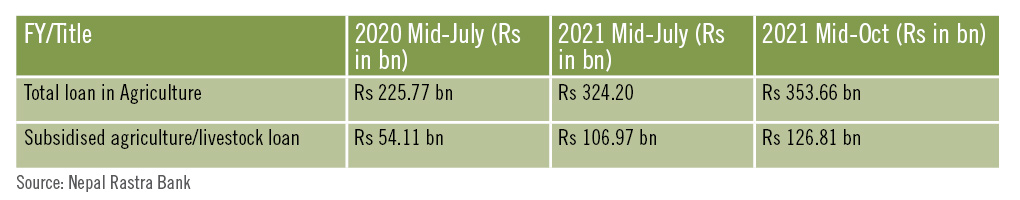

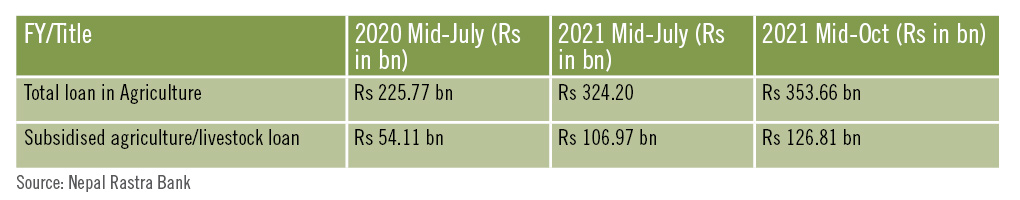

Credit mobilisation by banks and financial institutions (BFIs) in the agriculture sector has been increasing over the years. According to Nepal Rastra Bank - the central regulatory and monetary authority – loan mobilisation by BFIs in the agriculture sector hovers at Rs 353.66 billion. However, when one looks at the figures closely, we can notice that there is a contrast between agriculture output and loan mobilisation of BFIs. The surging import of agricultural products despite the rise in loan mobilisation reveals the weak performance of the country’s agriculture sector.

In the last two decades, the contribution of the agriculture sector to the country’s GDP has slumped from 37.6% in 2000-2001 to 26.4% as of 2020-2021. In the past, agriculture used to be the major sector to engage the country’s work force but it in the recent years it has remained at a subsistence level, despite two-thirds of Nepal’s population being engaged in agriculture till a decade back.

Agro imports have surged exponentially in recent years. For instance, Nepal imported agro products worth Rs 323 billion in fiscal year 2020-21, according to statistics unveiled by the Department of Customs (DoC). As per the DoC, import of agro products accounts for 21% share of total imports. In the last few years, rice has consistently been among the top ten imports of Nepal. In the last fiscal year, the country imported rice worth a whopping Rs 50 billion and in the first quarter of this fiscal 2021-22, the country has imported rice worth Rs 10.47 billion.

It is an irony that Nepal has been importing agro products from India on such a large scale because Nepal used to export rice to India till 1976-77 through the government-owned Rice Export Company. Nepal’s food export to India halted as the southern neighbour started making great strides in their agriculture sector and began producing sufficient quantities of food grains in the late 1970s.

“Policymakers often talk about self-reliance in agriculture products citing the prospect of farming high value crops, fruits and vegetables. However, the government has been working on a piecemeal basis,” states Pawan Golyan, Chairman of Golyan Group, who has been involved in the agriculture sector. “Farming in our country is still based on the traditional style and sorely lacks inputs and extension services to compete with the cheaper imports,” he mentions.

“It is time we start adopting sanitary and phytosanitary measures, and making use of anti-dumping laws in a bid to discourage the rampant import of agro products that has been destroying the production base in the country,” he adds.

Golyan opines that the local governments should have a strong data base of land and promote farmers to farm viable crops, fruits and vegetables. “The local levels should also establish centres through which farmers can rent agricultural tools and other equipment to help mechanise farming practices. Proper storage facilities must also be set up along with market centres,” he says.

“All three tiers of the government should work together to bring about transformation in the agriculture industry of the country,” shares Golyan. He lays emphasis on promoting the production of high-value crops that suit our climate and ecological diversity as well as organic production to reap benefits through the export of niche agro products.

Credit mobilisation by banks and financial institutions (BFIs) in the agriculture sector has been increasing over the years. According to Nepal Rastra Bank - the central regulatory and monetary authority – loan mobilisation by BFIs in the agriculture sector hovers at Rs 353.66 billion. However, when one looks at the figures closely, we can notice that there is a contrast between agriculture output and loan mobilisation of BFIs. The surging import of agricultural products despite the rise in loan mobilisation reveals the weak performance of the country’s agriculture sector.

As per the central bank’s regulation, by fiscal year 2023-24, banks will have to maintain 15% of their total loan portfolio in agriculture, energy and small and medium enterprises (SMEs) with ticket size of Rs 10 million and below. The total loan disbursed to the agriculture sector is expected to hover at around Rs 600 billion by fiscal 2023-24 if the aforementioned rule of the central bank is adhered to.

The government, meanwhile, provides subsidies on interest rates for loans provided to the agriculture sector and other nine headings to promote inclusive development of micro, small and medium enterprises (MSMEs) in the country. Borrowers can avail loans at 5% interest under subsidised credit scheme and the government’s subsidy covers the interest rate that is above 5%.

“The loans mobilised in the agriculture sector should reflect in agriculture output,” states Indra Bahadur Thapa, Director of Nepal Bangladesh Bank. “Nepal must enhance competitiveness by providing needful incentives and subsidies keeping an eye on the cheaper imports from India and China’s highly subsidised agricultural products.”

“To lure the private sector towards agriculture, the government should enact a contract farming law,” according to Pradip Maharjan, former CEO of the Agro Enterprise Centre, the agriculture wing of the Federation of Nepalese Chambers of Commerce and Industry. “The private sector’s engagement in farming will help in terms of economies of scale.” However, Nepal’s Agriculture Development Strategy (ADS) and Foreign Investment and Technology Transfer Act (FITTA) restrict foreign investment in primary production of agriculture though it allows investment in processing and agro-based industries.

Nepal’s trade deficit has been ballooning over the past few years as imports have skyrocketed but exports have slowed to a crawl. Import of agricultural products has been increasing at an alarming rate in recent years and accounts for 21% of the country’s total import at Rs 323 billion in the last fiscal 2020-21. The country has been spending its foreign currency reserves to import agro products for consumption.

All concerned stakeholders agree the country has been spending its foreign exchange reserves to import agriculture products despite having the potential to produce enough in the country to become self-sufficient which is critical from the perspective of food security. The country’s balance of payments (BoP) deficit escalated to Rs 76.13 billion in the first quarter of the ongoing fiscal 2021-22. Similarly, current account deficit, which states the real time inflow and outflow of funds in/from the country, shows deficit worth Rs 151.70 billion in the first quarter of 2021-22, according to the central bank. This indicates that Nepal needs to undertake massive reforms in the agriculture sector to boost production along with agriculture yield to ensure self-sufficiency of agricultural products.

As per the central bank’s regulation, by fiscal year 2023-24, banks will have to maintain 15% of their total loan portfolio in agriculture, energy and small and medium enterprises (SMEs) with ticket size of Rs 10 million and below. The total loan disbursed to the agriculture sector is expected to hover at around Rs 600 billion by fiscal 2023-24 if the aforementioned rule of the central bank is adhered to.

The government, meanwhile, provides subsidies on interest rates for loans provided to the agriculture sector and other nine headings to promote inclusive development of micro, small and medium enterprises (MSMEs) in the country. Borrowers can avail loans at 5% interest under subsidised credit scheme and the government’s subsidy covers the interest rate that is above 5%.

“The loans mobilised in the agriculture sector should reflect in agriculture output,” states Indra Bahadur Thapa, Director of Nepal Bangladesh Bank. “Nepal must enhance competitiveness by providing needful incentives and subsidies keeping an eye on the cheaper imports from India and China’s highly subsidised agricultural products.”

“To lure the private sector towards agriculture, the government should enact a contract farming law,” according to Pradip Maharjan, former CEO of the Agro Enterprise Centre, the agriculture wing of the Federation of Nepalese Chambers of Commerce and Industry. “The private sector’s engagement in farming will help in terms of economies of scale.” However, Nepal’s Agriculture Development Strategy (ADS) and Foreign Investment and Technology Transfer Act (FITTA) restrict foreign investment in primary production of agriculture though it allows investment in processing and agro-based industries.

Nepal’s trade deficit has been ballooning over the past few years as imports have skyrocketed but exports have slowed to a crawl. Import of agricultural products has been increasing at an alarming rate in recent years and accounts for 21% of the country’s total import at Rs 323 billion in the last fiscal 2020-21. The country has been spending its foreign currency reserves to import agro products for consumption.

All concerned stakeholders agree the country has been spending its foreign exchange reserves to import agriculture products despite having the potential to produce enough in the country to become self-sufficient which is critical from the perspective of food security. The country’s balance of payments (BoP) deficit escalated to Rs 76.13 billion in the first quarter of the ongoing fiscal 2021-22. Similarly, current account deficit, which states the real time inflow and outflow of funds in/from the country, shows deficit worth Rs 151.70 billion in the first quarter of 2021-22, according to the central bank. This indicates that Nepal needs to undertake massive reforms in the agriculture sector to boost production along with agriculture yield to ensure self-sufficiency of agricultural products.

In the last two decades, the contribution of the agriculture sector to the country’s GDP has slumped from 37.6% in 2000-2001 to 26.4% as of 2020-2021. In the past, agriculture used to be the major sector to engage the country’s work force but it in the recent years it has remained at a subsistence level, despite two-thirds of Nepal’s population being engaged in agriculture till a decade back.

Agro imports have surged exponentially in recent years. For instance, Nepal imported agro products worth Rs 323 billion in fiscal year 2020-21, according to statistics unveiled by the Department of Customs (DoC). As per the DoC, import of agro products accounts for 21% share of total imports. In the last few years, rice has consistently been among the top ten imports of Nepal. In the last fiscal year, the country imported rice worth a whopping Rs 50 billion and in the first quarter of this fiscal 2021-22, the country has imported rice worth Rs 10.47 billion.

It is an irony that Nepal has been importing agro products from India on such a large scale because Nepal used to export rice to India till 1976-77 through the government-owned Rice Export Company. Nepal’s food export to India halted as the southern neighbour started making great strides in their agriculture sector and began producing sufficient quantities of food grains in the late 1970s.

“Policymakers often talk about self-reliance in agriculture products citing the prospect of farming high value crops, fruits and vegetables. However, the government has been working on a piecemeal basis,” states Pawan Golyan, Chairman of Golyan Group, who has been involved in the agriculture sector. “Farming in our country is still based on the traditional style and sorely lacks inputs and extension services to compete with the cheaper imports,” he mentions.

“It is time we start adopting sanitary and phytosanitary measures, and making use of anti-dumping laws in a bid to discourage the rampant import of agro products that has been destroying the production base in the country,” he adds.

Golyan opines that the local governments should have a strong data base of land and promote farmers to farm viable crops, fruits and vegetables. “The local levels should also establish centres through which farmers can rent agricultural tools and other equipment to help mechanise farming practices. Proper storage facilities must also be set up along with market centres,” he says.

“All three tiers of the government should work together to bring about transformation in the agriculture industry of the country,” shares Golyan. He lays emphasis on promoting the production of high-value crops that suit our climate and ecological diversity as well as organic production to reap benefits through the export of niche agro products.

Credit mobilisation by banks and financial institutions (BFIs) in the agriculture sector has been increasing over the years. According to Nepal Rastra Bank - the central regulatory and monetary authority – loan mobilisation by BFIs in the agriculture sector hovers at Rs 353.66 billion. However, when one looks at the figures closely, we can notice that there is a contrast between agriculture output and loan mobilisation of BFIs. The surging import of agricultural products despite the rise in loan mobilisation reveals the weak performance of the country’s agriculture sector.

In the last two decades, the contribution of the agriculture sector to the country’s GDP has slumped from 37.6% in 2000-2001 to 26.4% as of 2020-2021. In the past, agriculture used to be the major sector to engage the country’s work force but it in the recent years it has remained at a subsistence level, despite two-thirds of Nepal’s population being engaged in agriculture till a decade back.

Agro imports have surged exponentially in recent years. For instance, Nepal imported agro products worth Rs 323 billion in fiscal year 2020-21, according to statistics unveiled by the Department of Customs (DoC). As per the DoC, import of agro products accounts for 21% share of total imports. In the last few years, rice has consistently been among the top ten imports of Nepal. In the last fiscal year, the country imported rice worth a whopping Rs 50 billion and in the first quarter of this fiscal 2021-22, the country has imported rice worth Rs 10.47 billion.

It is an irony that Nepal has been importing agro products from India on such a large scale because Nepal used to export rice to India till 1976-77 through the government-owned Rice Export Company. Nepal’s food export to India halted as the southern neighbour started making great strides in their agriculture sector and began producing sufficient quantities of food grains in the late 1970s.

“Policymakers often talk about self-reliance in agriculture products citing the prospect of farming high value crops, fruits and vegetables. However, the government has been working on a piecemeal basis,” states Pawan Golyan, Chairman of Golyan Group, who has been involved in the agriculture sector. “Farming in our country is still based on the traditional style and sorely lacks inputs and extension services to compete with the cheaper imports,” he mentions.

“It is time we start adopting sanitary and phytosanitary measures, and making use of anti-dumping laws in a bid to discourage the rampant import of agro products that has been destroying the production base in the country,” he adds.

Golyan opines that the local governments should have a strong data base of land and promote farmers to farm viable crops, fruits and vegetables. “The local levels should also establish centres through which farmers can rent agricultural tools and other equipment to help mechanise farming practices. Proper storage facilities must also be set up along with market centres,” he says.

“All three tiers of the government should work together to bring about transformation in the agriculture industry of the country,” shares Golyan. He lays emphasis on promoting the production of high-value crops that suit our climate and ecological diversity as well as organic production to reap benefits through the export of niche agro products.

Credit mobilisation by banks and financial institutions (BFIs) in the agriculture sector has been increasing over the years. According to Nepal Rastra Bank - the central regulatory and monetary authority – loan mobilisation by BFIs in the agriculture sector hovers at Rs 353.66 billion. However, when one looks at the figures closely, we can notice that there is a contrast between agriculture output and loan mobilisation of BFIs. The surging import of agricultural products despite the rise in loan mobilisation reveals the weak performance of the country’s agriculture sector.

As per the central bank’s regulation, by fiscal year 2023-24, banks will have to maintain 15% of their total loan portfolio in agriculture, energy and small and medium enterprises (SMEs) with ticket size of Rs 10 million and below. The total loan disbursed to the agriculture sector is expected to hover at around Rs 600 billion by fiscal 2023-24 if the aforementioned rule of the central bank is adhered to.

The government, meanwhile, provides subsidies on interest rates for loans provided to the agriculture sector and other nine headings to promote inclusive development of micro, small and medium enterprises (MSMEs) in the country. Borrowers can avail loans at 5% interest under subsidised credit scheme and the government’s subsidy covers the interest rate that is above 5%.

“The loans mobilised in the agriculture sector should reflect in agriculture output,” states Indra Bahadur Thapa, Director of Nepal Bangladesh Bank. “Nepal must enhance competitiveness by providing needful incentives and subsidies keeping an eye on the cheaper imports from India and China’s highly subsidised agricultural products.”

“To lure the private sector towards agriculture, the government should enact a contract farming law,” according to Pradip Maharjan, former CEO of the Agro Enterprise Centre, the agriculture wing of the Federation of Nepalese Chambers of Commerce and Industry. “The private sector’s engagement in farming will help in terms of economies of scale.” However, Nepal’s Agriculture Development Strategy (ADS) and Foreign Investment and Technology Transfer Act (FITTA) restrict foreign investment in primary production of agriculture though it allows investment in processing and agro-based industries.

Nepal’s trade deficit has been ballooning over the past few years as imports have skyrocketed but exports have slowed to a crawl. Import of agricultural products has been increasing at an alarming rate in recent years and accounts for 21% of the country’s total import at Rs 323 billion in the last fiscal 2020-21. The country has been spending its foreign currency reserves to import agro products for consumption.

All concerned stakeholders agree the country has been spending its foreign exchange reserves to import agriculture products despite having the potential to produce enough in the country to become self-sufficient which is critical from the perspective of food security. The country’s balance of payments (BoP) deficit escalated to Rs 76.13 billion in the first quarter of the ongoing fiscal 2021-22. Similarly, current account deficit, which states the real time inflow and outflow of funds in/from the country, shows deficit worth Rs 151.70 billion in the first quarter of 2021-22, according to the central bank. This indicates that Nepal needs to undertake massive reforms in the agriculture sector to boost production along with agriculture yield to ensure self-sufficiency of agricultural products.

As per the central bank’s regulation, by fiscal year 2023-24, banks will have to maintain 15% of their total loan portfolio in agriculture, energy and small and medium enterprises (SMEs) with ticket size of Rs 10 million and below. The total loan disbursed to the agriculture sector is expected to hover at around Rs 600 billion by fiscal 2023-24 if the aforementioned rule of the central bank is adhered to.

The government, meanwhile, provides subsidies on interest rates for loans provided to the agriculture sector and other nine headings to promote inclusive development of micro, small and medium enterprises (MSMEs) in the country. Borrowers can avail loans at 5% interest under subsidised credit scheme and the government’s subsidy covers the interest rate that is above 5%.

“The loans mobilised in the agriculture sector should reflect in agriculture output,” states Indra Bahadur Thapa, Director of Nepal Bangladesh Bank. “Nepal must enhance competitiveness by providing needful incentives and subsidies keeping an eye on the cheaper imports from India and China’s highly subsidised agricultural products.”

“To lure the private sector towards agriculture, the government should enact a contract farming law,” according to Pradip Maharjan, former CEO of the Agro Enterprise Centre, the agriculture wing of the Federation of Nepalese Chambers of Commerce and Industry. “The private sector’s engagement in farming will help in terms of economies of scale.” However, Nepal’s Agriculture Development Strategy (ADS) and Foreign Investment and Technology Transfer Act (FITTA) restrict foreign investment in primary production of agriculture though it allows investment in processing and agro-based industries.

Nepal’s trade deficit has been ballooning over the past few years as imports have skyrocketed but exports have slowed to a crawl. Import of agricultural products has been increasing at an alarming rate in recent years and accounts for 21% of the country’s total import at Rs 323 billion in the last fiscal 2020-21. The country has been spending its foreign currency reserves to import agro products for consumption.

All concerned stakeholders agree the country has been spending its foreign exchange reserves to import agriculture products despite having the potential to produce enough in the country to become self-sufficient which is critical from the perspective of food security. The country’s balance of payments (BoP) deficit escalated to Rs 76.13 billion in the first quarter of the ongoing fiscal 2021-22. Similarly, current account deficit, which states the real time inflow and outflow of funds in/from the country, shows deficit worth Rs 151.70 billion in the first quarter of 2021-22, according to the central bank. This indicates that Nepal needs to undertake massive reforms in the agriculture sector to boost production along with agriculture yield to ensure self-sufficiency of agricultural products.

Published Date: December 14, 2021, 12:00 am

Post Comment

E-Magazine

RELATED Feature