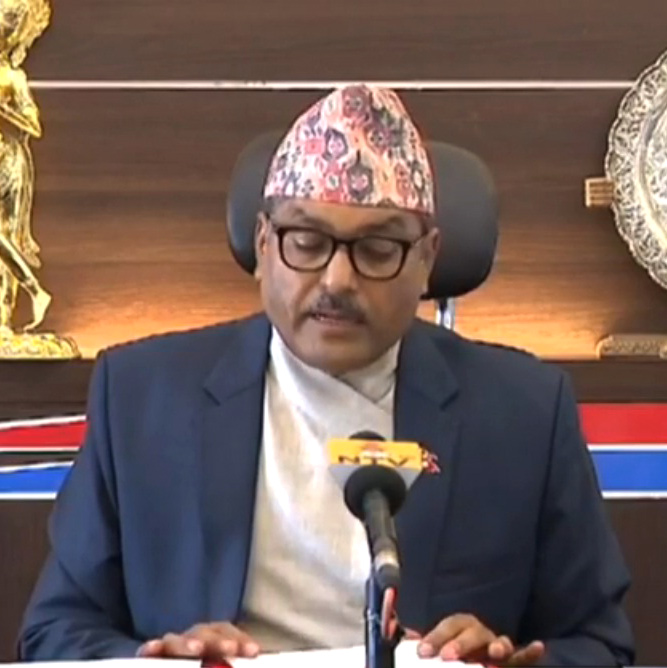

The Governor of NRB, Maha Prasad Adhikari launched the Monetary Policy for the fiscal year 2020-21 with most of the policies directed to mitigate the economic effects of Covid 19, promising to help support businesses get back on their feet.

The private sector and the primary opposition Nepali Congress welcomed some of the measures in the Monetary Policy such as extension of the loan repayment deadline, refinance facility, grace period extension for infrastructure projects and targeted lending in productive sectors at cheaper rate. The Monetary Policy also provisions mandatory lending to sectors such as agriculture; micro, small and medium enterprises and hydropower. As part of providing relief, it has extended the deadline for paying loan installments by six months, nine months and one year, depending on the degree of impact on the particular sector as the Central Bank seeks to ease the pains on the businesses caused by the pandemic. It has permitted banks and financial institutions to extend further loans to industries and businesses affected badly by the pandemic by 20% of the working capital maintained in mid-April.

In order to revive businesses severely hit by Covid 19, it has decided to provide refinance funds up to five times. However, the size of the fund has not been revealed. As per the policy, exports and sick industries as well as other sectors will get special refinancing facilities at a maximum 3% interest rate, while micro, cottage and small industries will get credit at a maximum 5% interest rate.

Commercial banks need to lend at least 15% to the agriculture sector by mid-July 2023; 15% to micro, small and medium enterprises; and 10% to the hydropower sector of the total loans by mid-July 2024. At present, they need to extend 10% loans to agriculture, 15% to energy and tourism sectors but both targets have not been met so far, according to the Central Bank.

The private sector had demanded that the loan repayment reschedule be extended by six months after the lockdown for the sectors affected by the pandemic; and for others, an extension of the deadline by three months. The borrowers of the worst affected sectors, which were supposed to pay installments by mid-July this year, could pay their dues by mid-July 2021.

The service industry particularly the tourism and aviation sectors, and micro, small, and medium-scale enterprises is among the worst hit by the pandemic. The sectors facing medium impact can now pay installments by mid-April next year and those facing a mild impact can pay them by mid-January next year

There is a provision of a fund worth Rs 50 billion through which badly affected sectors like tourism and micro, small and medium enterprises get loans at a 5% percent interest rate for reviving the enterprises and paying staff salary. This is the fund created as per the budgetary provision of the government.

The private sector had also been demanding an exit policy through waiver of interest considering that many businesses were in no position to revive. The Monetary Policy, however, has failed to address this demand. The private sector had demanded waiver of all interests to ease exit.

The Central Bank has also allowed banks and financial institutions to renew short-term working capital loans such as demand loan and cash credit till mid-January next year by analysing the situation of the borrowers. If a borrower whose loan is active till mid-January next year can propose a new timetable for repayment within that period can get the loan restructured or rescheduled by paying a minimum of 10% interest. If restructuring and rescheduling of loans are not adequate to revive the worst-affected sectors, the Central Bank has also opened the door for reviving the enterprises through new investments by way of private equity funds, venture capital, debt equity conversion and special purpose vehicles. For the banking sector, the policy has encouraged mergers with a number of incentives. It has relaxed the provisions related to provisioning in case the loans extended are related to Covid 19 affected sectors.

Published Date: August 12, 2020, 12:00 am

Post Comment

E-Magazine

Click Here To Read Full Issue

RELATED B360 National