Nepal is taking big strides towards a digital economy along with creating a digital transaction ecosystem that consists of infrastructure, literacy, data security, legislation and other enablers. The pandemic accelerated the digitisation process, particularly in the financial sector. The government also expanded its digital coverage in collection of revenues and making payments such that now more than 91% of the government's revenue and payments are covered by the digital process.

Nepal Rastra Bank (NRB) - the central regulatory and monetary authority - has said that digital transaction momentum has encouraged it to initiate groundwork for Central Bank Digital Currency (CBDC). NRB Governor Maha Prasad Adhikari confirmed that the central bank has initiated the study on CBDC. Though miles from execution, the infrastructure, literacy, data security and growing acceptance of the digital payment platforms and products have strongly motivated the central bank to consider the prospect of digital currency and its impact on the value chains of the economy, moving from brick banks to click banks in days to come.

Technological disruptions have provided solutions and greater access to keep clients at the forefront of financial sector services. Sandeep Ghosh, Group Country Manager Asia and South Asia of Visa Inc, an American multinational financial services corporation, underlined four different dimensions to accelerate the digitisation of the economy. Few of these are announced to be put into practice through the Monetary Policy 2022-23 executed by the NRB. According to Ghosh, digital sandbox, digital financial literacy, discrete digital team and departments at banks, and digital funds are crucial steps to embark on the journey towards digitization in a rapid and sustainable manner. Digital sandbox is digital supervision from the regulator, the regulator should be well equipped with enhanced capacity for effective regulation and supervision of banks and financial institutions (BFIs) launching digital solutions supported by the fintech companies.

The Monetary Policy issued for the current fiscal has said the central bank will continue promoting digital transactions and effective institutional coordination to mark FY 2022/23 as Digital Payment Promotion Year. The Monetary Policy has announced initiating study to establish an innovation centre or regulatory sandbox.

The digital ecosystem proliferates with greater speed only if digital financial literacy is ensured. According to Ghosh, BFIs should have a separate dedicated department for digital services with focus on efficacy and security of the process and services including digital KYC, digital AML, digital cyber security, data security among others.

Ghosh underscored the need for setting up digital fund in public-private partnership for incentivising digital transactions.

NRB has already introduced Digital Lending Guideline since last year for cost-effective, simplified and accessible lending. Likewise, Retail Payment Switch came into operation which is considered as the first step of establishing National Payment Switch to pave way for settlement and recording of payments within the country and bring Nepal's own payment card into operation. Payment system has been simplified as QR (quick response) brought into use massively by the sellers of goods and services - from restaurants to fruit vendors.

NRB has said that the country will have its own payment switch - National Payment Switch - within a year. Retail Payment Switch has been operationalised for settlement of transaction made through QR and wallets or non-card payments. Guru Prasad Poudel, Executive Director, Payment System Department has informed that Nepal Clearing House Ltd has been developing a National Payment Switch, and it will procure necessary equipment through competitive bidding and the country will have its own cards. This will save on the costs that the country has been paying for payment gateways; payment card network processors namely Visa, MasterCard and UPI (Unified Payment Interface).

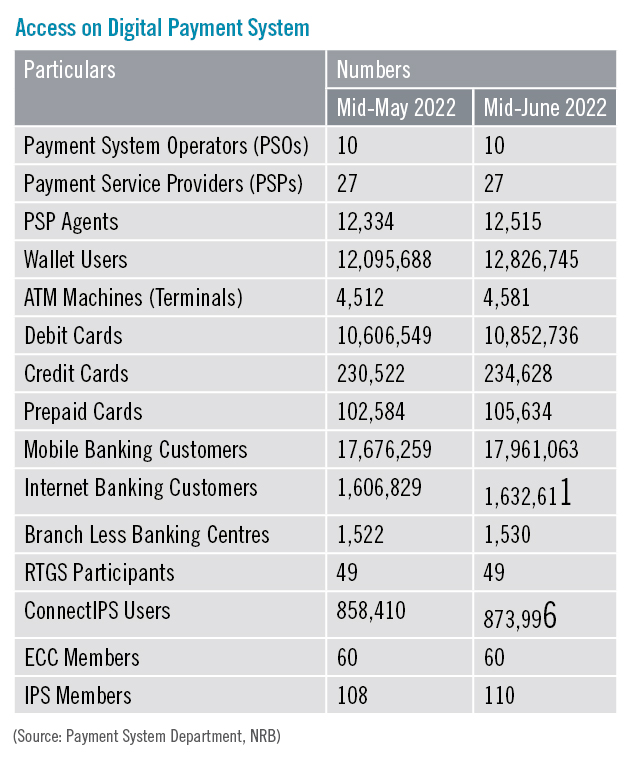

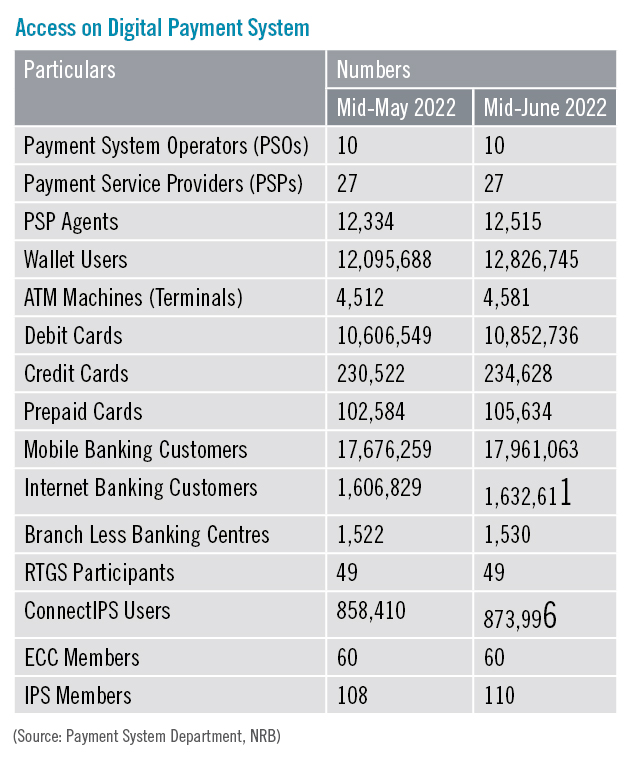

The country will require to co-brand its card with international payment card networks so that Nepali card users can make transactions in foreign countries. Currently, Nepal doesn't have its own card. The cards being used in Nepal are Visa, MasterCard and UPI and the country has been making payments against their service. A total of 10,852,736 debit cards have been issued according to NRB, among them 80% of the cards are availed from Visa.

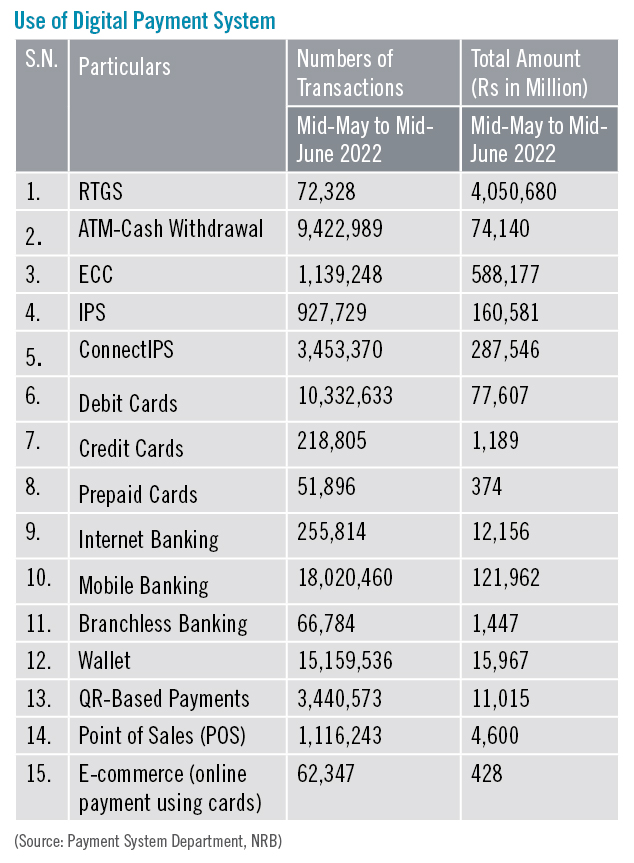

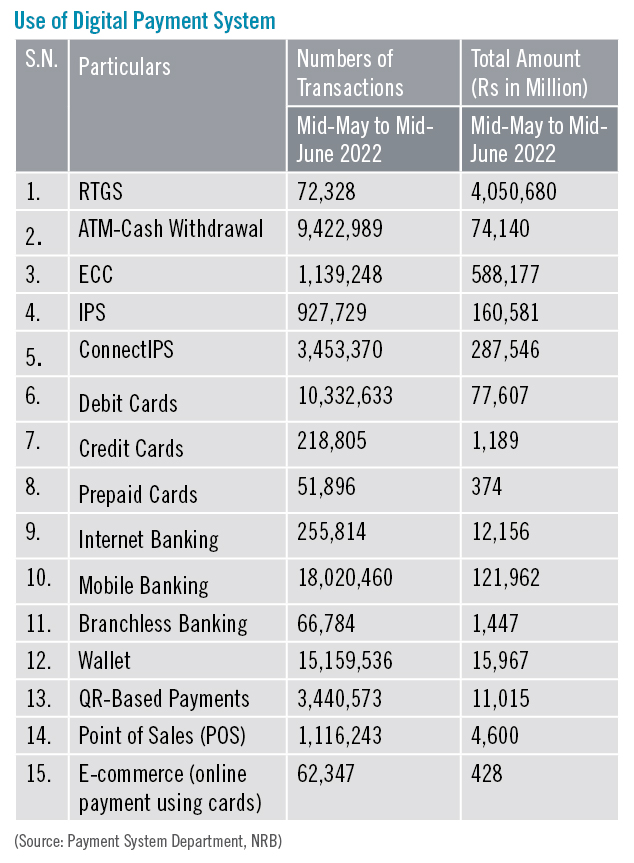

Huge cash withdrawal transactions are still being done from ATMs. During mid-May to mid-June a total of Rs 77.6 billion has been withdrawn from ATMs through 10,332,633 transactions. "It has a huge cost with charges on each transaction from Rs 10 to Rs 15,” according to Poudel. 'NRB has instructed banks to make at least two off-us transaction free for card users, however, banks must pay for this.' Off-us transactions are income for any bank since ATM owner bank (also called acquirer bank) charges a fee for each financial and non-financial transaction. Poudel suggests that consumers switch to complete digital transactions rather than making cash withdrawals from ATMs that come at a cost.

To exercise sovereignty in financial terms, we need to have our own payment switch, cards and so on,” Poudel reiterated stressing on the importance of National Payment Switch and also deliberating on the added advantage of data security.

Digitisation of the financial sector will provide necessary impetus for digitisation of different verticals of the economy leveraging the supply chain while promoting convenience, inclusiveness, resilience, transparency and e-governance.

The government of Nepal's Digital Nepal Framework was unveiled in 2019 and envisioned digitisation of eight sectors: digital foundation, agriculture, health, education, energy, tourism, finance, and urban infrastructure through 80 different digital initiatives based on close engagement with stakeholders in a bid to unlock Nepal’s growth potential.

NRB has already introduced Digital Lending Guideline since last year for cost-effective, simplified and accessible lending. Likewise, Retail Payment Switch came into operation which is considered as the first step of establishing National Payment Switch to pave way for settlement and recording of payments within the country and bring Nepal's own payment card into operation. Payment system has been simplified as QR (quick response) brought into use massively by the sellers of goods and services - from restaurants to fruit vendors.

NRB has said that the country will have its own payment switch - National Payment Switch - within a year. Retail Payment Switch has been operationalised for settlement of transaction made through QR and wallets or non-card payments. Guru Prasad Poudel, Executive Director, Payment System Department has informed that Nepal Clearing House Ltd has been developing a National Payment Switch, and it will procure necessary equipment through competitive bidding and the country will have its own cards. This will save on the costs that the country has been paying for payment gateways; payment card network processors namely Visa, MasterCard and UPI (Unified Payment Interface).

The country will require to co-brand its card with international payment card networks so that Nepali card users can make transactions in foreign countries. Currently, Nepal doesn't have its own card. The cards being used in Nepal are Visa, MasterCard and UPI and the country has been making payments against their service. A total of 10,852,736 debit cards have been issued according to NRB, among them 80% of the cards are availed from Visa.

Huge cash withdrawal transactions are still being done from ATMs. During mid-May to mid-June a total of Rs 77.6 billion has been withdrawn from ATMs through 10,332,633 transactions. "It has a huge cost with charges on each transaction from Rs 10 to Rs 15,” according to Poudel. 'NRB has instructed banks to make at least two off-us transaction free for card users, however, banks must pay for this.' Off-us transactions are income for any bank since ATM owner bank (also called acquirer bank) charges a fee for each financial and non-financial transaction. Poudel suggests that consumers switch to complete digital transactions rather than making cash withdrawals from ATMs that come at a cost.

To exercise sovereignty in financial terms, we need to have our own payment switch, cards and so on,” Poudel reiterated stressing on the importance of National Payment Switch and also deliberating on the added advantage of data security.

Digitisation of the financial sector will provide necessary impetus for digitisation of different verticals of the economy leveraging the supply chain while promoting convenience, inclusiveness, resilience, transparency and e-governance.

The government of Nepal's Digital Nepal Framework was unveiled in 2019 and envisioned digitisation of eight sectors: digital foundation, agriculture, health, education, energy, tourism, finance, and urban infrastructure through 80 different digital initiatives based on close engagement with stakeholders in a bid to unlock Nepal’s growth potential.

READ ALSO:

READ ALSO:

NRB has already introduced Digital Lending Guideline since last year for cost-effective, simplified and accessible lending. Likewise, Retail Payment Switch came into operation which is considered as the first step of establishing National Payment Switch to pave way for settlement and recording of payments within the country and bring Nepal's own payment card into operation. Payment system has been simplified as QR (quick response) brought into use massively by the sellers of goods and services - from restaurants to fruit vendors.

NRB has said that the country will have its own payment switch - National Payment Switch - within a year. Retail Payment Switch has been operationalised for settlement of transaction made through QR and wallets or non-card payments. Guru Prasad Poudel, Executive Director, Payment System Department has informed that Nepal Clearing House Ltd has been developing a National Payment Switch, and it will procure necessary equipment through competitive bidding and the country will have its own cards. This will save on the costs that the country has been paying for payment gateways; payment card network processors namely Visa, MasterCard and UPI (Unified Payment Interface).

The country will require to co-brand its card with international payment card networks so that Nepali card users can make transactions in foreign countries. Currently, Nepal doesn't have its own card. The cards being used in Nepal are Visa, MasterCard and UPI and the country has been making payments against their service. A total of 10,852,736 debit cards have been issued according to NRB, among them 80% of the cards are availed from Visa.

Huge cash withdrawal transactions are still being done from ATMs. During mid-May to mid-June a total of Rs 77.6 billion has been withdrawn from ATMs through 10,332,633 transactions. "It has a huge cost with charges on each transaction from Rs 10 to Rs 15,” according to Poudel. 'NRB has instructed banks to make at least two off-us transaction free for card users, however, banks must pay for this.' Off-us transactions are income for any bank since ATM owner bank (also called acquirer bank) charges a fee for each financial and non-financial transaction. Poudel suggests that consumers switch to complete digital transactions rather than making cash withdrawals from ATMs that come at a cost.

To exercise sovereignty in financial terms, we need to have our own payment switch, cards and so on,” Poudel reiterated stressing on the importance of National Payment Switch and also deliberating on the added advantage of data security.

Digitisation of the financial sector will provide necessary impetus for digitisation of different verticals of the economy leveraging the supply chain while promoting convenience, inclusiveness, resilience, transparency and e-governance.

The government of Nepal's Digital Nepal Framework was unveiled in 2019 and envisioned digitisation of eight sectors: digital foundation, agriculture, health, education, energy, tourism, finance, and urban infrastructure through 80 different digital initiatives based on close engagement with stakeholders in a bid to unlock Nepal’s growth potential.

NRB has already introduced Digital Lending Guideline since last year for cost-effective, simplified and accessible lending. Likewise, Retail Payment Switch came into operation which is considered as the first step of establishing National Payment Switch to pave way for settlement and recording of payments within the country and bring Nepal's own payment card into operation. Payment system has been simplified as QR (quick response) brought into use massively by the sellers of goods and services - from restaurants to fruit vendors.

NRB has said that the country will have its own payment switch - National Payment Switch - within a year. Retail Payment Switch has been operationalised for settlement of transaction made through QR and wallets or non-card payments. Guru Prasad Poudel, Executive Director, Payment System Department has informed that Nepal Clearing House Ltd has been developing a National Payment Switch, and it will procure necessary equipment through competitive bidding and the country will have its own cards. This will save on the costs that the country has been paying for payment gateways; payment card network processors namely Visa, MasterCard and UPI (Unified Payment Interface).

The country will require to co-brand its card with international payment card networks so that Nepali card users can make transactions in foreign countries. Currently, Nepal doesn't have its own card. The cards being used in Nepal are Visa, MasterCard and UPI and the country has been making payments against their service. A total of 10,852,736 debit cards have been issued according to NRB, among them 80% of the cards are availed from Visa.

Huge cash withdrawal transactions are still being done from ATMs. During mid-May to mid-June a total of Rs 77.6 billion has been withdrawn from ATMs through 10,332,633 transactions. "It has a huge cost with charges on each transaction from Rs 10 to Rs 15,” according to Poudel. 'NRB has instructed banks to make at least two off-us transaction free for card users, however, banks must pay for this.' Off-us transactions are income for any bank since ATM owner bank (also called acquirer bank) charges a fee for each financial and non-financial transaction. Poudel suggests that consumers switch to complete digital transactions rather than making cash withdrawals from ATMs that come at a cost.

To exercise sovereignty in financial terms, we need to have our own payment switch, cards and so on,” Poudel reiterated stressing on the importance of National Payment Switch and also deliberating on the added advantage of data security.

Digitisation of the financial sector will provide necessary impetus for digitisation of different verticals of the economy leveraging the supply chain while promoting convenience, inclusiveness, resilience, transparency and e-governance.

The government of Nepal's Digital Nepal Framework was unveiled in 2019 and envisioned digitisation of eight sectors: digital foundation, agriculture, health, education, energy, tourism, finance, and urban infrastructure through 80 different digital initiatives based on close engagement with stakeholders in a bid to unlock Nepal’s growth potential.

READ ALSO:

READ ALSO:

Published Date: August 28, 2022, 12:00 am

Post Comment

E-Magazine

RELATED Feature