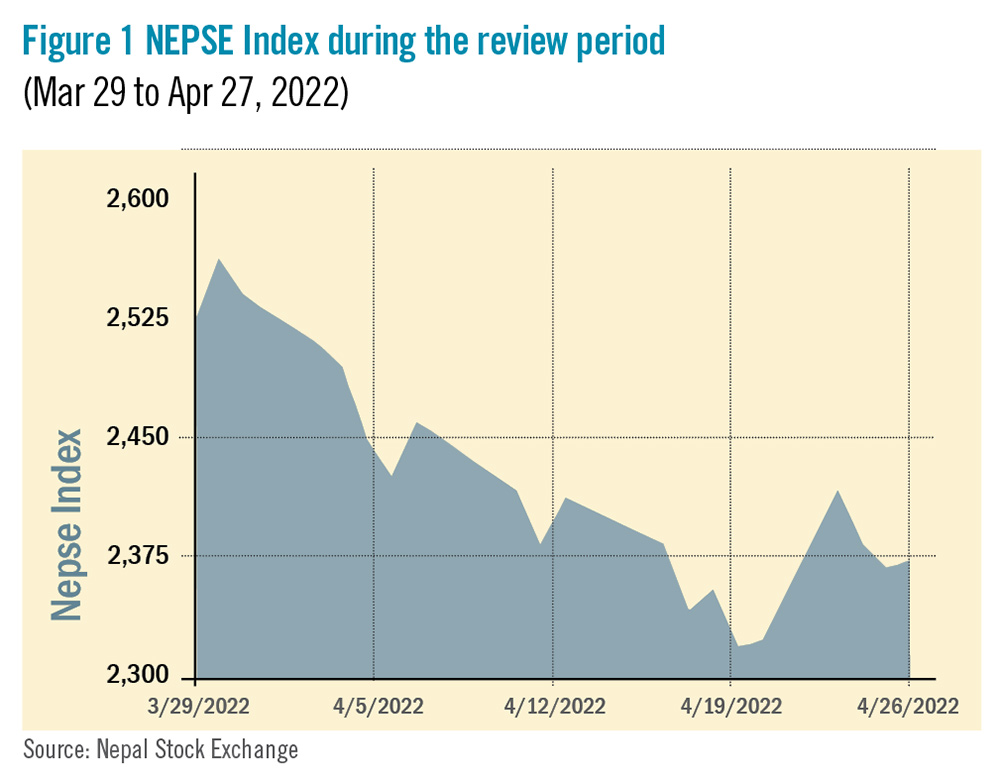

During the review period of March 29 to April 27, the Nepal Stock Exchange (NEPSE) index fell by 165.67 points (-6.52%) to close at 2,376.17 points. Although the market began the review period with a high of 2,527.58 points on March 29, it couldn’t sustain its gain as it continuously shed points thereafter. Continuous pressure on macro indicators of the economy along with various policy measures taken by the government to control depleting foreign currency reserves further dampened investor confidence. As a result, the overall market volume during the review period decreased significantly by 42.09% with a total transaction of Rs 35.082 billion.

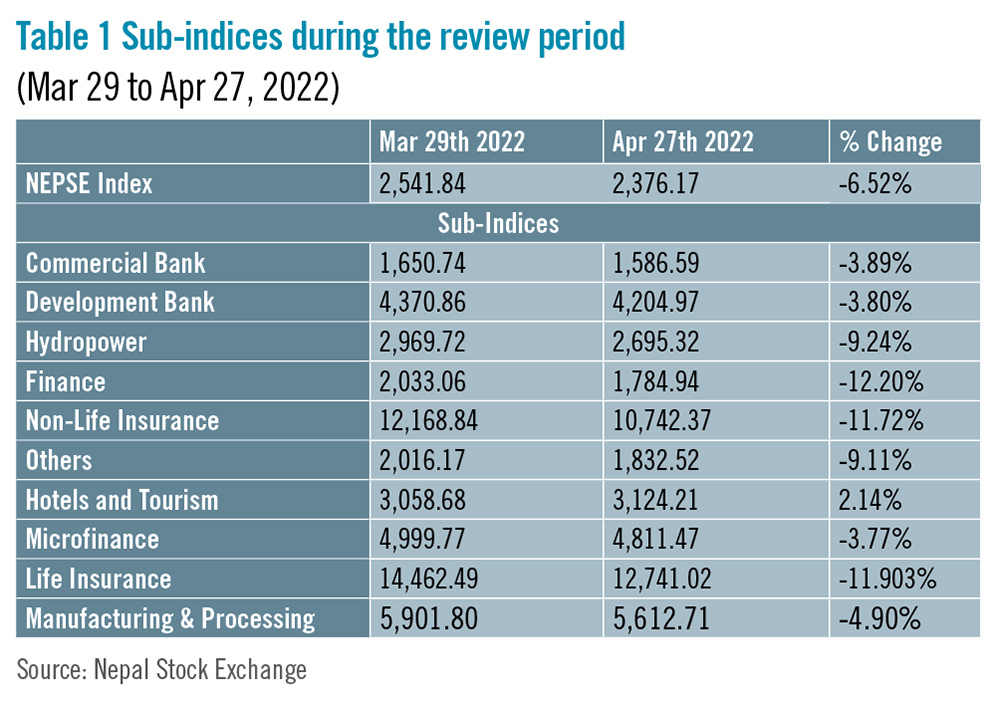

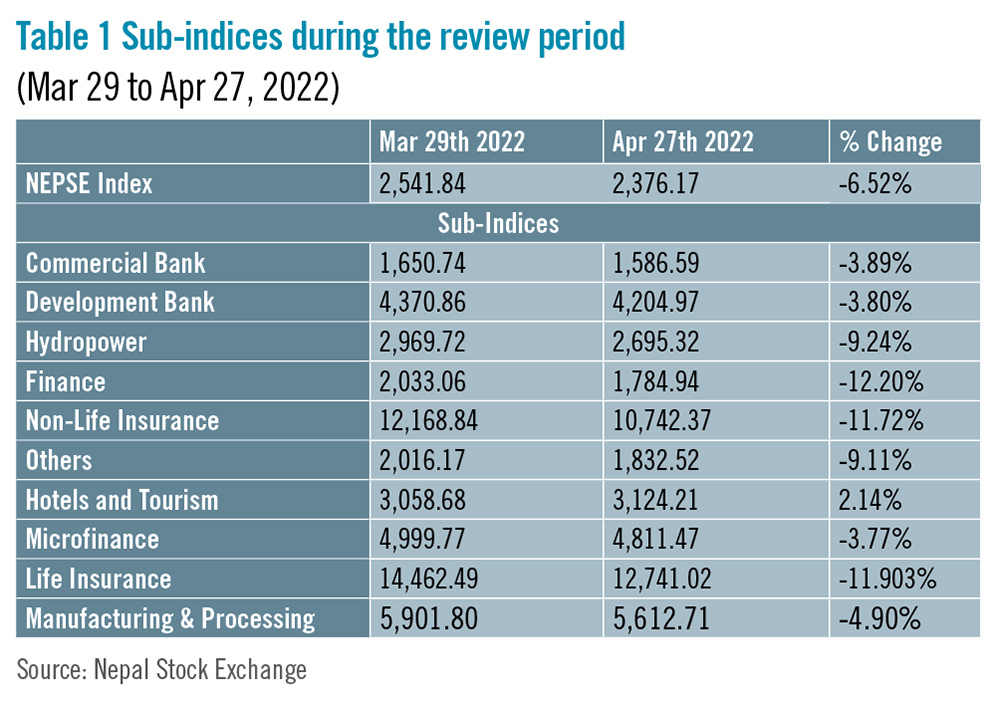

During the review period, in line with the previous review period, only one sub-index landed in the green zone whereas all the other nine sub-indices landed in the red zone.

Hotels and Tourism sub-index (+2.14%) was the sole gainer as the share value of Oriental Hotels (+Rs 33), Taragaon Regency (+Rs 7.8) and Soaltee Hotel (+Rs 7.3) increased substantially.

Amongst the sub-indices, Finance sub-index (-12.20%) was the biggest loser with a drop in the share value of Gurkhas Finance (-Rs 133), ICFC Finance (-Rs 120) and Manjushree Finance (-Rs 90.5). Life Insurance sub-index (-11.90%) was second as it witnessed a reduction in the share prices of Nepal Life Insurance (-Rs 124.9), National Life Insurance (-Rs 93) and Gurans Life Insurance (-Rs 88). Non-life Insurance sub-index (-11.72%) followed suit with drop in the share prices of Rastriya Beema Company (-Rs 1,933), Siddhartha Insurance (-Rs 246.4) and Shikhar Insurance (-Rs 195). Hydropower sub-index (-9.24%) also declined as share value of Barun Hydropower (-Rs 65.1), Upper Tamakoshi Hydropower (-Rs 64) and Api Power (-Rs 62.2) went down.

Similarly, Others sub-index (-9.11%) witnessed a deflation in the share prices of Citizen Investment Trust (-Rs 255), Nepal Telecom (-Rs 84.5) and Hydroelectricity Investment and Development (-Rs 22.6). Manufacturing and Processing sub-index (-4.90%) substantially decreased with a drop in the share value of Himalayan Distillery Ltd (-Rs 193.1) and Shivam Cements (-Rs 112.5).

Along the same lines, Commercial Bank sub-index (-3.89%) witnessed a fall in the share prices of Nabil Bank (-Rs 82.1), Prabhu Bank (-Rs 25) and Bank of Kathmandu (-Rs 20.4). Development Bank sub-index (-3.80%) also decreased marginally with fall in share value of Karnali Development (-Rs 60.9), Corporate Development (-Rs 34) and Kamana Sewa (-Rs 26). Microfinance sub-index (-3.77%) also fell with a decrease in the share value of Global IME Microfinance (-Rs 181.9), Vijaya Microfinance (-Rs 109) and Mirmire Microfinance (-Rs 105).

News and Highlights

In light of the new government rule of declaring two-day public holiday (Saturday and Sunday) effective from May 15, 2022, the Nepal Stock Exchange (NEPSE) is also considering to run the secondary market from Monday to Friday every week. On the public issue front, Securities Exchange Board of Nepal (SEBON) approved the Initial Public Offerings (IPOs) of four hydropower companies which includes Bindhyabasini Hydropower Development company worth Rs 750 million, Dordi Khola Hydropower at Rs 759.067 million, Himalayan Hydropower at Rs 870 million and Upper Solu Hydro Electric Company at Rs 1.01925 billion. Sanima Capital has been appointed as issue manager for Bindhyabasini Hydropower whereas for Dordi Khola Hydropower, Himalayan Hydropower and Upper Solu Hydro Electric Company, Siddhartha Capital, Global IME and NMB capital have been appointed issue managers respectively. SEBON has also added the IPO of City Hotel worth Rs 167.4 million and Aviyan Microfinance at Rs 97.5 million to its pipeline. Global Capital has been appointed as issue manager for City Hotel and Muktinath Capital has been appointed as issue manager for Aviyan Microfinance.Outlook

The banking system’s liquidity has been limited as the economy continues to struggle with large Balance of Payments deficit. Further, the market’s drop in volume implies that investors are presently extremely cautious. As a result, substantial trend reversal in the market is unlikely in the near term but with the upcoming elections, speculations-based trading is expected to grow in order to book short-term price swings. This is an analysis from beed Management. No expressed or implied warrant is made for usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis. READ ALSO:

Published Date: June 4, 2022, 12:00 am

Post Comment

E-Magazine

RELATED Beed Take