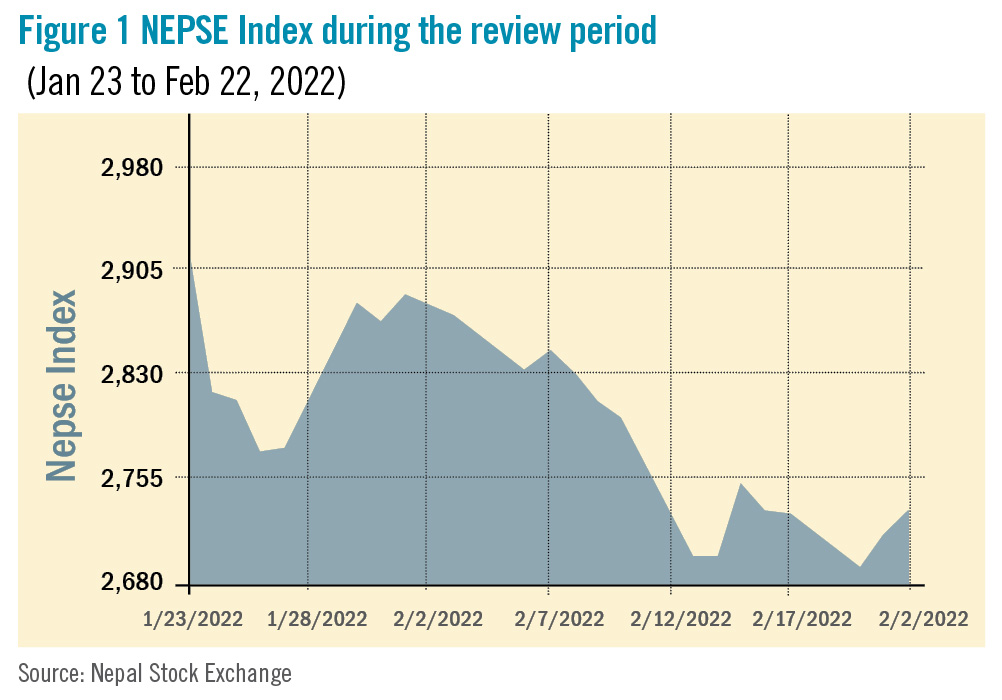

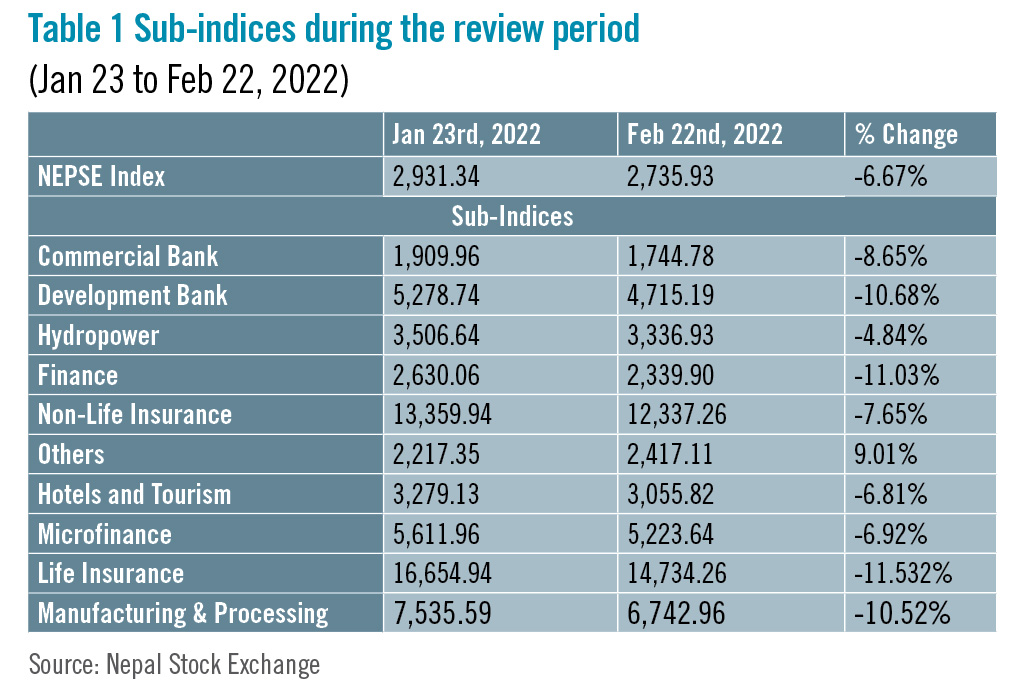

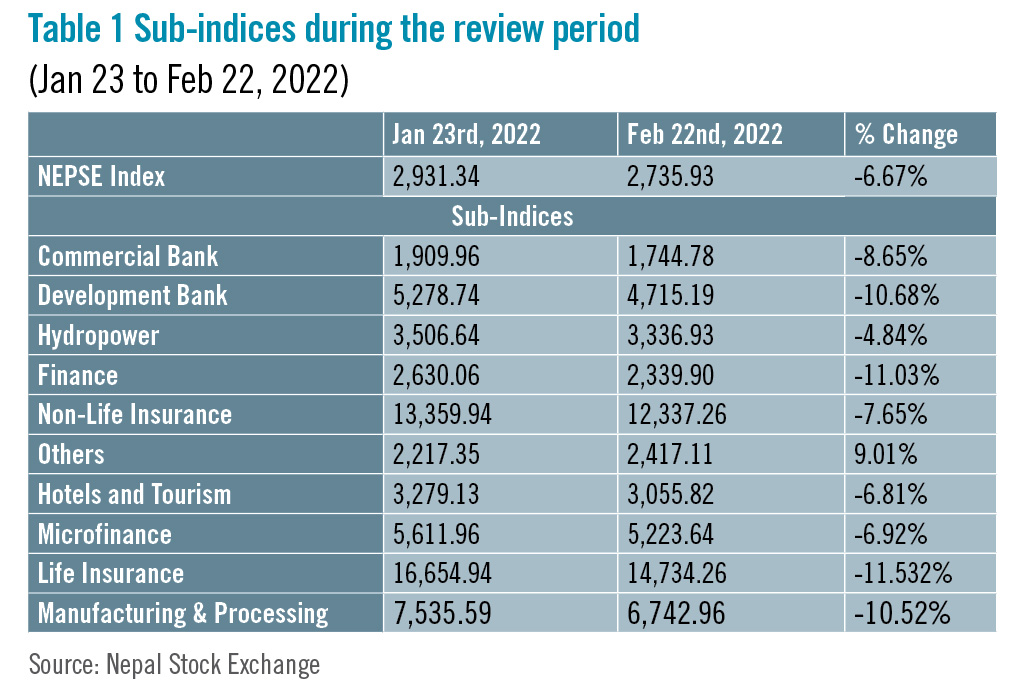

During the review period from January 23 to February 22, the Nepal Stock Exchange (NEPSE) Index fell by 195.41 points (-6.67%) to close at 2,735.93 points. The market began the review period on a strong note reaching 2,920.51 points on January 23, however, throughout the rest of the review period, the market went through a continuous downfall with some retrenchments, further dampening already shaken investor confidence. Despite the steep downfall, the overall volume during the review period only decreased marginally by 3.29% and reached Rs 108.57 billion, signalling strong buying on speculation of short-term spikes.

During the review period, contrary to the previous review period, only one sub-index landed in the green zone whereas all the other nine sub-indices landed in the red zone.

Others sub-index (+9.01%) was the index in the green zone as share value of Nepal Telecom (+Rs 322) increased substantially.

Life Insurance sub-index (-11.53%) was the biggest loser with a drop in the share value of Asian Life Insurance (-Rs 442), Nepal Life Insurance (-Rs 408.4) and Life Insurance Company (-Rs 290). Finance sub-index (-11.03%) came in second in the red zone as it witnessed a reduction in the share prices of Gurkhas Finance (-Rs 153), Janaki Finance (-Rs 154.8), and Manjushree Finance (-Rs 112.9). Development Bank sub-index (-10.68%) followed suit with drop in the share prices of Corporate Development Bank (-Rs 88), Karnali Development (-Rs 78) and Excel Development (-Rs 73.9). Likewise, Manufacturing & Processing sub-index (-10.52%) also regressed as share value of Himalayan Distillery (-Rs 664), Bottlers Nepal (-Rs 517.9) and Shivam Cements (-Rs 191) went down.

Similarly, Commercial Bank sub-index (-8.65%) witnessed a deflation in the share prices of NIC Asia Bank (-Rs 109), Nabil Bank (-Rs 107.5) and Sanima Bank (-Rs 52.9). Non-Life Insurance sub-index (-7.65%) also substantially decreased with drop in the share value of Shikhar Insurance (-Rs 560), IME General Insurance (-Rs 477),

and Rastriya Beema Company (-Rs 196).

Microfinance sub-index (-6.92%) decreased as share value of Asha Microfinance (-Rs 227), Global IME Microfinance (-Rs 200) and Laxmi Microfinance (-Rs 192.2) deflated. Hotels and Tourism sub-index (-6.81%) witnessed a fall in the share prices of Taragaon Regency (-Rs 27), Oriental Hotels (-Rs 23) and Soaltee Hotel (-Rs 20.7). Likewise, Hydropower sub-index (-4.84%) decreased marginally with a fall in share value of Radhi Bidhyut Hydropower (-Rs 75.1).

News and Highlights

On the public issue front, Securities Exchange Board of Nepal (SEBON) approved the Initial Public Offerings (IPOs) of six companies including two hydropower companies, three microfinance companies and one investment company during the review period. SEBON approved the IPOs of Balephi Hydropower worth Rs 1.827 billion, Green Ventures Hydropower worth Rs 3.125 billion, NESDO Sambridha Microfinance worth Rs 255 million, Jalpa Samudayik Microfinance worth Rs 160 million, Rastra Utthan Microfinance worth Rs 260 million and Emerging Nepal worth Rs 555.6 million. However, the IPO issue of Rastra Uttan Microfinance was concluded on February 20 within four days of its opening due to a 38.30 time oversubscription on the first day. According to the Central Depository Service and Clearing Ltd (CDSC), 2,626,090 applicants applied for a total of 30,431,370 units whereas the company had offered only 850,000 units (13,000 units for employees, 42,500 units for mutual funds, and 794,500 for the general public). Emerging Nepal’s IPO was also oversubscribed by more than 51.09 times, and as a result, the IPO allotment concluded on February 16. The company had offered 555,600 units wherein 11,112 units were reserved for employees, 27,780 units for mutual funds, and the remaining 516,708 units for the general public. However, the company received applications for 26,401,970 units from 2,328,706 applicants. Out of this, a total of 51,670 applicants received 10 units each via lottery, with eight applicants receiving an additional unit.Outlook

With growing Balance of Payments (BOP) deficit and slowing remittances, there is no signal of ease in the ongoing liquidity crisis in the banking system. On one hand, the increasing interest rates on bank deposits are attracting investors while on the other, the rising interest rate along with further tightening of credit, particularly margin lending, are not attracting funds into the secondary market. Until there is stronger evidence of market stability, the market is likely to maintain its current momentum with minor corrections. Despite these challenges, certain stimuli such as the forthcoming local elections, and resumption of primary market IPOs have kept investors hopeful in the medium to long-term.This is an analysis from beed Management. No expressed or implied warrant is made for usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis.

READ ALSO:

Published Date: March 30, 2022, 12:00 am

Post Comment

E-Magazine

RELATED Beed Take