The government has unveiled the fiscal budget 2022/23 with strong focus on import substitution through productive capacity enhancement of industrial and agriculture sectors. With an eye on the strain on foreign exchange reserves and alarming Balance of Payments (BoP) deficit caused by skyrocketing imports, the budget has announced some flagship programmes to boost productivity as the country’s industrial and agriculture production base has been hit hard by cheaper imports.

As life bounced back to pre-pandemic normalcy and businesses started resuming operations, there was higher demand for imports to accelerate activities and cover the losses faced during the pandemic subsequently hitting the BoP situation. But as the country’s foreign exchange reserves sharply plummeted in the first half of the ongoing fiscal 2021/22, the government woke up to discouraging imports through various fiscal and monetary measures.

Under unstable ongoing economic conditions, the fiscal budget 2022/23 has set some ambitious targets like lowering the import of agricultural commodities such as rice, maize, wheat, vegetables and fruits by 30%. “Exports will be doubled and overall imports will be minimised by at least 20% in fiscal 2022-23 and trade balance will be achieved within five years,” the budget stated, adding, “Decent jobs will be increased by 30% each year and 800,000 Nepalis living below the poverty line will be brought above that margin.” The fiscal budget has announced to provide accommodation for Dalits deprived of land ownership within three years and envisioned improving the overall human development index (HDI) by initiating reforms in education and health sectors.

Macro-economic targets

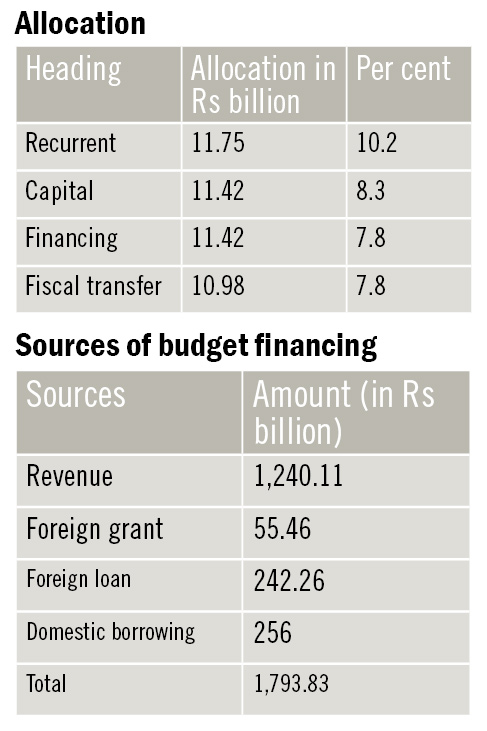

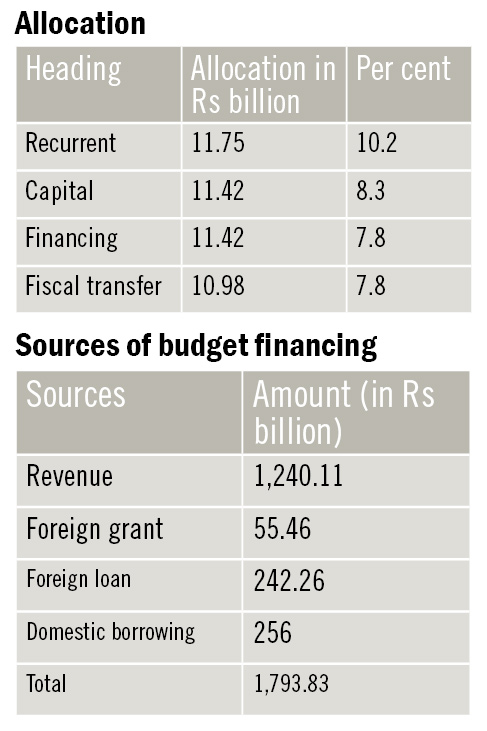

The government has unveiled a total budget of Rs 1,793.83 billion. Allocation under capital, recurrent and financing stands at Rs 380.38 billion, Rs 753.40 billion and Rs 230.22 billion, respectively. Fiscal transfer to the provinces and local level stands at Rs 429.83 billion.

The government has envisioned achieving 8% economic growth through the implementation of the budget and has also kept a target to tame inflation below 7% despite envisioning substantive increase in government spending.

The government has increased the size of budget for fiscal 2022-23 by Rs 261 billion as compared to the budget of the ongoing fiscal. Revenue collection target has also been increased by Rs 59.5 billion compared to the current fiscal.

The government has increased the size of budget for fiscal 2022-23 by Rs 261 billion as compared to the budget of the ongoing fiscal. Revenue collection target has also been increased by Rs 59.5 billion compared to the current fiscal.

READ ALSO:

READ ALSO:

Where will the budget be spent?

Recurrent Expenses- Fiscal transfer to local governments: Rs 300.37 billion

- Fiscal transfer to provincial governments: Rs 129.46 billion

- Salaries and perks: Rs 188.74 billion

- Pensions and gratuities: Rs 105.45 billion

- Social security expenses: Rs 131.89 billion

- Programmes and training: Rs 26.10 billion

- Maintenance of capital goods: Rs 7.57 billion

- Services and consultancy: Rs 11.54 billion

- Office equipment and service procurement: Rs 4.30 billion

- Evaluation, monitoring and travel: Rs 3.16 billion

- Scholarships, rescue, relief, rehabilitation and medicines: Rs 15.68 billion

- Capital Expenses

- Development expenses (rail, electricity, dams, irrigation, water supply and sanitation, gabions): Rs 247 billion

- Building construction: Rs 51.50 billion

- Land acquisition: Rs 18.96 billion

- Research and consultancy services: Rs 18.10 billion

- Machinery and equipment: Rs 16.55 billion

- Contingency expenses: Rs 13.26 billion

- Furniture: Rs 1.67 billion

- Vehicles: Rs 815.0 billion

Expansionary budget with an eye on upcoming elections

The fiscal budget has lowered the minimum eligibility age for senior citizen allowance from 70 years to 68 years. Many have considered this a populist move to lure voters towards the current political alliance of parties running the government. Former Finance Minister Ram Sharan Mahat opined that such ‘competitive populism’ adds to the long-term liability of the government as the average life expectancy has improved in recent years. “Such expenses concentrated in urban areas and populous districts like Kathmandu valley, Jhapa, Morang, Sunsari, Rupandehi, Chitwan, among others will trigger consumption of imported goods,” he said. “Actually, the state should extend such social security to deprived people. If elderly people in Karnali receive more money as social security as compared to the developed and urban areas, the fund mobilised in such places will support the local economy, consumption of local products, and help generate employment at the local level,” opined Mahat. The decision to lower the eligibility age of senior citizens to receive elderly allowance has expanded the government’s liability on social security. The fiscal budget estimates to spend Rs 131.89 billion under social security. Mahat further said that the government should have introduced a budget by adopting austerity measures at a time when the country has been struggling to cope with external sector pressure. “The expansionary fiscal policy will increase money supply in the economy and this increased money supply will create demand of goods and services which will further trigger imports,” he stated. The fiscal budget has also raised the salary of civil servants by 15% in a bid to encourage them to deliver public service more effectively. The budget has announced to extend Rs 5,000 monthly to cancer patients and survivors, and paralysed (spinal cord injury) and kidney patients. In addition, new mothers living in 25 backward districts with low HDI ranking will get Rs 5,000 as nutrition support. Finance Minister Janardan Sharma, in his budget, has also allocated Rs 100 million for kidney transplantation of the economically deprived (poor) free of cost. Former Chief Secretary Bimal Prasad Koirala has said the fiscal budget 2022-23 lacks focused priorities, and resource allocation is scattered. He doubts there will be effective execution as the budget sorely lacks a solution to address the impediments of budget execution. The Finance Minister has unveiled a populist budget keeping an eye on the upcoming elections to the Federal Parliament and Provincial Assembly, according to analysts. “The size of the budget has started swelling every year and resource planning is unrealistic,” said Koirala. “The government has adopted policies to curb imports and tax rates have been hiked up which means import-based revenue could drop in the upcoming fiscal. Likewise, the government might not be able to mobilise domestic borrowing as banks and financial institutions are facing prolonged liquidity crisis,” he added. High domestic borrowing could cause a crowding-out effect on the country’s private sector which will have an adverse impact on the country’s economic growth. The government has increased the size of budget for fiscal 2022-23 by Rs 261 billion as compared to the budget of the ongoing fiscal. Revenue collection target has also been increased by Rs 59.5 billion compared to the current fiscal.

The government has increased the size of budget for fiscal 2022-23 by Rs 261 billion as compared to the budget of the ongoing fiscal. Revenue collection target has also been increased by Rs 59.5 billion compared to the current fiscal.

- Major announcements and resource allocation

- Agro production for self-reliance programme: Rs 10 billion

- Farmers Welfare Fund: Rs 1 billion

- PM Nepali Production and Consumption Promotion Programme: Rs 3.45 billion

- Startups to promote local economy: Rs 3 billion

- Climate change and disaster management (National Disaster Risk Reduction and Management Authority): Rs 1.61 billion

- President Educational Reform Programme: Rs 8.8 billion

- Prime Minister Employment Programme: Rs 7.05 billion

- Minimum threshold of foreign investment: Rs 20 million

- Reduction in number of civil servants: 10%

- Reduction of recurrent expenses of government offices: 15%

- Reduction of vehicle procurement in government offices: 100%

- Subsidies on crops and livestock insurance (of the premium): 80%

- Reduction in agro imports: 30%

- Increase in exports: 100%

- Increase decent jobs annually: 30%

- Import reduction: 20%

- Campaign to ensure seed distribution for food security

- One local level, one specified product

- Plantation of 10,000 trees under People’s Desire: Green City campaign

- Completion of local level hospitals: 655

- Entrepreneurship training through Business Incubation Centre: 10,0000

- Electricity tariff waiver for industries consuming electricity worth Rs 100 million and plus in a year: 2-15%

Fiscal transfers

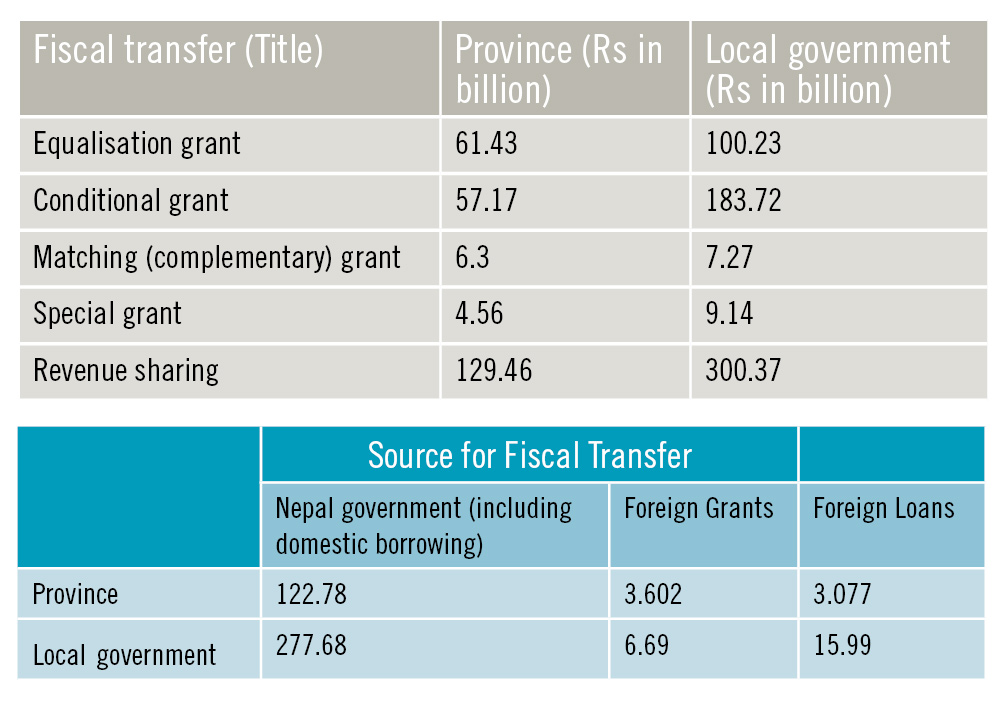

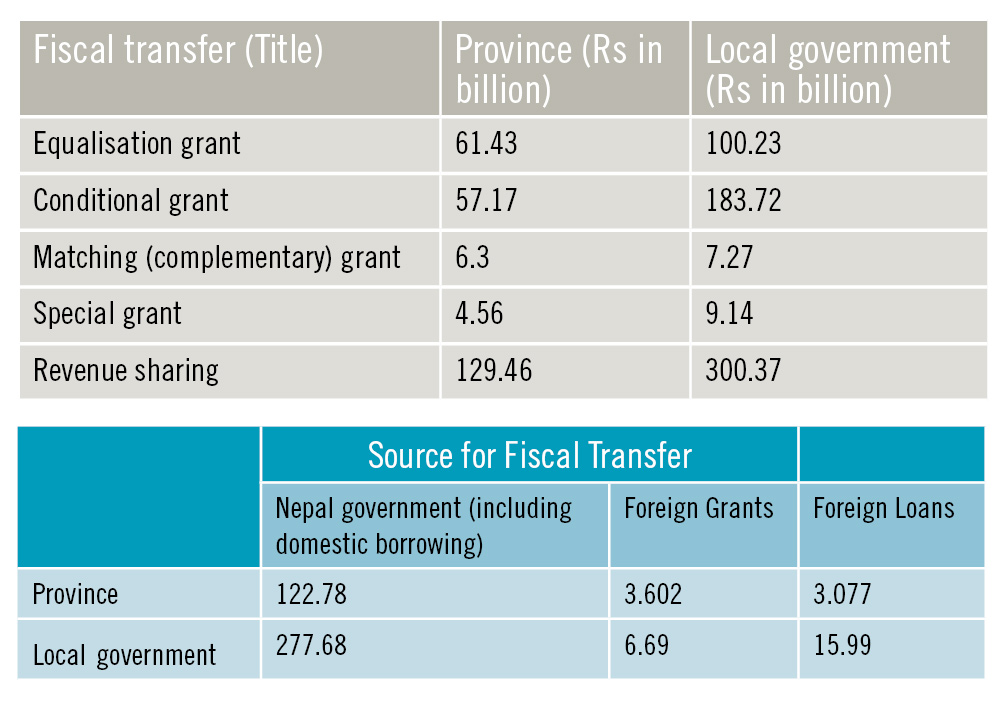

The federal government has transferred funds worth Rs 429.83 billion to local and provincial governments — Rs 129.46 billion to provinces and Rs 300.37 billion to local governments.Changes in Tax Headings

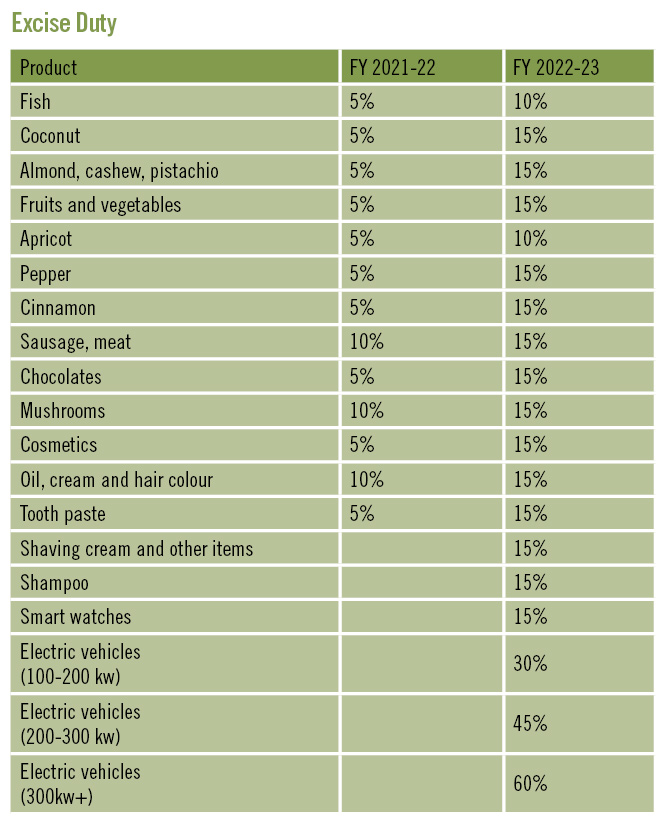

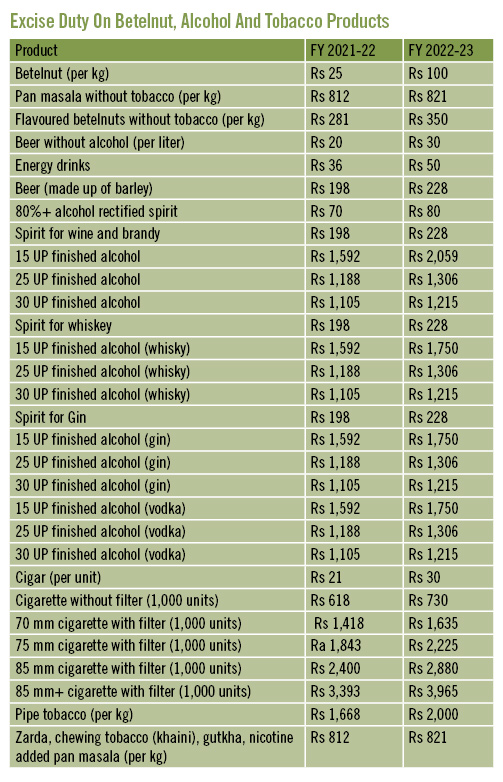

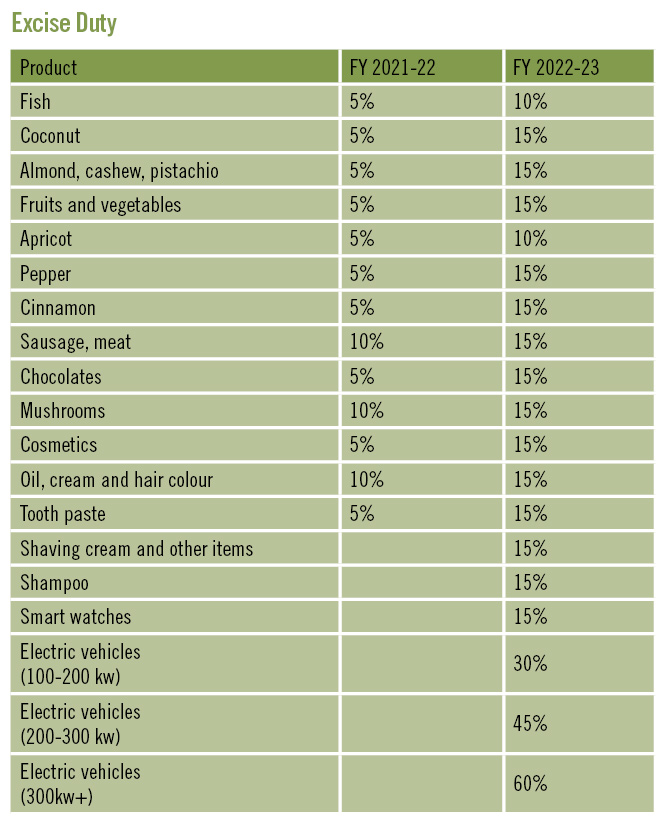

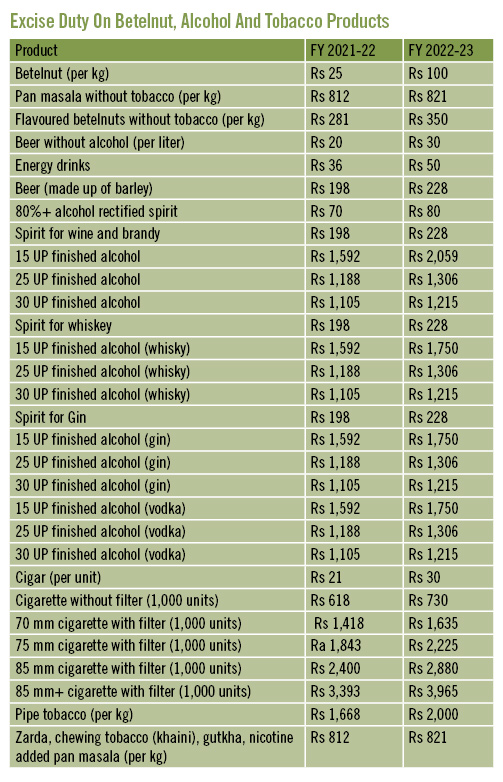

The fiscal budget 2022-23 has extended tax incentives for productive capacity enhancement and earmarked adequate resources along with a commitment to induct reforms to expedite development expenditure. Meanwhile, excise and customs tariffs have been increased on finished imported goods. Some industries producing GI wires, gabion boxes, sanitary pads among others have reportedly been hit hard due to the change in customs tariff and excise. The fiscal budget has lowered the customs tariff on GI wire at 6% and excise by Rs 10 per kg. Similarly, the government has lowered the tariff to import sanitary pads to 10%. Likewise, 1% customs tariff has been slapped on import of raw materials to produce sanitary pads in the country. GI wire and sanitary pad manufacturing industries have been vocal against this citing that the fiscal budget’s move to lower import tariffs on these finished goods will have negative consequences for industries. The fiscal budget has increased capital gains tax (CGT) of land by 2.5 percentage points if a property is sold within five years of ownership. The government has slapped 7.5% CGT for property in possession for five years and 5% CGT for property in possession for more than five years. Likewise, property owners have to pay double registration fees for possessing more than one house or apartment. The fiscal budget has come up with this provision to curb speculative practices in real estate transactions. The fiscal budget has tried to lure investment in the productive sector through lucrative offers for investments.Tax waivers and incentives

- Effective tax rate on software, electronic transactions, BPO services (overseas) : 1%

- Effective tax rate on royalty of literary works, articles (TDS only): 1.5%

- Discount for passport, work permit and consular services: 50%

- Excise waiver for automobile production in the country: 50%

- Customs waiver for automobile production in the country: 50%

- Income tax waiver for assembly plants for 5 years: 40%

- Income tax waiver for entrepreneurs with annual turnover of Rs 3 million: 75%

- Income tax waiver for entrepreneurs with annual turnover of Rs 3 to Rs 10 million: 50%

- Income tax waiver for tourism industry: 50%

- Income tax waiver for agriculture inputs factory for five years: 100%

Individual Income Tax (IIT) provisions

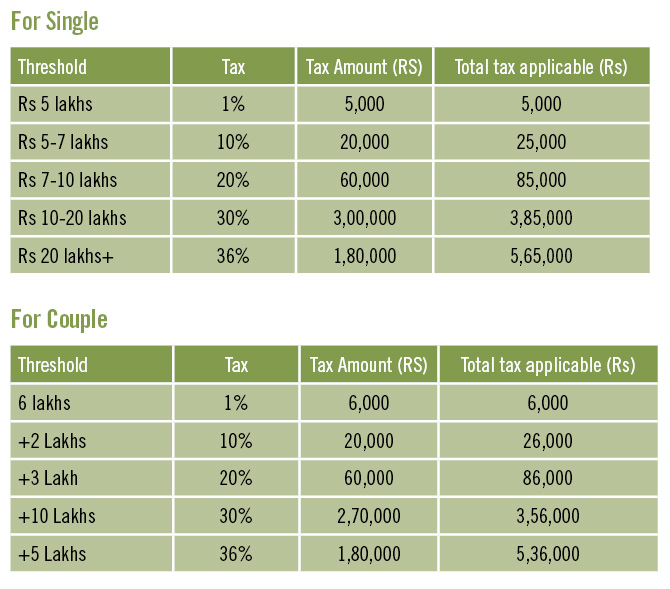

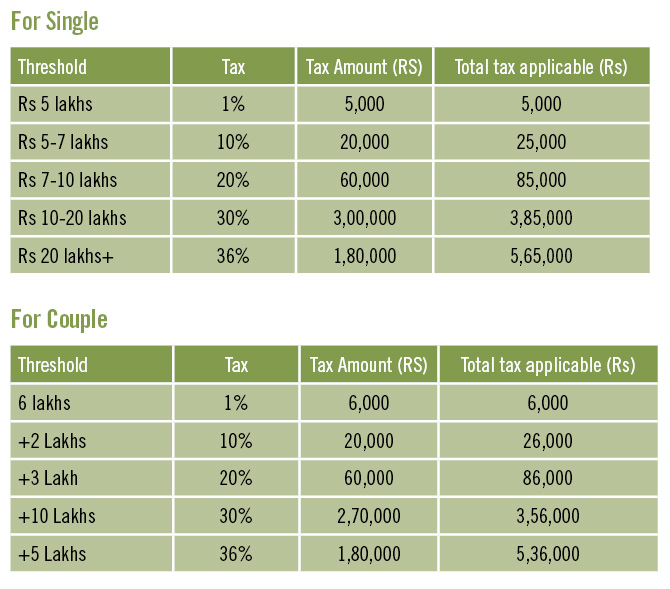

The fiscal budget has adopted a flexible policy on individual income tax. There will be no income tax for annual income of up to Rs 5 lakhs for single and Rs 6 lakhs for couple (married). The highest effective rate of individual income tax remains at 36%. However, the fiscal budget has provided room to deduct insurance premium of up to Rs 40,000 from the annual income while calculating the taxable income under IIT heading.

READ ALSO:

READ ALSO:

Published Date: July 2, 2022, 12:00 am

Post Comment

E-Magazine

RELATED Feature