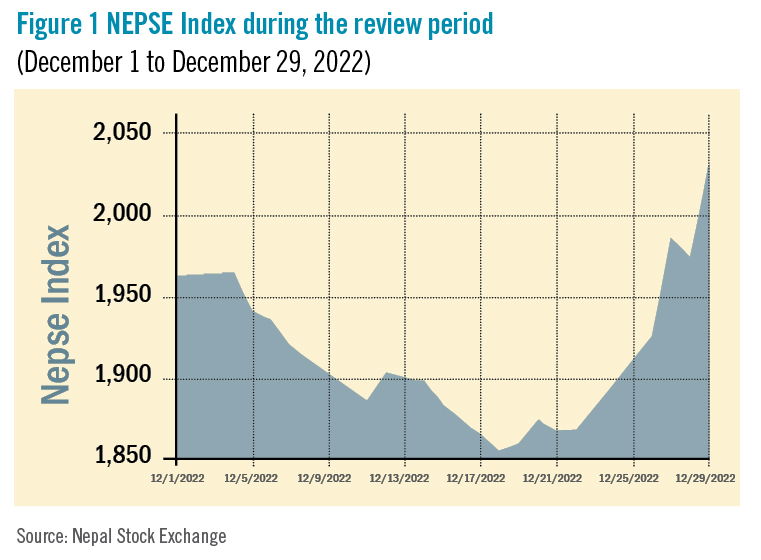

During the review period from December 1 to 29, 2022, the Nepal Stock Exchange (NEPSE) index rose significantly by 79.18 points (+4.06%) to close above 2,000 points after four months at 2,029.03 points. The NEPSE index opened on a positive note in the initial days of the review period, however, it went down to as low as 1,855 points on December 18 as investors were on a cautious mode about the formation of a new government following the federal elections. The momentum returned towards the end of the review period with the formation of the new government. Resultantly, the total market volume during the review period soared magnificently by 102.98% with total transactions of Rs 28.295 billion.

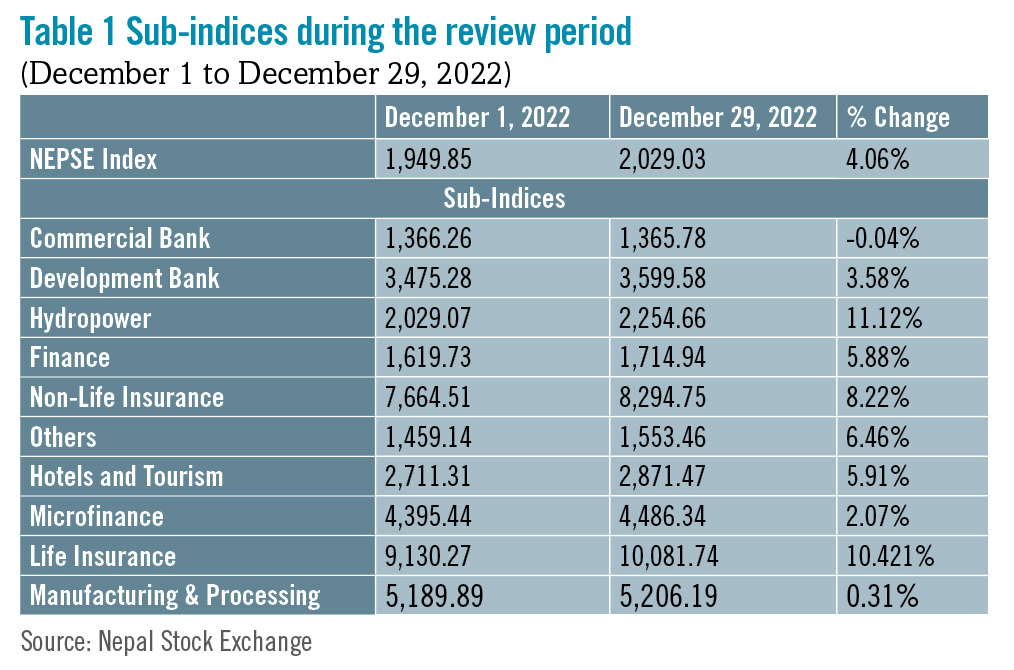

During the review period, contrary to the previous period, nine of the sub-indices landed in the green zone, indicating slight recovery across the sub-sectors, while one index fell into the red zone.

Among the gainers, Hydropower sub-index (+11.12%) was the biggest gainer as share value of Upper Tamakoshi (+Rs 88.9), Kalika Power (+Rs 65.4), and Dibyashwori Hydropower (+Rs 28.5) increased substantially. Life Insurance sub-index (+10.42%) was second in line as it witnessed a rise in the share prices of Asian Life Insurance (+Rs 97), Nepal Life Insurance (+Rs 89.2) and National Life Insurance (+Rs 59.9).

Non-life Insurance sub-index (+8.22%) followed suit with increase in the share prices of Rastriya Beema (+Rs 890), Siddhartha Insurance (+Rs 122) and Shikhar Insurance (+Rs 93). Others sub-index (+6.46%) also rose as share value of Citizen Investment Trust (+Rs 92), Nepal Telecom (+Rs 33.8) and Hydroelectricity Investment and Development (+Rs 5.8) went up.

Hotels and Tourism sub-index (+5.91%) went up with share prices of Taragaon Regency (+Rs 45), Oriental Hotels (+Rs 19) and Soaltee Hotel (+Rs 2) increasing. Finance sub-index (+5.88%) also surged with a rise in the share value of Gurkhas Finance (+Rs 42), Reliance Finance (+Rs 29) and Shree Investment (+Rs 28.9).

Development Bank sub-index (+3.58%) witnessed a rise in the share prices of Excel Development (+Rs 27), Muktinath Development (+Rs 21.7), and Corporate Development (+Rs 14). Likewise, Microfinance sub-index (+2.07%) witnessed an upswing with rise in the share value of Mithila Microfinance (+Rs 129), RMDC Microfinance (+Rs 93) and Civil Microfinance (+Rs 82). Manufacturing and Processing sub-index (+0.31%) followed suit with escalation in the share value of Bottlers Nepal (+Rs 1,270), Unilever Nepal (+Rs 975) and Himalayan Distillery (+Rs 28).

Contrary to the others, Commercial Bank sub-index (-0.04%) was the only sub-index in the red zone with decrease in the share prices of Nabil Bank (-Rs 39), Sanima Bank (-Rs 27), and NMB Bank (-Rs 21.3).

News and Highlights

On the public issues front, the Securities Board of Nepal (SEBON) has approved the initial public offering (IPO) of three hydropower companies: Molung Hydropower, Makar Jitumaya Suri Hydropower and Sarima Middle Tamor Hydropower worth Rs 353 million, Rs 228 million and Rs 833 million, respectively. Sunrise Capital, Prabhu Capital and Sanima Capital have been onboarded as issue managers, respectively. Likewise, SEBON has also kept the IPO of Bhagawati Hydropower worth Rs 165 million and Accord Pharmaceuticals worth Rs 70.6 million in its pipeline under preliminary review. Global IME and Prabhu Capital are the issue managers.Outlook

The secondary market has gained positive momentum since the formation of a new government. Investor confidence was boosted earlier with the correction of interest rates by the Central Bank through the Monetary Policy review. It is important to note that the market has mostly remained bearish over a long period, so strong market volume is key to keeping the growth going. This is an analysis from beed Management Pvt Ltd. No expressed or implied warrant is made for usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis. READ ALSO:

Published Date: February 3, 2023, 12:00 am

Post Comment

E-Magazine

RELATED Beed Take