KATHMANDU: The strain on foreign exchange reserves due to ballooning imports has recently forced the government to adopt import restriction measures to navigate the economy during this turbulent time, largely considered to be the outcome of the global impact of the Covid 19 pandemic along with the Russia-Ukraine war. There also have been very low tourism activities which contribute quite significantly to Nepal’s foreign exchange reserves. Inflation too has overshot expectations raising import bills and the government has had to bear increased expenses in the import of vaccines and medical equipment to combat the pandemic.

Import-driven economies lacking stable foreign exchange earnings have been facing challenges to maintain external sector stability as the post-Covid economic revival demands increased requirement of foreign currency for import of goods and services.

Nepal and Bangladesh are taking precautions following the crisis that recently hit Sri Lanka with a great magnitude. Very recently, Bangladesh decided to stop foreign trips of its officials and postponed implementation of less important projects that require imports, reportedly, in a bid to ease pressure on foreign exchange reserves. The crisis in Sri Lanka is largely due to the fact that the government there was running out of foreign currency to import vital supplies including medicines, fuel and other essentials.

In recent days many people have started to compare Nepal’s economy with that of Sri Lanka and there are fears that we could go the Sri Lankan way. However, economists and experts have said that the economies of Nepal and Sri Lanka carry different features and can’t be compared. Nepal has less exposure of foreign debt and has mainly availed debt from senior creditors like the World Bank, Asian Development Bank and International Monetary Fund and bilateral lenders, in which Nepal can request for flexible moratorium based on its requirement.

On the other hand, traders claim that imports will normalise soon as the demand in the domestic market is gradually normalising. Nepal Rastra Bank – central regulatory and monetary authority of the country – also came into flak for restricting banks (in the form of moral suasion) to open letters of credit (L/Cs) except vital supplies following its attempt to discourage imports by making credit rate dearer. The NRB has raised the risk weightage of the credit issued for imports which means the credit rate went up, though it could not deliver results.

Import ban and consequences

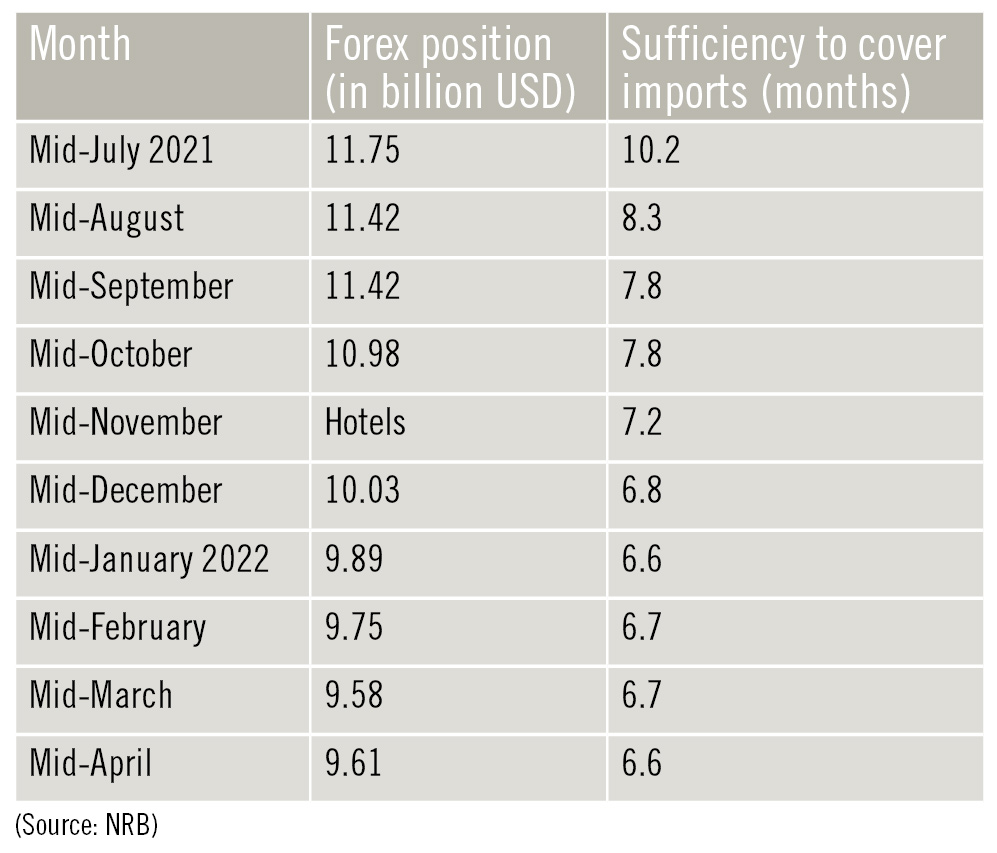

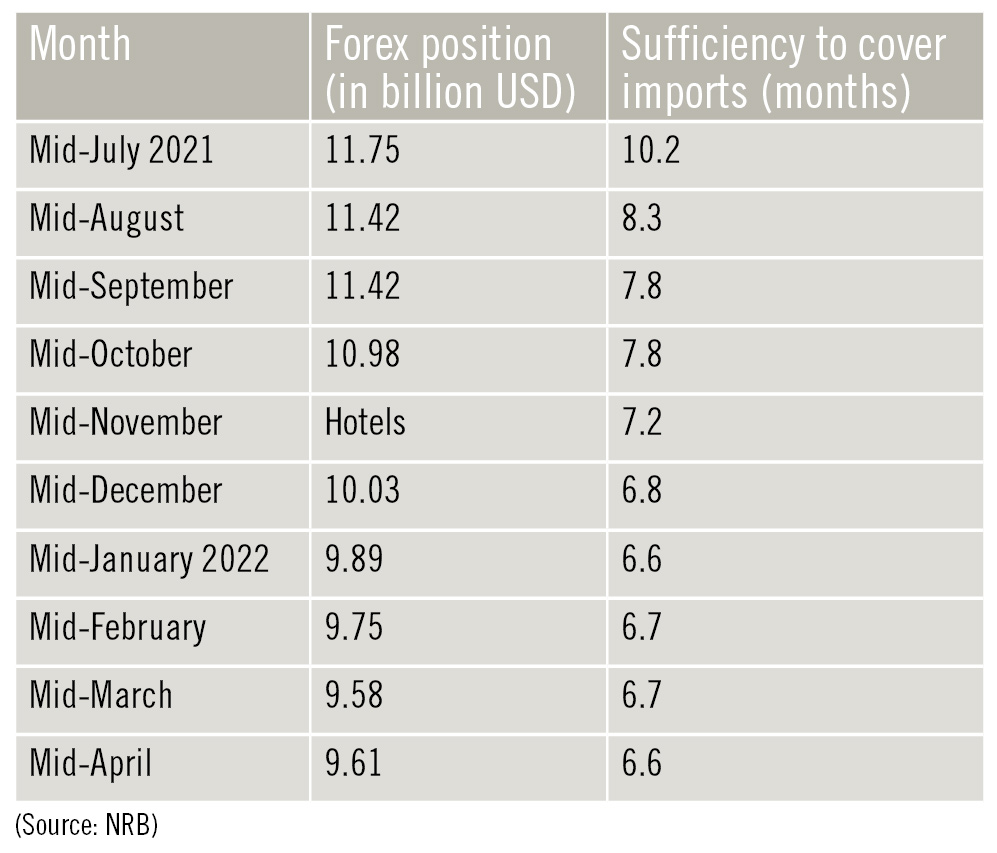

The government has banned the import of ten items that used to be imported under 92 types of harmonised code from April 26, 2022 by issuing a gazette notice. Nepal has restricted the import of some food products like potato chips and similar snacks. The other items restricted for import are finished alcohol products, finished cigarettes, tobacco products and finished diamond products. Import of mobile phones of defined HS codes or expensive mobile phones costing above $600 and colour television sets of above 32 inches has also been restricted. The government has halted the import of jeeps, cars, vans and SUVs (except ambulances and hearses) and motorcycles of 250 cc capacity and above. The other products that have been restricted are toys and playing cards till the end of this fiscal year. This is a formal announcement. Meanwhile, traders have said that the central bank has issued an informal instruction to banks to stop opening L/Cs except for the import of vital supplies. Nepal’s foreign exchange reserves plunged sharply by 182% from $11.75 billion to $9.61 billion in the first nine months (mid-July to mid-April) of the ongoing FY 2021-22. Initially, at the beginning of this fiscal, Nepal’s foreign exchange reserves position was sufficient to cover the import of merchandise goods and services for 8.3 months. However, in mid-April due to a sharp plunge, the foreign exchange reserves position is sufficient to cover import of merchandise goods and services for only 6.6 months.Investment climate and tourism

“Balancing the foreign exchange reserves and supply (import) is a herculean task for the government, however, the private sector feels that Nepal Rastra Bank seems to be quite impatient and the frequency of policy interventions has increased without making proper assessments on whether the policy intervention has worked or not,” said Anuj Agarwal, Vice President of the Confederation of Nepalese Industries and Chairman of Nepal Infrastructure Bank. “The regulator should take at least three months to assess the impact of the various policy interventions it comes up with,” he added. Agarwal claimed that the impatient policy interventions bring unfavourable consequences in the economy. He cited the example of a friend in the United Arab Emirates who enquired about Nepal’s economic condition to be assured before visiting the country with his family. “Such frequent changes in policy tend to impact other sectors which we had not even thought about,” he shared. “Impatient policy interventions, import ban, and negative publicity will have an adverse impact on tourism, foreign investment and other areas,” said Agarwal, adding, “We don’t need to panic based on indicators of the external sector. The regulating bodies must handle such issues cautiously and must not give out negative messages every time there is a slight problem.”Supply chain

Kamalesh Kumar Agrawal, Vice President of Nepal Chamber of Commerce, said that the negativism and exaggeration of Nepal’s economic scenario have been dampening the confidence of both foreign and domestic investors. “Supply restriction will have livelihood impacts as entrepreneurs have been deprived from conducting businesses like wholesale and retail trade. It will also affect value chain integration and value addition opportunities, and the general people will have limited choices,” he said.Government’s revenue

Import restrictions will also affect the government because there will be an adverse impact as revenue collection plunges. Surendra Kumar Upreti, Senior Economic Advisor at the Finance Ministry, has said import restrictions imposed by the government have hit 10% of the government revenue which comes through imports. As Nepal is an import-driven economy, government’s revenue is largely based on imports that is fuelled by the remittance that the country receives. Slowdown in remittances, low export base, slow revival of tourism activities, discouraging foreign direct investment, and the government’s inability to expedite development projects funded through foreign aid sources are major reasons behind the huge Balance of Payments deficit worth Rs 268.26 billion by mid-April. The current account deficit has hit a record historical high of Rs 512.71 billion or more than 10% of the country’s gross domestic product by mid-April. Such current account deficit was at Rs 210.51 billion in the same period of the previous fiscal year. Remittance inflow also went down by 2.2% by mid-April as compared to the corresponding period of the previous fiscal to stand at $6.80 billion.Growth

Import restrictions will certainly impact economic growth as economic activities in concerned sectors where imported goods or services play a pivotal role in leveraging the growth will stall. For instance, the ban on alcohol will deprive the hospitality sector of serving the preferred choice of tourists seeking high-end alcohol products and the mobile phone market too will be impacted as import of mobile phones costing more than $600 has been restricted, according to Nara Bahadur Thapa, Former Executive Director of Nepal Rastra Bank. “Rather than restricting imports, the government should have checked imports by raising the tariffs,” he added. “People should be allowed to buy the commodities they prefer.” Dr Yubaraj Khatiwada, former Finance Minister, has said that till the time the trend of economic activities that are fundamentally derived through imports continue, the pressure on foreign exchange reserves can’t be avoided. “We achieved phenomenal growth for three subsequent years before the Covid 19 pandemic due to reconstruction and economic activities leveraged by imports. But when we achieve phenomenal growth simultaneously, the external sector pressure starts to threaten us,” he said. According to Manik Lal Shrestha, who previously worked with the International Monetary Fund, a gradual collapse of the self-sufficient rural economy and increased import dependence fuelled by remittance could lead us towards a crisis if Nepal faces a major shock in remittance inflow. “Previously, households in rural areas used to produce crops, lentils, oil, dairy products and others. Their need for imported products was very minimal. But now there is migration of families of migrant workers to urban and semi-urban areas and the demand for imported items and utilities has grown,” he said. Shrestha further added the aforementioned trend has gradually marred the rural production base and a larger segment of the country’s population could easily get impacted by such a crisis compared to the past. “Previously, most people were based in the rural areas so restrictions on imports or external sector pressure wouldn’t affect them much but now a larger segment of the population is living in urban areas and depend a lot on imports,” he stated. READ ALSO:

Published Date: June 2, 2022, 12:00 am

Post Comment

E-Magazine

RELATED Feature