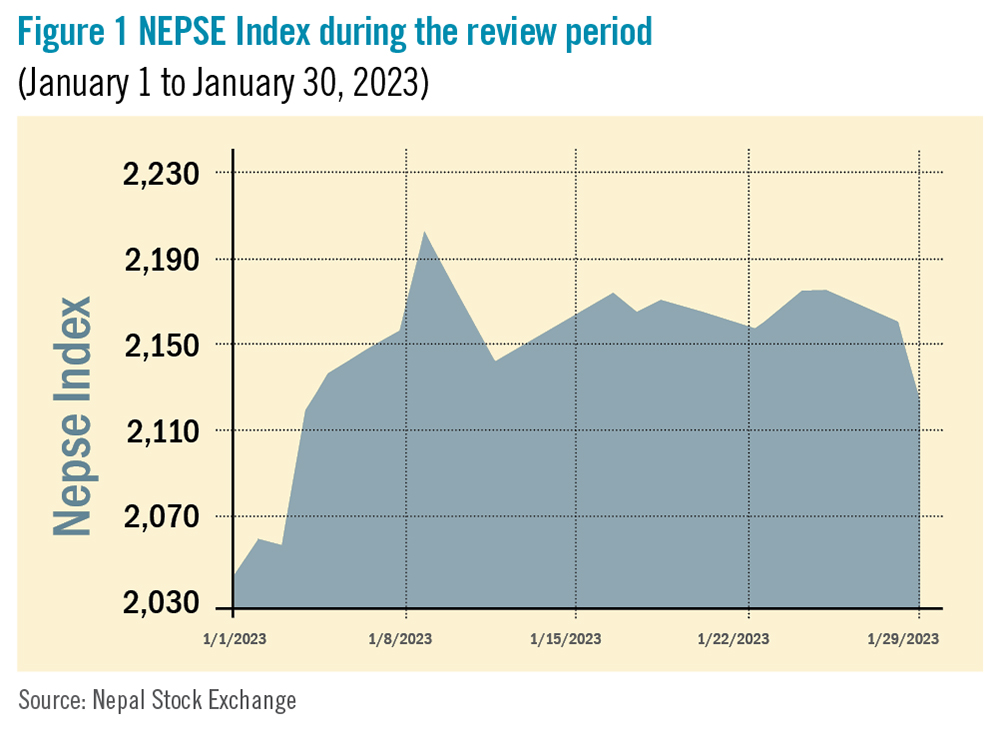

During the review period of January 1 to 30, the Nepal Stock Exchange (NEPSE) index rose by 98.34 points (+4.85%) to close at 2,029.03 points. After 11 months, the NEPSE index went above 2,000 points during the review period, marking a new threshold. The secondary market, which remained volatile due to lack of market liquidity, introduction of regressive policies, and high interest rates, began the current review period on a positive note and gradually gained momentum peaking at 2,211.76 points on January 9.

Numerous factors have contributed to this bullish trend, including the positive sentiment brought by the reappointment of Bishnu Prasad Paudel as Finance Minister, the improvement of liquidity as a result of the central bank’s modification of the working capital loan terms and conditions, the introduction of policies regarding the addition of brokers to the market, and the reservation of a 10% quota for migrant workers willing to invest in the primary market. The total market volume during the review period soared by 161.99% with total transactions of Rs 74.13 billion.

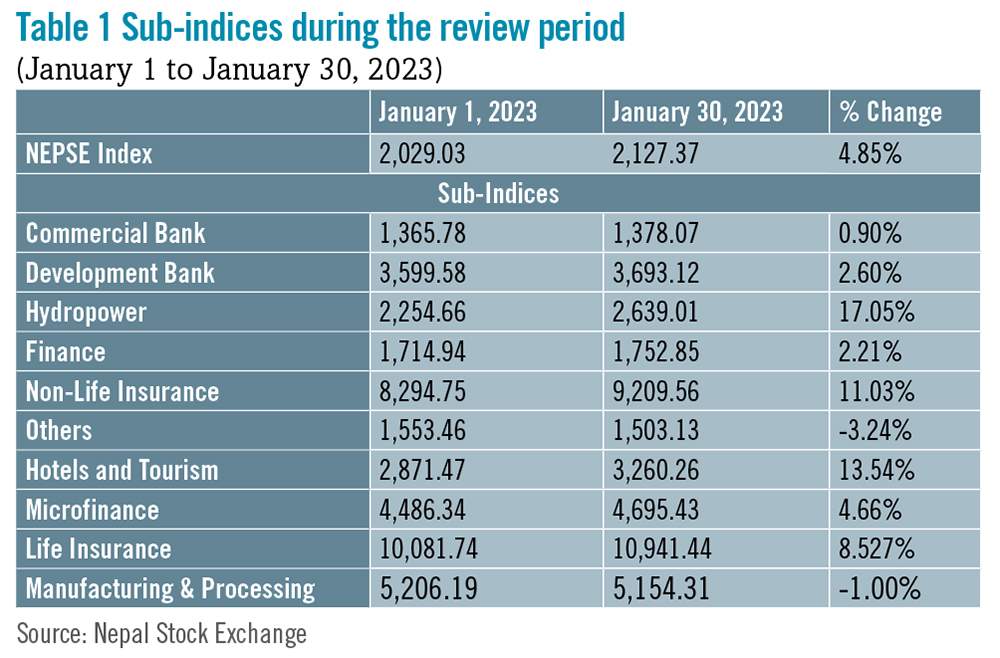

During the review period, eight of the sub-indices landed in the green zone, indicating slight recovery across the sub-sectors, while two fell in the red zone.

In the green zone, Hydropower sub-index (+17.05%) was the biggest gainer as the share value of Himalayan Power (+Rs 68.6), Ngadi Group Power (+Rs 61.8), and Chilime Hydropower (+Rs 58.2) increased substantially. Hotels and Tourism sub-index (+13.54%) was second in line with the rise in the share prices of Taragaon Regency (+Rs 89), Oriental Hotels (+Rs 32), and Soaltee Hotel (+Rs 9.5).

Non-life insurance sub-index (+11.03%) followed suit with the increase in the share prices of Rastriya Beema (+Rs 656), NLG Insurance (+Rs 145) and Prabhu Insurance (+Rs 111.1). Likewise, Life Insurance sub-index (+8.52%) also rose as share value of Asian Life Insurance (+Rs 103), National Life Insurance (+Rs 48.1) and Nepal Life Insurance (+Rs 41) went up.

The Microfinance sub-index (+4.66%) went up as share prices of Swarojgar Microfinance (+Rs 112), Nirdhan Utthan Microfinance (+Rs 80) and RMDC Microfinance (+Rs 77) increased. Development Bank sub-index (+2.60%) also surged with rise in the share value of Green Development (+Rs 27.9), Karnali Development (+Rs 25.6) and Shine Resunga Development (+Rs 24.4).

The Finance sub-index (+2.21%) witnessed a rise in the share prices of Manjushree Finance (+Rs 38), Goodwill Finance (+Rs 18) and Pokhara Financec (+Rs 17). Likewise, Commercial Bank sub-index (+0.90%) faced an upswing with rise in share value of NIC Asia Bank (+Rs 89.7), Standard Chartered Nepal (+Rs 67) and Nepal SBI (+Rs 34).

The Others sub-index (-3.24%) was the biggest loser with the decrease in share prices of Nepal Telecom (-Rs 69). Manufacturing and Processing sub-index (-1%) also followed suit with decline in the share value of Bottlers Nepal (-Rs 1,695), Himalayan Distillery (-Rs 1,396) and Unilever Nepal (-Rs 175).

News and Highlights

On the public issues front, the Securities Exchange Board of Nepal (SEBON) has approved the initial public offering (IPO) of two microfinance companies and one hydropower company. The IPO of BPW Microfinance worth Rs 9.7 million and Aatmanirbhar Microfinance worth Rs 20.338 million were issued. Mega Capital and Sunrise Capital were appointed as issue managers respectively. Likewise, the IPO of Sagarmatha Jalbidhyut Company worth Rs 548.8 million was also issued with Prabhu Capital as its issue manager. SEBON has also kept the IPO of Mandu Hydropower worth Rs 405.81 million, Nepal Warehousing worth Rs 137.5 million and Mid-Solu Hydropower worth Rs 149.68 million in the pipeline under preliminary review. Prabhu Capital, Himalayan Capital and NIC Asia Capital are the issue managers, respectively.Outline

Investor confidence has been restored as a result of the formation of a new government followed by improvement in liquidity in the market and introduction of new policies. For the current positive market trend to continue, investor confidence must be bolstered by constant and efficient implementation of regulatory policies. Authorities responsible for the secondary market should now also place priority on enhancing people’s skills and supporting them in comprehending the secondary market so that their financial knowledge is improved and the market attracts more long-term and stable investments. This is an analysis from beed Management Pvt Ltd. No expressed or implied warrant is made for usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis. READ ALSO:

Published Date: March 3, 2023, 12:00 am

Post Comment

E-Magazine

RELATED Beed Take