Any trend reversal is unlikely amidst the rising interest rates. Until there are stronger evidences of market stability, the market is likely to maintain its current momentum with minor corrections.

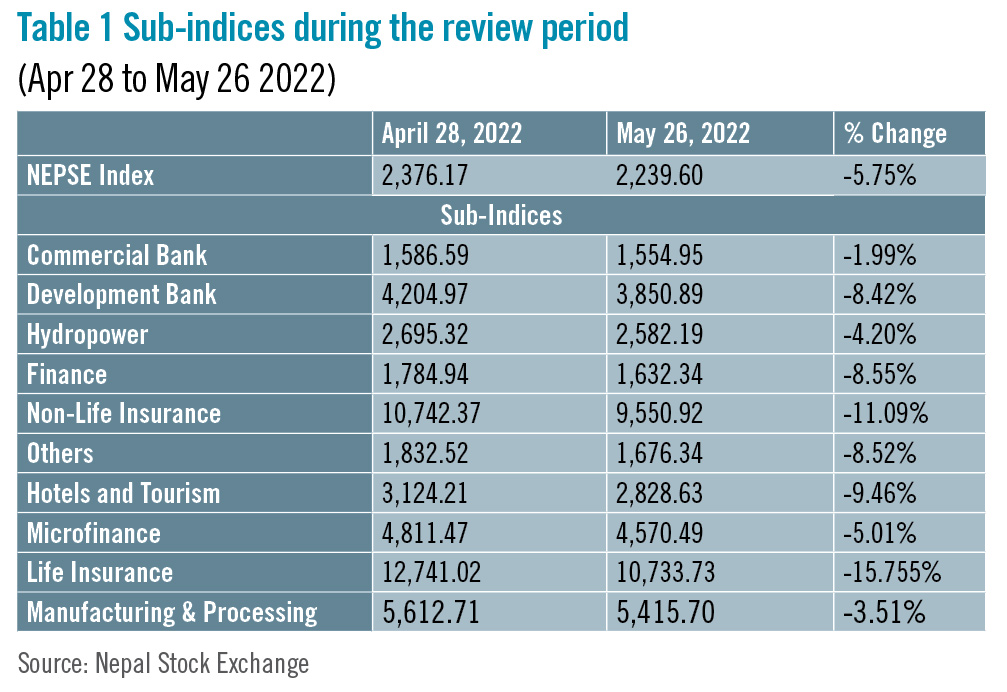

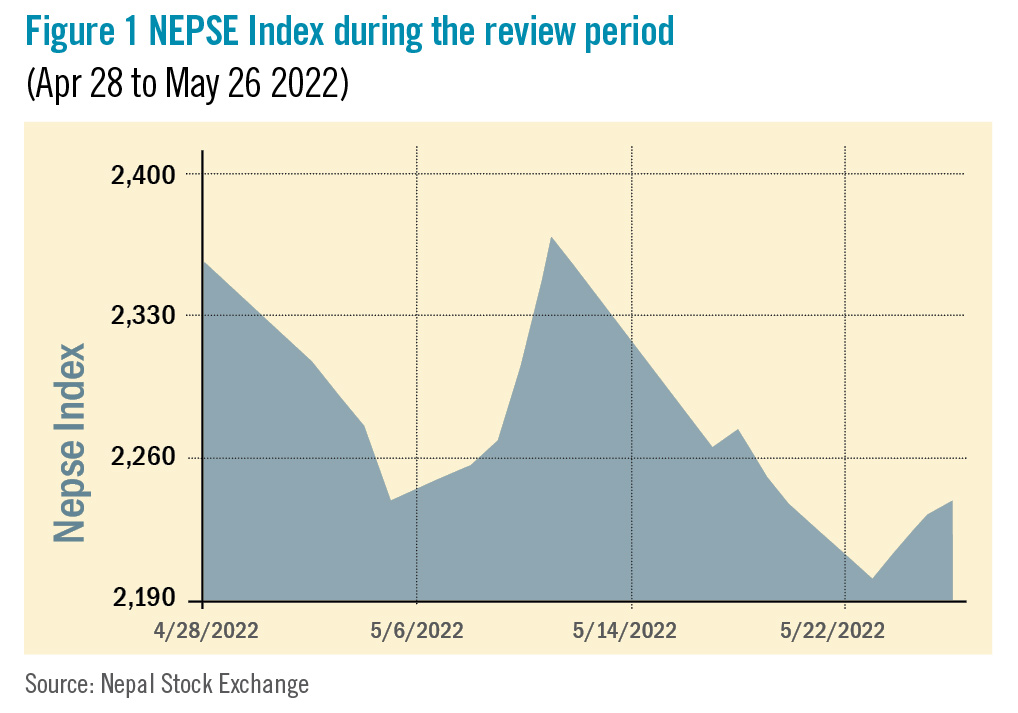

During the review period from April 28 to May 26, the Nepal Stock Exchange (NEPSE) index fell by 136.57 points (-5.75%) to close at 2,239.60 points. Although the market began the review period with a high of 2,356.17 points on April 28, it underwent a series of fluctuations and ended at a low at 2,239.60 points on May 26. Despite investor expectations that local elections would alleviate liquidity in the banking sector and boost the secondary market, the market continued to decline even after successful completion of the elections. The overall market volume during the review period decreased significantly by 31.57% with a total transaction of Rs 24.006 billion. In this time, contrary to the previous review period, all sub-indices landed in the red zone. Life Insurance sub-index (-15.75%) was the biggest loser as the share value of Life Insurance Company (-Rs 339.2), Asian Life Insurance Company (-Rs 197.7) and Surya Life Insurance Company (-Rs 154.9) decreased substantially. Non-life Insurance sub-index (-11.09%) was second as it witnessed a reduction in the share prices of Sagarmatha Insurance (-Rs 398), Rastriya Beema Company (-Rs 254), and Lumbini General Insurance (-Rs 149.9). Hotels and tourism sub-index (-9.46%) followed suit with a drop in the share prices of Oriental Hotels (-Rs 28), Taragaon Regency (-Rs 25.8), and Soaltee Hotel (-Rs 18.8). Likewise, Finance sub-index (-8.55%) also declined as share value of Multipurpose Finance Company (-Rs 73.9), Goodwill Finance (-Rs 57), and Central Finance (-Rs 54) went down. Others sub-index (-8.52%) witnessed a deflation in the share prices of Citizen Investment Trust (-Rs 216), Nepal Telecom (-Rs 67.5) and Hydroelectricity Investment and Development (-Rs 20.9). Development Bank sub-index (-8.42%) also substantially decreased with a drop in the share value of Corporate Development Bank (-Rs 93), Lumbini Development Bank (-Rs 48), and Kamana Sewa Development (-Rs 43.2). Microfinance sub-index (-5.01%) witnessed a fall in the share prices of Unnati Microfinance (-Rs 192), Janautthan Microfinance (-Rs 191) and Mithila Microfinance (-Rs 160). Likewise, Hydropower sub-index (-4.20%) decreased marginally with a fall in share value of Panchakanya Mai Hydropower (-Rs 38.9), Chhyandi Hydropower (-Rs 38.1), and Himalayan Power (-Rs 37.6). Manufacturing and Processing sub-index (-3.51%) also fell with a decrease in the share value of Unilever Nepal (-Rs 209.1), Himalayan Distillery (-Rs 121) and Shivam Cements (-Rs 71.6). Lastly, Commercial Bank sub-index (-1.99%) also lost value with a fall in share prices of Nabil Bank (-Rs 36.3), Nepal SBI Bank (-Rs 15) and Everest Bank (-Rs 13.8).

Microfinance sub-index (-5.01%) witnessed a fall in the share prices of Unnati Microfinance (-Rs 192), Janautthan Microfinance (-Rs 191) and Mithila Microfinance (-Rs 160). Likewise, Hydropower sub-index (-4.20%) decreased marginally with a fall in share value of Panchakanya Mai Hydropower (-Rs 38.9), Chhyandi Hydropower (-Rs 38.1), and Himalayan Power (-Rs 37.6). Manufacturing and Processing sub-index (-3.51%) also fell with a decrease in the share value of Unilever Nepal (-Rs 209.1), Himalayan Distillery (-Rs 121) and Shivam Cements (-Rs 71.6). Lastly, Commercial Bank sub-index (-1.99%) also lost value with a fall in share prices of Nabil Bank (-Rs 36.3), Nepal SBI Bank (-Rs 15) and Everest Bank (-Rs 13.8).

News and Highlights

As per the information published in the Nepal Gazette Part 5 2079, the securities market participants who have obtained licence from the Securities Exchange Board of Nepal (SEBON) should also make arrangements in alignment with the government’s new decision of providing two-day holiday (Saturday and Sunday). As such, Nepal Stock Exchange (NEPSE) decided to open the share market from Monday to Friday with effect from May 15, 2022, instead of the current Sunday to Thursday. Nepal Rastra Bank (NRB), published its Current Macroeconomic and Financial Situation Update of nine months of the current FY 2021/22, ending mid-April 2022. As per the report, the number of companies listed in NEPSE increased from 218 in mid-April 2021 to 229 in mid-April 2022, indicating a boom in the capital market in the past year. On the public issue front, SEBON approved the Initial Public Offerings (IPOs) of three hydropower companies which include Upper Hewakhola Hydropower worth Rs 200 million, Rapti Hydro and General Construction worth Rs 291.14 million and Swetganga Hydropower worth Rs 398.25 million. NMB Capital, Siddhartha Capital and Sanima Capital have been appointed as issue managers respectively. Additionally, SEBON also approved the IPO of a microfinance company called Adarsha Microfinance at Rs 6.7 million. BoK Capital has been appointed its issue manager.

SEBON has also added the IPO of Srijanshil Microfinance worth Rs 39.37 million and Peoples Hydropower worth Rs 800 million to its pipeline. Sunrise Capital and Sanima Capital have been appointed issue managers respectively.

On the public issue front, SEBON approved the Initial Public Offerings (IPOs) of three hydropower companies which include Upper Hewakhola Hydropower worth Rs 200 million, Rapti Hydro and General Construction worth Rs 291.14 million and Swetganga Hydropower worth Rs 398.25 million. NMB Capital, Siddhartha Capital and Sanima Capital have been appointed as issue managers respectively. Additionally, SEBON also approved the IPO of a microfinance company called Adarsha Microfinance at Rs 6.7 million. BoK Capital has been appointed its issue manager.

SEBON has also added the IPO of Srijanshil Microfinance worth Rs 39.37 million and Peoples Hydropower worth Rs 800 million to its pipeline. Sunrise Capital and Sanima Capital have been appointed issue managers respectively.

Outlook

The current market volume clearly depicts deteriorating investor confidence. Further, any trend reversal is unlikely amidst the rising interest rates. Until there are stronger evidences of market stability, the market is likely to maintain its current momentum with minor corrections.This is an analysis from beed Management. No expressed or implied warrant is made for usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis.

READ ALSO:

Published Date: July 6, 2022, 12:00 am

Post Comment

E-Magazine

RELATED Beed Take