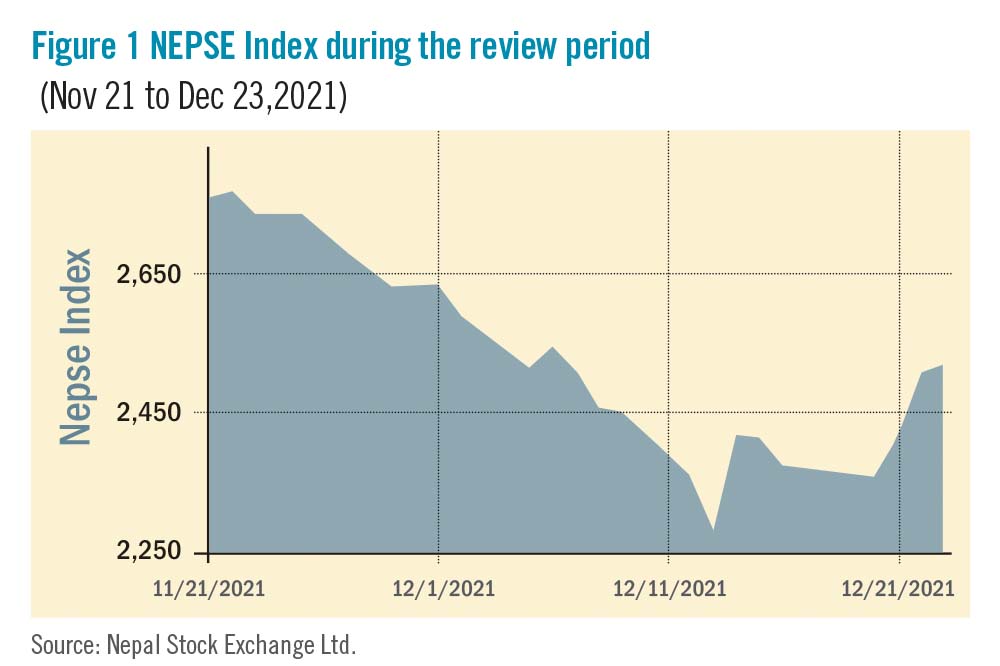

The Nepal Stock Exchange (NEPSE) index dropped considerably by 248.90 points (-8.99%) to close at 2,520.23 points during the review period of November 21 to December 23, 2021. Since Nepal Rastra Bank (NRB) introduced a few measures via the Monetary Policy of the current fiscal year, the secondary market has been on a downward trend. Further, lack of improvement on the ongoing liquidity crunch and increasing interest rates in the banking system have been major factors behind the fall in the index. Nonetheless, the market witnessed a steady recovery after closing at 2,281.67 points on December 13, the lowest decline in recent trading days. Although the index has climbed over the psychological 2,400-mark hurdle indicating a short-term recovery, the secondary market is yet to witness a notable momentum. With this, the overall volume during the review period decreased notably by 13.68%, and reached Rs 86.619 billion.

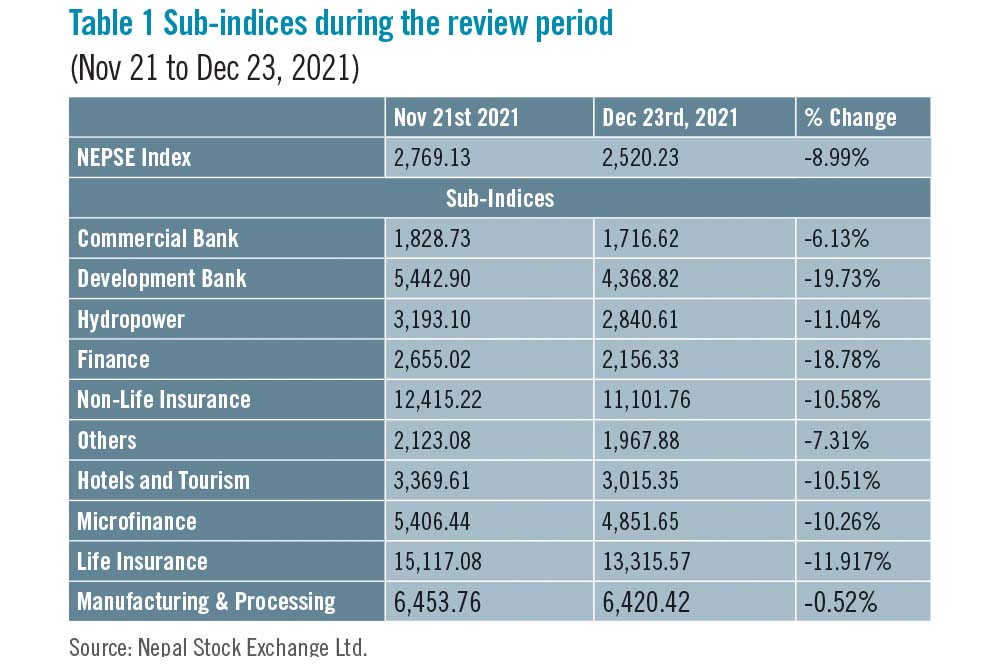

During the review period, contrary to the previous review period, all of the sub-indices landed in the red zone. Development Bank sub-index (-19.73%) was the biggest loser as the share value of Muktinath Development (-Rs 216.9), Lumbini Development (-Rs 193) and Mahalaxmi Development (-Rs 168) decreased substantially. The Finance sub-index (-18.78%) was second in line with a fall in the share value of ICFC Finance (-Rs 300.2), Goodwill Finance (-Rs 206) and Manjushree Finance (-Rs 197). Life Insurance sub-index (-11.91%) also witnessed decrease in the share price of Prime Life Insurance (-Rs 249.2), Asian Life Insurance (-Rs 205) and Nepal Life Insurance (-Rs 180). Hydropower sub-index (-11.04%) followed suit with a fall in the share price of Ngadi Group Power (-Rs 133), Nepal Hydro Developers (-Rs 115.5) and Radhi Bidhyut Company (-Rs 106.4).

Non-life Insurance sub-index (-10.58%) depreciated as share value of Rastriya Beema Company (-Rs 2,710), Lumbini General Insurance (-Rs 129) and Premier Insurance (-Rs 128.7) went down. Similarly, Hotels and Tourism (-10.51%) witnessed a reduction in the share prices of Soaltee Hotel (-Rs 30.2), Oriental Hotels (-Rs 20) and Taragaon Regency (-Rs 1). Microfinance sub-index (-10.26%) also substantially declined with a fall in the share value of Global IME Microfinance (-Rs 628), Support Microfinance (-Rs 620.3) and National Microfinance (-Rs 594).

The Others sub-index (-7.31%) decreased as share value of Citizen Investment Trust (-Rs 330.1) and Nepal Telecom (-Rs 103) fell. Commercial Bank sub-index (-6.13%) witnessed a fall in the share price of Prime Commercial Bank (-Rs 122.2), Nepal Bank (-Rs 100) and NIC Asia Bank (-Rs 94). Likewise, Manufacturing & Processing sub-index (-0.52%) decreased marginally with fall in share value of Shivam Cements (-Rs 12) and Himalayan Distillery (-Rs 10).

News and Highlights

NEPSE has decided to distribute dividends to its shareholders from the previous fiscal year’s profits. The exchange has declared 166.67% dividend, which includes 66.67% bonus shares of paid-up capital and 100% cash dividend (tax purpose). To distribute the dividend, NEPSE will endorse it in the upcoming general meeting on January 13, 2022.

On the public issue front, SEBON has added the IPOs of three hydropower companies to its pipeline. It includes Supermai Hydropower worth Rs 100 million, Sanjen Hydropower worth Rs 365 million and Eastern Hydropower worth Rs 124 million. Sanima Capital, Citizen Investment Trust and NM Capital have been appointed as the issue managers for the three hydropower companies respectively.

Likewise, SEBON has approved the right shares of Chhanyngdi Hydropower (10:3 ratio) worth Rs 89.3 million and Corporate Development Bank (1:1.50 ratio) worth Rs 300 million. Global IME Capital and Civil Capital have been appointed as issue managers for the two respectively.

Outlook

Negative remarks about the market, along with restricted liquidity and increasing interest rates, have harmed investor confidence. Despite the circumstances, the market has exhibited indications of recovery as share prices of many companies are trading at attractive prices. Furthermore, market demand has improved as many companies are closing their books to pay out dividends from the previous fiscal year’s earnings.

This is an analysis from beed Management Pvt. Ltd. No expressed or implied warrant is made for usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis.

READ ALSO:

The Others sub-index (-7.31%) decreased as share value of Citizen Investment Trust (-Rs 330.1) and Nepal Telecom (-Rs 103) fell. Commercial Bank sub-index (-6.13%) witnessed a fall in the share price of Prime Commercial Bank (-Rs 122.2), Nepal Bank (-Rs 100) and NIC Asia Bank (-Rs 94). Likewise, Manufacturing & Processing sub-index (-0.52%) decreased marginally with fall in share value of Shivam Cements (-Rs 12) and Himalayan Distillery (-Rs 10).

News and Highlights

NEPSE has decided to distribute dividends to its shareholders from the previous fiscal year’s profits. The exchange has declared 166.67% dividend, which includes 66.67% bonus shares of paid-up capital and 100% cash dividend (tax purpose). To distribute the dividend, NEPSE will endorse it in the upcoming general meeting on January 13, 2022.

On the public issue front, SEBON has added the IPOs of three hydropower companies to its pipeline. It includes Supermai Hydropower worth Rs 100 million, Sanjen Hydropower worth Rs 365 million and Eastern Hydropower worth Rs 124 million. Sanima Capital, Citizen Investment Trust and NM Capital have been appointed as the issue managers for the three hydropower companies respectively.

Likewise, SEBON has approved the right shares of Chhanyngdi Hydropower (10:3 ratio) worth Rs 89.3 million and Corporate Development Bank (1:1.50 ratio) worth Rs 300 million. Global IME Capital and Civil Capital have been appointed as issue managers for the two respectively.

Outlook

Negative remarks about the market, along with restricted liquidity and increasing interest rates, have harmed investor confidence. Despite the circumstances, the market has exhibited indications of recovery as share prices of many companies are trading at attractive prices. Furthermore, market demand has improved as many companies are closing their books to pay out dividends from the previous fiscal year’s earnings.

This is an analysis from beed Management Pvt. Ltd. No expressed or implied warrant is made for usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis.

READ ALSO:

The Others sub-index (-7.31%) decreased as share value of Citizen Investment Trust (-Rs 330.1) and Nepal Telecom (-Rs 103) fell. Commercial Bank sub-index (-6.13%) witnessed a fall in the share price of Prime Commercial Bank (-Rs 122.2), Nepal Bank (-Rs 100) and NIC Asia Bank (-Rs 94). Likewise, Manufacturing & Processing sub-index (-0.52%) decreased marginally with fall in share value of Shivam Cements (-Rs 12) and Himalayan Distillery (-Rs 10).

News and Highlights

NEPSE has decided to distribute dividends to its shareholders from the previous fiscal year’s profits. The exchange has declared 166.67% dividend, which includes 66.67% bonus shares of paid-up capital and 100% cash dividend (tax purpose). To distribute the dividend, NEPSE will endorse it in the upcoming general meeting on January 13, 2022.

On the public issue front, SEBON has added the IPOs of three hydropower companies to its pipeline. It includes Supermai Hydropower worth Rs 100 million, Sanjen Hydropower worth Rs 365 million and Eastern Hydropower worth Rs 124 million. Sanima Capital, Citizen Investment Trust and NM Capital have been appointed as the issue managers for the three hydropower companies respectively.

Likewise, SEBON has approved the right shares of Chhanyngdi Hydropower (10:3 ratio) worth Rs 89.3 million and Corporate Development Bank (1:1.50 ratio) worth Rs 300 million. Global IME Capital and Civil Capital have been appointed as issue managers for the two respectively.

Outlook

Negative remarks about the market, along with restricted liquidity and increasing interest rates, have harmed investor confidence. Despite the circumstances, the market has exhibited indications of recovery as share prices of many companies are trading at attractive prices. Furthermore, market demand has improved as many companies are closing their books to pay out dividends from the previous fiscal year’s earnings.

This is an analysis from beed Management Pvt. Ltd. No expressed or implied warrant is made for usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis.

READ ALSO:

The Others sub-index (-7.31%) decreased as share value of Citizen Investment Trust (-Rs 330.1) and Nepal Telecom (-Rs 103) fell. Commercial Bank sub-index (-6.13%) witnessed a fall in the share price of Prime Commercial Bank (-Rs 122.2), Nepal Bank (-Rs 100) and NIC Asia Bank (-Rs 94). Likewise, Manufacturing & Processing sub-index (-0.52%) decreased marginally with fall in share value of Shivam Cements (-Rs 12) and Himalayan Distillery (-Rs 10).

News and Highlights

NEPSE has decided to distribute dividends to its shareholders from the previous fiscal year’s profits. The exchange has declared 166.67% dividend, which includes 66.67% bonus shares of paid-up capital and 100% cash dividend (tax purpose). To distribute the dividend, NEPSE will endorse it in the upcoming general meeting on January 13, 2022.

On the public issue front, SEBON has added the IPOs of three hydropower companies to its pipeline. It includes Supermai Hydropower worth Rs 100 million, Sanjen Hydropower worth Rs 365 million and Eastern Hydropower worth Rs 124 million. Sanima Capital, Citizen Investment Trust and NM Capital have been appointed as the issue managers for the three hydropower companies respectively.

Likewise, SEBON has approved the right shares of Chhanyngdi Hydropower (10:3 ratio) worth Rs 89.3 million and Corporate Development Bank (1:1.50 ratio) worth Rs 300 million. Global IME Capital and Civil Capital have been appointed as issue managers for the two respectively.

Outlook

Negative remarks about the market, along with restricted liquidity and increasing interest rates, have harmed investor confidence. Despite the circumstances, the market has exhibited indications of recovery as share prices of many companies are trading at attractive prices. Furthermore, market demand has improved as many companies are closing their books to pay out dividends from the previous fiscal year’s earnings.

This is an analysis from beed Management Pvt. Ltd. No expressed or implied warrant is made for usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis.

READ ALSO:

Published Date: January 21, 2022, 12:00 am

Post Comment

E-Magazine

RELATED Beed Take