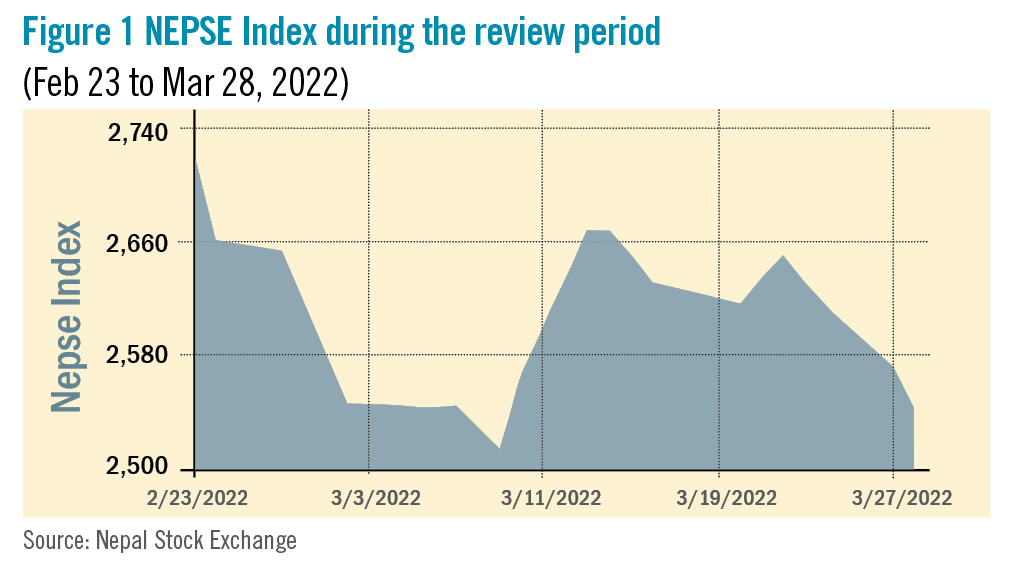

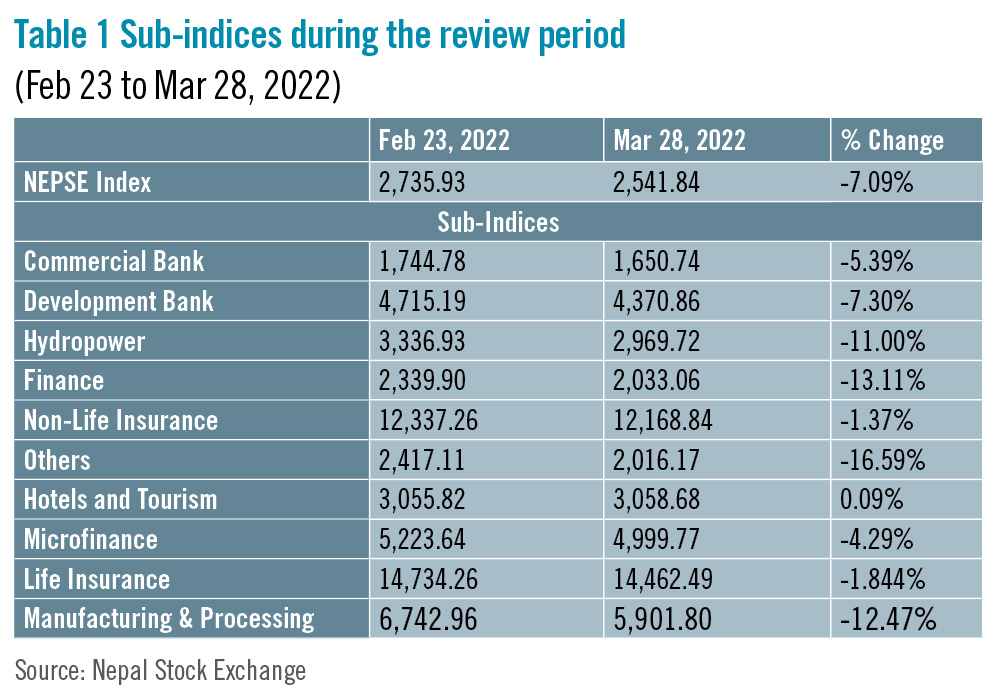

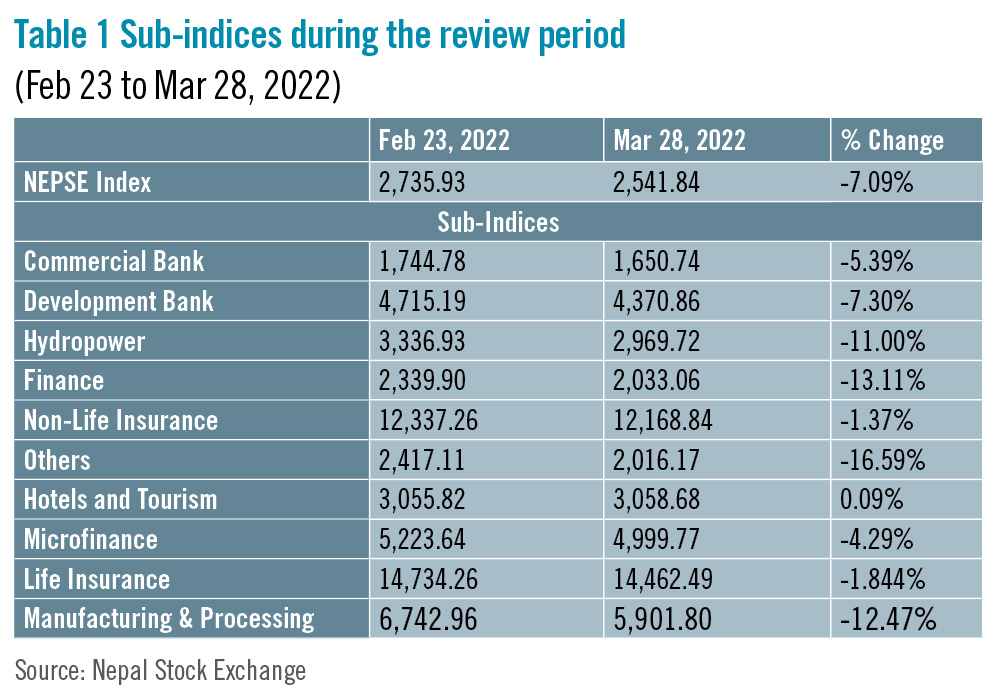

During the review period from February 23 to March 28, the Nepal Stock Exchange (NEPSE) index fell by 194.09 points (-7.09%) to close at 2,541.84 points. Although the market started the review period strong, with the NEPSE index reaching a high of 2,720.43 points on February 23, it could not sustain its growth thereafter. In light of tumbling index and significant fall in the book value of the investor’s portfolio, the investor confidence remained low throughout the review period as indicated by the market volume. The overall market volume during the review period decreased significantly by 44.20% and reached Rs 60.581 billion.

During the review period, in alignment to the previous review period, only one sub-index landed in the green zone whereas all the other nine sub-indices landed in the red zone. Hotels and tourism sub-index (+0.09%) was the sole winner as the share value of Soaltee Hotel (+Rs 12.2) increased substantially.

Others sub-index (-16.59%) was the biggest loser with the drop in the share value of Nepal Telecom (-Rs 645.5), Citizen Investment Trust (-Rs 70), and Hydroelectricity Investment and Development Company (-Rs 35.4). Finance sub-index (-13.11%) was second in line in the red zone as it witnessed a reduction in the share prices of Gurkhas Finance (-Rs 120), ICFC Finance (-Rs 89), and Manjushree Finance (-Rs 85). Manufacturing & Processing sub-index (-12.47%) followed suit with a drop in the share prices of Himalayan Distillery (-Rs 402.9), Shivam Cements (-Rs 325) and Bottlers Nepal (-Rs 282.1). Likewise, Hydropower sub-index (-11%) also regressed as share value of Api Power (-Rs 157), National Hydro Power (-Rs 128) and Shivam Cements (-Rs 191) went down.

Similarly, Development Bank sub-index (-7.30%) witnessed a deflation in the share prices of Garima Development Bank (-Rs 127), Excel Development Bank (-Rs 73), and Mahalaxmi Development Bank (-Rs 51). Commercial Bank sub-index (-5.39%) also substantially decreased with a drop in the share value of Everest Bank (-Rs 73), Nabil Bank (-Rs 53.5) and NIC Asia (-Rs 48.1).

Along the same lines, Microfinance sub-index (-4.29%) decreased as share value of National Microfinance (-Rs 173), Mithila Microfinance (-Rs 145), and Janauttan Samudayik Microfinance (-Rs 138) deflated. Life Insurance sub-index (-1.84%) witnessed a fall in the share prices of Nepal Life Insurance (-Rs 272.6) and National Life Insurance (-Rs 235). Likewise, Non-life Insurance sub-index (-1.37%) decreased marginally with the fall in share value of Rastriya Beema (-Rs 359), Neco Insurance (-Rs 169.8) and Shikhar Insurance (-Rs 117).

News and Highlights

During a programme organised at the Ministry of Finance on March 2, Finance Minister Janardan Sharma voiced concerns regarding secondary market manipulation that has influenced the daily transaction of stocks. He stated that insider trading, pump-and-dump and circular trading have all been reported at NEPSE, resulting in erratic fluctuations. As a result, he urged NEPSE and Securities Board of Nepal (SEBON) to improve their coordination and take necessary steps to increase small investor participation and safety in the secondary market. It also entails raising capital, introducing big market makers and promoting financial literacy programs in the secondary market. On the public issue front, SEBON approved the Initial Public Offerings (IPOs) of one hydropower and two microfinance companies. It includes River Falls Power hydropower worth Rs 357 million, Upakar Microfinance worth Rs 26.625 million and CYC Nepal Microfinance worth Rs 39.533 million. Prabhu Capital has been appointed as the issue manager of River Falls Power whereas, Nepal SBI Merchant and Global IME Capital have been appointed as issue managers of the two microfinance companies, respectively. Likewise, SEBON has also added the IPO of Dhaulagiri Microfinance worth Rs 33.1 million to its pipeline. Sunrise Capital has been appointed as the issue manager for this. Similarly, SEBON has approved the right shares of Api Power Company (10:3.9 ratio) worth Rs 1.086 billion and Nepal Finance (10:7 ratio) worth Rs 345.447 million. Mukthinath Capital and Prabhu Captial have been appointed as issue managers for these two companies, respectively.Outlook

The secondary market has shown no signs of ease as key macroeconomic indicators of the economy are indicating worrying signals. Investor confidence has dampened and stock trading has been continuously declining due to rising interest rates and tightening liquidity situation in the banking system. Further, as the current fiscal year’s third quarter approaches, investors will be on the lookout for fundamentals of the listed companies in expectation of annual returns. Furthermore, as we approach upcoming local level elections, the market is likely to be in a wait-and-see mode. This is an analysis from beed Management. No expressed or implied warrant is made for the usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis. READ ALSO:

Published Date: May 1, 2022, 12:00 am

Post Comment

E-Magazine

RELATED Beed Take