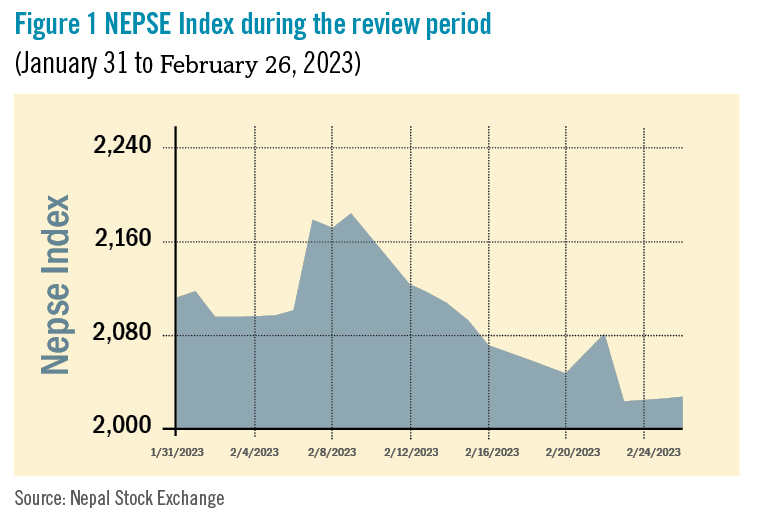

During the review period of January 31 to February 26, the Nepal Stock Exchange (NEPSE) index plunged by 100.18 points (-4.71%) to close at 2,027.19 points. Even though a support level at 2,000 points was witnessed at the end, the market continued with its downward momentum after reaching 2,182.64 points on February 8.

Numerous factors have contributed to the current downward trend, including the current liquidity crisis in the market, the absence of fundamental investors in the market, and low investor confidence as a result of the government’s failure to meet its targets in the semi-annual review of the Monetary Policy 2022/23. In addition, recent political developments and insecurity undermined investor confidence. During the time under consideration, the total market volume plummeted by 51.09% to a mere Rs 36.26 billion.

During the review period, all sub-indices landed in the red zone, indicating a worrisome state across the sub-sectors, contrary to the recovering picture demonstrated in the previous review period.

Microfinance sub-index (-14.48%) was the biggest loser and due to the impact of the new directive issued by the central bank for microfinance institutions, the share value of Civil Microfinance (-Rs 887.25), Deprosc Microfinance (-Rs 725.2) and Nirdhan Utthan Microfinance (-Rs 280) decreased substantially. Life Insurance sub-index (-6.86%) was second in line as it witnessed a fall in the share prices of Nepal Life Insurance (-Rs 48), Asian Life Insurance (-Rs 45) and National Life Insurance (-Rs 38.4)

Manufacturing and Processing sub-index (-4.30%) followed suit with a decrease in the share prices of Himalayan Distillery (-Rs 280) and Shivam Cements (-Rs 8.3). Similarly, Commercial Bank sub-index (-4%) also fell as share value of Everest Bank (-Rs 164.1), Nabil Bank (-Rs 34.5) and Himalayan Bank (-Rs 19.6) went down.

Non-life Insurance sub-index (-3.30%) went down as share prices of Shikhar Insurance (-Rs 200), Rastriya Beema Company (-Rs 153) and IME General Insurance (-Rs 66.9) decreased. Hotels and Tourism sub-index (-2.95%) also decreased with a fall in the share value of Oriental Hotels (-Rs 18.1), Taragaon Regency (-Rs 15) and Soaltee Hotel (-Re 1).

Along the same lines, Others sub-index (-2.43%) witnessed a decline in the share prices of Citizen Investment Trust (-Rs 134), Nepal Telecom (-Rs 20.9) and Hydroelectricity Investment and Development Corporation (-Rs 3). Likewise, Hydropower sub-index (-2.41%) faced a contraction in the share value of Upper Tamakoshi Hydropower (-Rs 45), Arun Valley Hydropower (-Rs 32.9) and Himalayan Power (-Rs 25.5).

Further, Finance sub-index (-1.67%) was also on the losing end with decrease in value of share prices of Guheshwori Merchant Bank and Finance (-Rs 32.5), Gurkhas Finance (-Rs 28.1) and Goodwill Finance (-Rs 19). Development Bank sub-index (-0.70%) followed suit with decline in the share value of Jyoti Development (-Rs 14), Mahalaxmi Development (-Rs 12.9), and Lumbini Development (-Rs 10.9).

Table 1 Sub-indices during the review period (January 31 to February 26, 2023)

|

January 31, 2023 |

February 26, 2023 |

% Change |

|

|

NEPSE Index |

2,127.37 |

2,027.19 |

-4.71% |

|

Sub-Indices |

|||

|

Commercial Bank |

1,378.07 | 1,322.94 |

-4.00% |

|

Development Bank |

3,693.12 | 3,667.33 |

-0.70% |

|

Hydropower |

2,639.01 | 2,575.34 |

-2.41% |

|

Finance |

1,752.85 | 1,723.61 |

-1.67% |

|

Non-Life Insurance |

9,209.56 | 8,905.92 |

-3.30% |

|

Others |

1,503.13 | 1,466.59 |

-2.43% |

|

Hotels and Tourism |

3,260.26 | 3,164.01 |

-2.95% |

|

Microfinance |

4,695.43 | 4,015.46 |

-14.48% |

|

Life Insurance |

10,941.44 | 10,190.48 |

-6.863% |

|

Manufacturing & Processing |

5,154.31 | 4,932.52 |

-4.30% |

Source: Nepal Stock Exchange

News and Highlights

On the public issues front, the Securities Board of Nepal (SEBON) has approved the initial public offering (IPO) of six hydropower companies. The IPOs of Dolti Power worth Rs 536.48 million, Bhugol Energy Development worth Rs 544.05 million, Menchhiyam Hydropower worth Rs 542.58 million, Ingwa Hydropower worth Rs 600 million, Mai Khola Hydropower worth Rs 392.15 million and Modi Energy worth Rs 2.9 billion were issued. NIC Asia Capital has been appointed as issue manager for Doti Power, Bhugol Energy Development and Menchhiyam Hydropower whereas Nepal SBI, Prabhu Capital and Sunrise Capital have been appointed as issue managers for the remaining three hydropower companies, respectively. SEBON has also kept the IPO of Manakamana Engineering Hydropower worth Rs 280 million, and Mathilo Mailun Khola Hydropower worth Rs 250 million in its pipeline under preliminary review. BoK Capital and Sanima Capital are the issue managers respectively.Outline

Political developments play a crucial role in Nepal’s secondary market movement as seen by recent market activity. It is also indicative of investor confidence. Until a clear signal of political stability can be provided, the market is likely to remain volatile. This is an analysis from beed Management Pvt Ltd. No expressed or implied warrant is made for usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis. READ ALSO:

Published Date: April 5, 2023, 12:00 am

Post Comment

E-Magazine

RELATED Beed Take