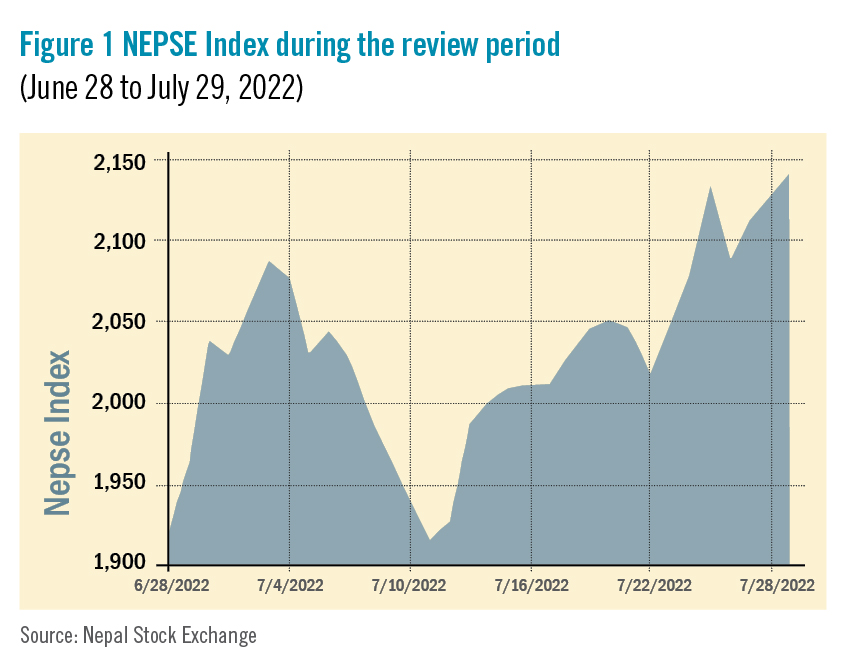

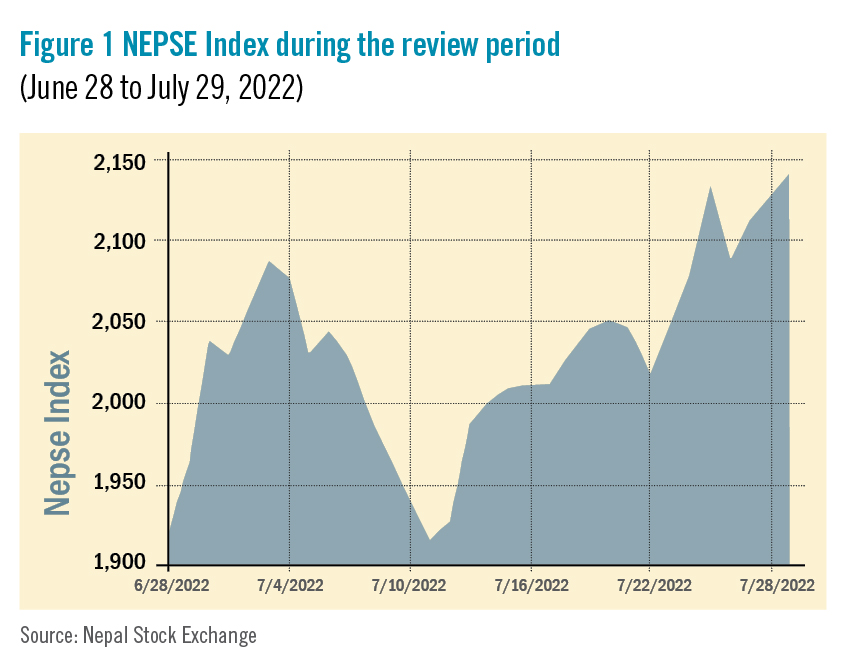

During the review period from June 28 to July 29, the Nepal Stock Exchange (NEPSE) index went up by an impressive 207.39 points (+10.73%) to close at 2,140.52 points. Although the market began the review period with only 1,921.31 points on June 29, the index steadily climbed thereafter while also facing minor fluctuations. It reached a high of 2,140.52 points on July 29, marking the market’s highest level since March of 2022 The modest improvement in the market’s liquidity, entry of new investors, and the release of Nepal Rastra Bank’s new Monetary Policy 2022/23 are some of the key factors driving investor confidence. As a result, the overall market volume during the review period increased significantly by 95.88% with a total transaction of Rs 61.840 billion.

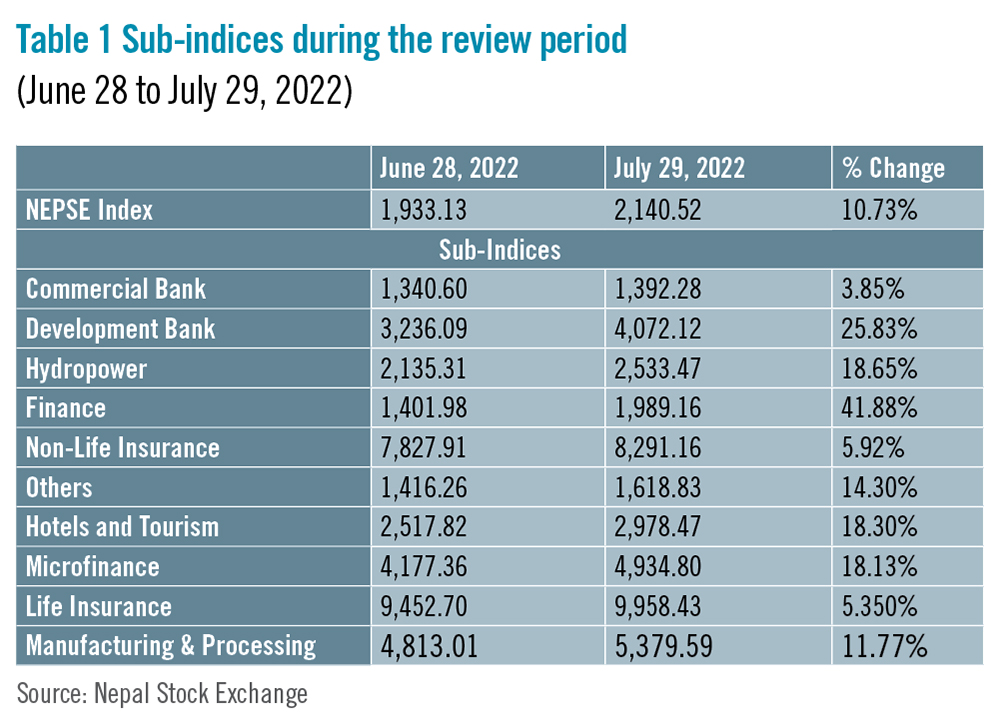

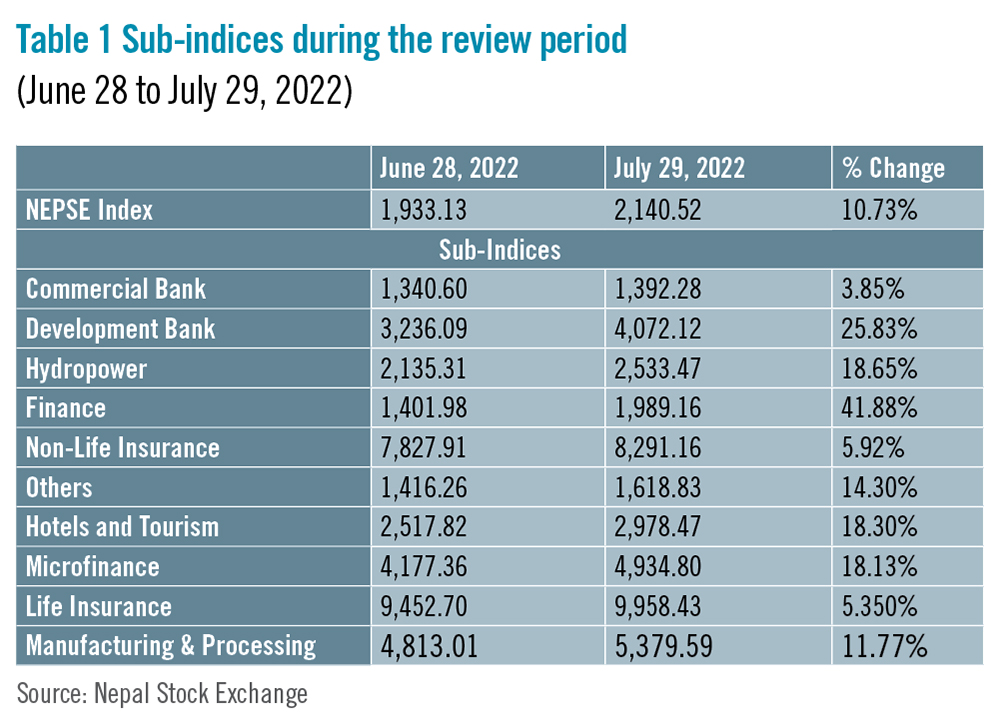

During the review period, contrary to the previous review period, all of the sub-indices landed in the green zone, showing signs of recovery in the market.

Finance sub-index (+41.88%) was the biggest winner as the share value of Gurkhas Finance (+Rs 295.4), Goodwill Finance (+Rs 162.1), and ICFC Finance (+Rs 159.3) increased substantially. Development Bank sub-index (+25.83%) was second in line as it witnessed a surge in the share prices of Lumbini Development (+Rs 104.9), Corporate Development (+Rs 102), and Mahalaxmi Development (+Rs 98). Hydropower sub-index (+18.65%) followed suit with a rise in the share prices of Upper Tamakoshi Hydropower (+Rs 123), United Modi Hydropower (+Rs 95.8) and Himalayan Power (+Rs 83). Hotels and tourism sub-index (+18.30%) also rose as share value of Taragaon Regency (+Rs 47), Oriental Hotels (+Rs 42) and Soaltee Hotel (+Rs 34.4) went up.

Similarly, Microfinance sub-index (+18.13%) witnessed an increase in the share prices of National Microfinance (+Rs 540), Swabalamban Microfinance (+Rs 354), and Laxmi Microfinance (+Rs 315.5). Others sub-index (+14.30%) also substantially increased with a rise in the share value of Citizen Investment Trust (+Rs 346.5), Nepal Telecom (+Rs 79) and Hydroelectricity Investment & Development (+Rs 10).

Along the same lines, Manufacturing and Processing sub-index (+11.77%) witnessed a hike in the share prices of Bottlers Nepal (+Rs 1954.9), Himalayan Distillery (+Rs 503) and Shivam Cements (+Rs 108). Likewise, Non-life Insurance sub-index (+5.92%) faced an upsurge with a rise in share value of Rastriya Beema (+Rs 578), Shikhar Insurance (+Rs 112) and NLG Insurance (+Rs 60.9). Life Insurance sub-index (+5.35%) also followed suit with an increase in the share value of Asian Life Insurance (+Rs 74), National Life Insurance (+Rs 63) and Nepal Life Insurance (+Rs 58).

Lastly, Commercial Bank sub-index (+3.85%) also gained value with a marginal rise in share price of Nabil Bank (+Rs 89.9), Everest Bank (+Rs 65), Standard Chartered Bank (+Rs 64) and NIC Asia Bank (+Rs 29.9).

Similarly, Microfinance sub-index (+18.13%) witnessed an increase in the share prices of National Microfinance (+Rs 540), Swabalamban Microfinance (+Rs 354), and Laxmi Microfinance (+Rs 315.5). Others sub-index (+14.30%) also substantially increased with a rise in the share value of Citizen Investment Trust (+Rs 346.5), Nepal Telecom (+Rs 79) and Hydroelectricity Investment & Development (+Rs 10).

Along the same lines, Manufacturing and Processing sub-index (+11.77%) witnessed a hike in the share prices of Bottlers Nepal (+Rs 1954.9), Himalayan Distillery (+Rs 503) and Shivam Cements (+Rs 108). Likewise, Non-life Insurance sub-index (+5.92%) faced an upsurge with a rise in share value of Rastriya Beema (+Rs 578), Shikhar Insurance (+Rs 112) and NLG Insurance (+Rs 60.9). Life Insurance sub-index (+5.35%) also followed suit with an increase in the share value of Asian Life Insurance (+Rs 74), National Life Insurance (+Rs 63) and Nepal Life Insurance (+Rs 58).

Lastly, Commercial Bank sub-index (+3.85%) also gained value with a marginal rise in share price of Nabil Bank (+Rs 89.9), Everest Bank (+Rs 65), Standard Chartered Bank (+Rs 64) and NIC Asia Bank (+Rs 29.9).

Additionally, the Securities Exchange Board of Nepal (SEBON) is set to welcome onboard Nepali migrant workers in the stock market, given their contribution to the country in the form of remittances and capital expansion. Considering this, SEBON has proposed a policy that reserves 10% in the sale of Initial Public Offerings (IPOs) in Nepal. Likewise, in order to expand the securities market to Non-Resident Nepalis (NRNs), it will also change its Securities Registration and Issue Regulation 2073 and other relevant regulations.

On the public issue front, SEBON approved the IPOs of Eastern Hydropwer worth Rs 620 million and Khaptad Microfinance worth Rs 40 million. NMB Capital and Prabhu Capital have been appointed as issue managers for the two companies, respectively. Similarly, SEBON has also approved the right shares of Radhi Bidhyut Hydropower worth Rs 953.576 million. Muktinath Capital has been appointed as its issue manager.

Additionally, the Securities Exchange Board of Nepal (SEBON) is set to welcome onboard Nepali migrant workers in the stock market, given their contribution to the country in the form of remittances and capital expansion. Considering this, SEBON has proposed a policy that reserves 10% in the sale of Initial Public Offerings (IPOs) in Nepal. Likewise, in order to expand the securities market to Non-Resident Nepalis (NRNs), it will also change its Securities Registration and Issue Regulation 2073 and other relevant regulations.

On the public issue front, SEBON approved the IPOs of Eastern Hydropwer worth Rs 620 million and Khaptad Microfinance worth Rs 40 million. NMB Capital and Prabhu Capital have been appointed as issue managers for the two companies, respectively. Similarly, SEBON has also approved the right shares of Radhi Bidhyut Hydropower worth Rs 953.576 million. Muktinath Capital has been appointed as its issue manager.

Similarly, Microfinance sub-index (+18.13%) witnessed an increase in the share prices of National Microfinance (+Rs 540), Swabalamban Microfinance (+Rs 354), and Laxmi Microfinance (+Rs 315.5). Others sub-index (+14.30%) also substantially increased with a rise in the share value of Citizen Investment Trust (+Rs 346.5), Nepal Telecom (+Rs 79) and Hydroelectricity Investment & Development (+Rs 10).

Along the same lines, Manufacturing and Processing sub-index (+11.77%) witnessed a hike in the share prices of Bottlers Nepal (+Rs 1954.9), Himalayan Distillery (+Rs 503) and Shivam Cements (+Rs 108). Likewise, Non-life Insurance sub-index (+5.92%) faced an upsurge with a rise in share value of Rastriya Beema (+Rs 578), Shikhar Insurance (+Rs 112) and NLG Insurance (+Rs 60.9). Life Insurance sub-index (+5.35%) also followed suit with an increase in the share value of Asian Life Insurance (+Rs 74), National Life Insurance (+Rs 63) and Nepal Life Insurance (+Rs 58).

Lastly, Commercial Bank sub-index (+3.85%) also gained value with a marginal rise in share price of Nabil Bank (+Rs 89.9), Everest Bank (+Rs 65), Standard Chartered Bank (+Rs 64) and NIC Asia Bank (+Rs 29.9).

Similarly, Microfinance sub-index (+18.13%) witnessed an increase in the share prices of National Microfinance (+Rs 540), Swabalamban Microfinance (+Rs 354), and Laxmi Microfinance (+Rs 315.5). Others sub-index (+14.30%) also substantially increased with a rise in the share value of Citizen Investment Trust (+Rs 346.5), Nepal Telecom (+Rs 79) and Hydroelectricity Investment & Development (+Rs 10).

Along the same lines, Manufacturing and Processing sub-index (+11.77%) witnessed a hike in the share prices of Bottlers Nepal (+Rs 1954.9), Himalayan Distillery (+Rs 503) and Shivam Cements (+Rs 108). Likewise, Non-life Insurance sub-index (+5.92%) faced an upsurge with a rise in share value of Rastriya Beema (+Rs 578), Shikhar Insurance (+Rs 112) and NLG Insurance (+Rs 60.9). Life Insurance sub-index (+5.35%) also followed suit with an increase in the share value of Asian Life Insurance (+Rs 74), National Life Insurance (+Rs 63) and Nepal Life Insurance (+Rs 58).

Lastly, Commercial Bank sub-index (+3.85%) also gained value with a marginal rise in share price of Nabil Bank (+Rs 89.9), Everest Bank (+Rs 65), Standard Chartered Bank (+Rs 64) and NIC Asia Bank (+Rs 29.9).

News and Highlights

During the review period, the central bank of Nepal, Nepal Rastra Bank, unveiled the Monetary Policy for the current fiscal year 2022/23. The policy’s provisions are perceived as market-friendly measures aimed at strengthening the secondary market. The policy, for instance, now permits individuals to borrow up to Rs 120 million (up from Rs 40 million) from a single bank or financial institution. A clause like this might prevent panic selling among shareholders and boost investor confidence, which would result in higher market turnovers. Additionally, the Securities Exchange Board of Nepal (SEBON) is set to welcome onboard Nepali migrant workers in the stock market, given their contribution to the country in the form of remittances and capital expansion. Considering this, SEBON has proposed a policy that reserves 10% in the sale of Initial Public Offerings (IPOs) in Nepal. Likewise, in order to expand the securities market to Non-Resident Nepalis (NRNs), it will also change its Securities Registration and Issue Regulation 2073 and other relevant regulations.

On the public issue front, SEBON approved the IPOs of Eastern Hydropwer worth Rs 620 million and Khaptad Microfinance worth Rs 40 million. NMB Capital and Prabhu Capital have been appointed as issue managers for the two companies, respectively. Similarly, SEBON has also approved the right shares of Radhi Bidhyut Hydropower worth Rs 953.576 million. Muktinath Capital has been appointed as its issue manager.

Additionally, the Securities Exchange Board of Nepal (SEBON) is set to welcome onboard Nepali migrant workers in the stock market, given their contribution to the country in the form of remittances and capital expansion. Considering this, SEBON has proposed a policy that reserves 10% in the sale of Initial Public Offerings (IPOs) in Nepal. Likewise, in order to expand the securities market to Non-Resident Nepalis (NRNs), it will also change its Securities Registration and Issue Regulation 2073 and other relevant regulations.

On the public issue front, SEBON approved the IPOs of Eastern Hydropwer worth Rs 620 million and Khaptad Microfinance worth Rs 40 million. NMB Capital and Prabhu Capital have been appointed as issue managers for the two companies, respectively. Similarly, SEBON has also approved the right shares of Radhi Bidhyut Hydropower worth Rs 953.576 million. Muktinath Capital has been appointed as its issue manager.

Outlook

The country’s favourable macroeconomic data, the new Monetary Policy with helpful provisions to ease capital movement and exchange, and improvements in liquidity position have all led to a rebound in the secondary market. Collectively, all of this has increased investor confidence and morale. However, to maintain market optimism, effective monitoring and enabling policies should be implemented effectively. This is an analysis from beed Management. No expressed or implied warrant is made for usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis. READ ALSO:

Published Date: August 31, 2022, 12:00 am

Post Comment

E-Magazine

RELATED Beed Take