During the review period of May 27 to June 27, the Nepal Stock Exchange (NEPSE) index fell by 306.47 points (-13.68%) to close at 1,933.13 points. Although the market began the review period with a high of 2,223.78 points on May 27, it underwent a continuous downfall and ended at a low of 1,933.13 points on June 27. On June 23, the market closed at 1,848.28 points, indicating an 18-month low mark. Some of the notable reasons of such a decline include dwindling economic conditions of the country, speculation on bank’s interest rates as well as anticipation of tightening monetary policy for the upcoming fiscal year 2022/23. Owing to that, the overall market volume during the review period decreased significantly by 31.51% with a total transaction of Rs 31.569 billion.

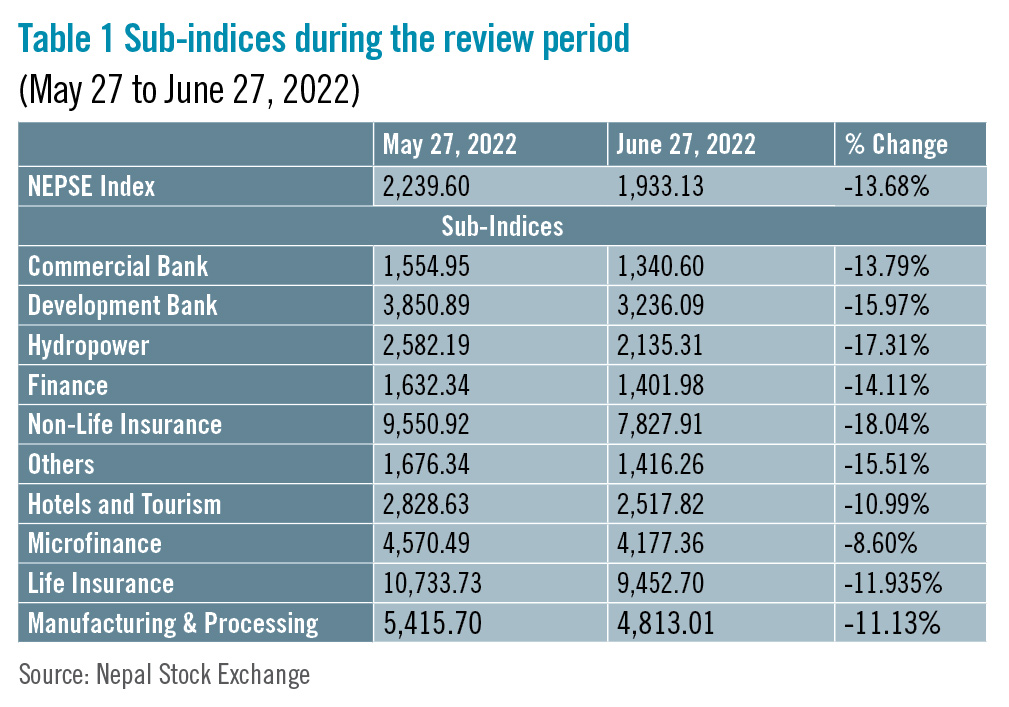

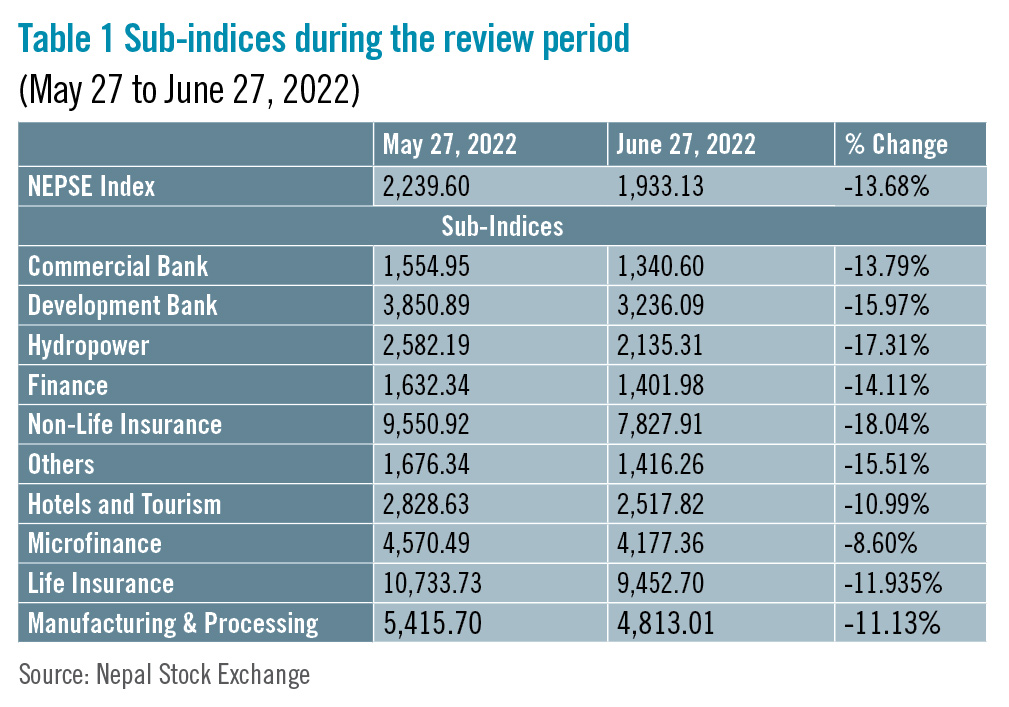

During the review period, all sub-indices landed in the red zone. The Non-Life Insurance sub-index (-18.04%) was the biggest loser as the share value of Rastriya Beema Company (-Rs 2,378), Shikhar Insurance (-Rs 311) and Nepal Insurance Company (-Rs 174) decreased substantially. Hydropower sub-index (-17.31%) was second in line as it witnessed a reduction in the share prices of Upper Tamakoshi Hydropower (-Rs 114), Chhyangdi Hydropower (-Rs 87) and Arun Valley Hydropower (-Rs 73.9). Development Bank sub-index (-15.97%) followed suit with a drop in the share prices of Corporate Development (-Rs 137), Karnali Development (-Rs 80) and Kamana Sewa Development (-Rs 73.8). Others sub-index (-15.51%) also declined as share value of Citizen Investment Trust (-Rs 107), Nepal Telecom (-Rs 101.5) and Hydroelectricity Investment and Development (-Rs 35.8) went down.

Similarly, Finance sub-index (-14.11%) witnessed deflation in the share prices of Shree Investment Finance (-Rs 72.5), Manjushree Finance (-Rs 65.9) and Best Finance (-Rs 63.8). Commercial Bank sub-index (-13.79%) also substantially decreased with drop in the share value of Nabil Bank (-Rs 118.6), NIC Asia Bank (-Rs 103.5) and Siddhartha Bank (-Rs 73).

Life Insurance sub-index (-11.93%) witnessed a fall in the share prices of Nepal Life Insurance (-Rs 172), National Life Insurance (-Rs 123) and Asian Life Insurance (-Rs 77). Likewise, Manufacturing and Processing sub-index (-11.13%) decreased marginally with fall in share value of Bottlers Nepal (-Rs 2,489.9), Himalayan Distillery (-Rs 234) and Shivam Cements (-Rs 174.9). Hotels and Tourism sub-index (-10.99%) also fell with decrease in the share value of Oriental Hotels (-Rs 45), Soaltee Hotel (-Rs 15) and Taragaon Regency (-Rs 7). Lastly, Microfinance sub-index (-8.60%) also lost value with a fall in share prices of Unnati Microfinance (-Rs 259), Janautthan Microfinance (-Rs 240), and Support Microfinance (-Rs 237).

News and Highlights

In the last review period, NEPSE decided to open the share market from Monday to Friday with effect from May 15 instead of the then prevailing Sunday to Thursday. However, in response to the government’s decision to revoke the holiday grant on Saturday and Sunday (two days a week), NEPSE has also decided to alter its working days and hours. According to NEPSE, the share market will now be open six days a week except Saturday, effective from June 15. Likewise, share trading will open from 11:00 am to 3:00 pm from Sunday to Thursday, and the market will remain open from 11:00 am to 1:00 pm on Friday. Additionally, the government unveiled a budget of Rs 1.79 trillion for the upcoming FY 2022/23 on May 29. However, investors were dismayed to see that there were no market-friendly announcements and no introduction of notable packages in the budget for the secondary market. Further, the government’s decision of mandating margin loan holders to clear all their arrears by August 23 had also weighed negatively on investor morale. As a result, large investors of the share market started offloading their shares to clear their dues which has also caused the market to fall further. Following this, a Capital Market Reform Struggle Committee held protests in support of 19-point demand since June 6 and embarked on a hunger strike at the SEBON office in Khumaltar, Lalitpur from June 15. On June 24, the protestors ended the strike following an agreement on the 19-point demand between share investors and SEBON, noting that a committee will be formed by comprising representatives of both sides to ensure smooth implementation of the 19-point agreement. SEBON also organised a press conference to express its commitment to address the genuine demands put forth by investors. On the public issue front, SEBON approved the Initial Public Offerings (IPOs) of five hydropower companies which includes Sayapatri Hydropower worth Rs 90 million, Mandakini Hydropower worth Rs 176.41 million, People’s Power worth Rs 310 million, Rasuwagadhi Hydropower worth Rs 684.21 million and Sanjen Hydropower worth Rs 365 million. NIBL Ace Capital, BoK Capital, Prabhu Capital, Siddhartha Capital and Citizen Investment Trust have been appointed as issue managers for the five hydropower companies, respectively. Similarly, SEBON has also approved the right shares of Ngadi Group Power worth Rs 1.060 billion. Siddhartha Capital has been appointed as its issue manager.

Outlook

The secondary market presented a dismal picture in the review period in light of poor macroeconomic indicators of the country and rising interest rates, leading to deteriorating investor confidence level. Despite the government’s assurance to uplift the market by forming a four-member panel to study the market, investors remained wary and the market did not perform well. Unless a positive environment with enabling factors to ease investor uncertainty is initiated or implemented, the market is less likely to recover. This is an analysis from beed Management. No expressed or implied warrant is made for usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis. READ ALSO:

Published Date: July 29, 2022, 12:00 am

Post Comment

E-Magazine

RELATED Beed Take